7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

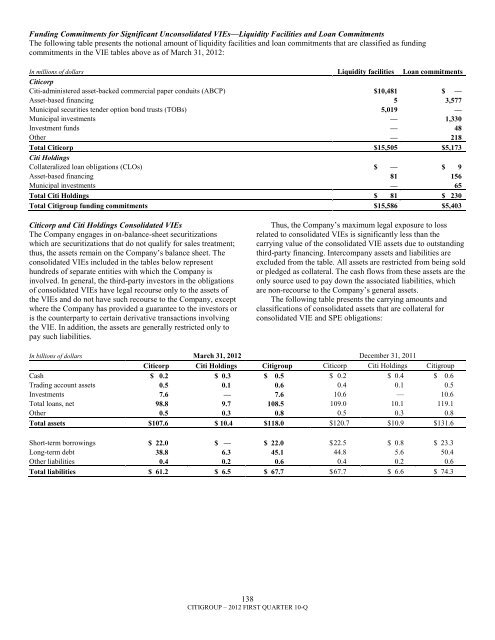

Funding Commitments for Significant Unconsolidated VIEs—Liquidity Facilities and Loan CommitmentsThe following table presents the notional amount of liquidity facilities and loan commitments that are classified as fundingcommitments in the VIE tables above as of March 31, 2012:In millions of dollars Liquidity facilities Loan commitmentsCiticorpCiti-administered asset-backed commercial paper conduits (ABCP) $10,481 $ —Asset-based financing 5 3,577Municipal securities tender option bond trusts (TOBs) 5,019 —Municipal investments — 1,330Investment funds — 48Other — 218Total Citicorp $15,505 $5,173Citi HoldingsCollateralized loan obligations (CLOs) $ — $ 9Asset-based financing 81 156Municipal investments — 65Total Citi Holdings $ 81 $ 230Total <strong>Citigroup</strong> funding commitments $15,586 $5,403Citicorp and Citi Holdings Consolidated VIEsThe Company engages in on-balance-sheet securitizationswhich are securitizations that do not qualify for sales treatment;thus, the assets remain on the Company‘s balance sheet. Theconsolidated VIEs included in the tables below representhundreds of separate entities with which the Company isinvolved. In general, the third-party investors in the obligationsof consolidated VIEs have legal recourse only to the assets ofthe VIEs and do not have such recourse to the Company, exceptwhere the Company has provided a guarantee to the investors oris the counterparty to certain derivative transactions involvingthe VIE. In addition, the assets are generally restricted only topay such liabilities.Thus, the Company‘s maximum legal exposure to lossrelated to consolidated VIEs is significantly less than thecarrying value of the consolidated VIE assets due to outstandingthird-party financing. Intercompany assets and liabilities areexcluded from the table. All assets are restricted from being soldor pledged as collateral. The cash flows from these assets are theonly source used to pay down the associated liabilities, whichare non-recourse to the Company‘s general assets.The following table presents the carrying amounts andclassifications of consolidated assets that are collateral forconsolidated VIE and SPE obligations:In <strong>billion</strong>s of dollars March 31, 2012 December 31, 2011Citicorp Citi Holdings <strong>Citigroup</strong> Citicorp Citi Holdings <strong>Citigroup</strong>Cash $ 0.2 $ 0.3 $ 0.5 $ 0.2 $ 0.4 $ 0.6Trading account assets 0.5 0.1 0.6 0.4 0.1 0.5Investments 7.6 — 7.6 10.6 — 10.6Total loans, net 98.8 9.7 108.5 109.0 10.1 119.1Other 0.5 0.3 0.8 0.5 0.3 0.8Total assets $107.6 $ 10.4 $118.0 $120.7 $10.9 $131.6Short-term borrowings $ 22.0 $ — $ 22.0 $ 22.5 $ 0.8 $ 23.3Long-term debt 38.8 6.3 45.1 44.8 5.6 50.4Other liabilities 0.4 0.2 0.6 0.4 0.2 0.6Total liabilities $ 61.2 $ 6.5 $ 67.7 $ 67.7 $ 6.6 $ 74.3138CITIGROUP – 2012 FIRST QUARTER 10-Q