7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

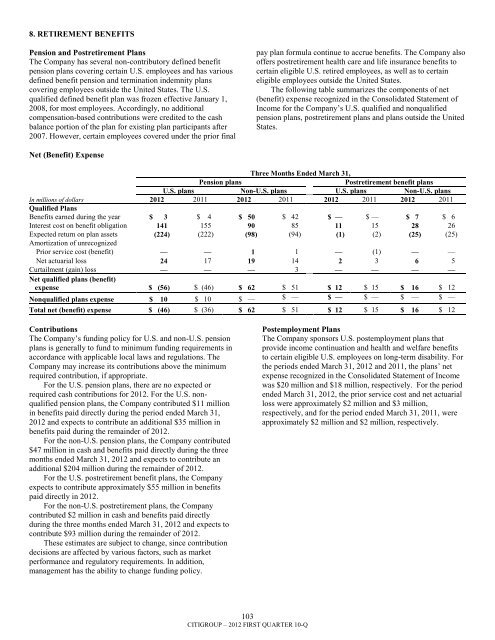

8. RETIREMENT BENEFITSPension and Postretirement PlansThe Company has several non-contributory defined benefitpension plans covering certain U.S. employees and has variousdefined benefit pension and termination indemnity planscovering employees outside the United States. The U.S.qualified defined benefit plan was frozen effective January 1,2008, for most employees. Accordingly, no additionalcompensation-based contributions were credited to the cashbalance portion of the plan for existing plan participants after2007. However, certain employees covered under the prior finalpay plan formula continue to accrue benefits. The Company alsooffers postretirement health care and life insurance benefits tocertain eligible U.S. retired employees, as well as to certaineligible employees outside the United States.The following table summarizes the components of net(benefit) expense recognized in the Consolidated Statement ofIncome for the Company‘s U.S. qualified and nonqualifiedpension plans, postretirement plans and plans outside the UnitedStates.Net (Benefit) ExpenseThree Months Ended March 31,Pension plansPostretirement benefit plansU.S. plans Non-U.S. plans U.S. plans Non-U.S. plansIn millions of dollars 2012 2011 2012 2011 2012 2011 2012 2011Qualified PlansBenefits earned during the year $ 3 $ 4 $ 50 $ 42 $ — $ — $ 7 $ 6Interest cost on benefit obligation 141 155 90 85 11 15 28 26Expected return on plan assets (224) (222) (98) (94) (1) (2) (25) (25)Amortization of unrecognizedPrior service cost (benefit) — — 1 1 — (1) — —Net actuarial loss 24 17 19 14 2 3 6 5Curtailment (gain) loss — — — 3 — — — —Net qualified plans (benefit)expense $ (56) $ (46) $ 62 $ 51 $ 12 $ 15 $ 16 $ 12Nonqualified plans expense $ 10 $ 10 $ — $ — $ — $ — $ — $ —Total net (benefit) expense $ (46) $ (36) $ 62 $ 51 $ 12 $ 15 $ 16 $ 12ContributionsThe Company‘s funding policy for U.S. and non-U.S. pensionplans is generally to fund to minimum funding requirements inaccordance with applicable local laws and regulations. TheCompany may increase its contributions above the minimumrequired contribution, if appropriate.For the U.S. pension plans, there are no expected orrequired cash contributions for 2012. For the U.S. nonqualifiedpension plans, the Company contributed $11 millionin benefits paid directly during the period ended March 31,2012 and expects to contribute an additional $35 million inbenefits paid during the remainder of 2012.For the non-U.S. pension plans, the Company contributed$47 million in cash and benefits paid directly during the threemonths ended March 31, 2012 and expects to contribute anadditional $204 million during the remainder of 2012.For the U.S. postretirement benefit plans, the Companyexpects to contribute approximately $55 million in benefitspaid directly in 2012.For the non-U.S. postretirement plans, the Companycontributed $2 million in cash and benefits paid directlyduring the three months ended March 31, 2012 and expects tocontribute $93 million during the remainder of 2012.These estimates are subject to change, since contributiondecisions are affected by various factors, such as marketperformance and regulatory requirements. In addition,management has the ability to change funding policy.Postemployment PlansThe Company sponsors U.S. postemployment plans thatprovide income continuation and health and welfare benefitsto certain eligible U.S. employees on long-term disability. Forthe periods ended March 31, 2012 and 2011, the plans‘ netexpense recognized in the Consolidated Statement of Incomewas $20 million and $18 million, respectively. For the periodended March 31, 2012, the prior service cost and net actuarialloss were approximately $2 million and $3 million,respectively, and for the period ended March 31, 2011, wereapproximately $2 million and $2 million, respectively.103CITIGROUP – 2012 FIRST QUARTER 10-Q