7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

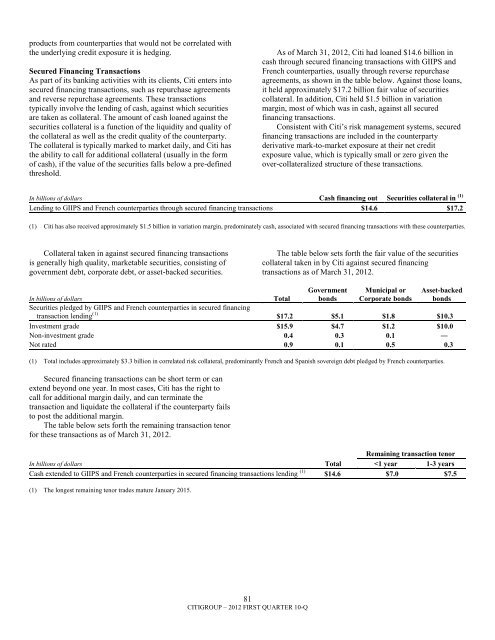

products from counterparties that would not be correlated withthe underlying credit exposure it is hedging.Secured Financing TransactionsAs part of its banking activities with its clients, Citi enters intosecured financing transactions, such as repurchase agreementsand reverse repurchase agreements. These transactionstypically involve the lending of cash, against which securitiesare taken as collateral. The amount of cash loaned against thesecurities collateral is a function of the liquidity and quality ofthe collateral as well as the credit quality of the counterparty.The collateral is typically marked to market daily, and Citi hasthe ability to call for additional collateral (usually in the formof cash), if the value of the securities falls below a pre-definedthreshold.As of March 31, 2012, Citi had loaned $14.6 <strong>billion</strong> incash through secured financing transactions with GIIPS andFrench counterparties, usually through reverse repurchaseagreements, as shown in the table below. Against those loans,it held approximately $17.2 <strong>billion</strong> fair value of securitiescollateral. In addition, Citi held $1.5 <strong>billion</strong> in variationmargin, most of which was in cash, against all securedfinancing transactions.Consistent with Citi‘s risk management systems, securedfinancing transactions are included in the counterpartyderivative mark-to-market exposure at their net creditexposure value, which is typically small or zero given theover-collateralized structure of these transactions.In <strong>billion</strong>s of dollars Cash financing out Securities collateral in (1)Lending to GIIPS and French counterparties through secured financing transactions $14.6 $17.2(1) Citi has also received approximately $1.5 <strong>billion</strong> in variation margin, predominately cash, associated with secured financing transactions with these counterparties.Collateral taken in against secured financing transactionsis generally high quality, marketable securities, consisting ofgovernment debt, corporate debt, or asset-backed securities.The table below sets forth the fair value of the securitiescollateral taken in by Citi against secured financingtransactions as of March 31, 2012.GovernmentbondsMunicipal orCorporate bondsAsset-backedbondsIn <strong>billion</strong>s of dollarsTotalSecurities pledged by GIIPS and French counterparties in secured financingtransaction lending (1) $17.2 $5.1 $1.8 $10.3Investment grade $15.9 $4.7 $1.2 $10.0Non-investment grade 0.4 0.3 0.1 ―Not rated 0.9 0.1 0.5 0.3(1) Total includes approximately $3.3 <strong>billion</strong> in correlated risk collateral, predominantly French and Spanish sovereign debt pledged by French counterparties.Secured financing transactions can be short term or canextend beyond one year. In most cases, Citi has the right tocall for additional margin daily, and can terminate thetransaction and liquidate the collateral if the counterparty failsto post the additional margin.The table below sets forth the remaining transaction tenorfor these transactions as of March 31, 2012.Remaining transaction tenorIn <strong>billion</strong>s of dollars Total