7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

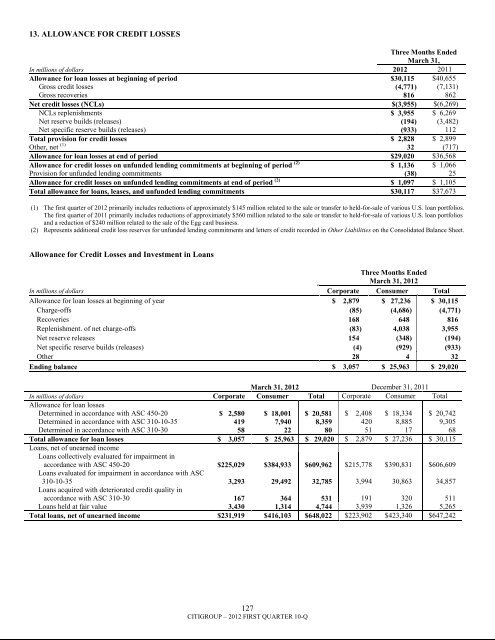

13. ALLOWANCE FOR CREDIT LOSSESThree Months EndedMarch 31,In millions of dollars 2012 2011Allowance for loan losses at beginning of period $30,115 $40,655Gross credit losses (4,771) (7,131)Gross recoveries 816 862Net credit losses (NCLs) $(3,955) $(6,269)NCLs replenishments $ 3,955 $ 6,269Net reserve builds (releases) (194) (3,482)Net specific reserve builds (releases) (933) 112Total provision for credit losses $ 2,828 $ 2,899Other, net (1) 32 (717)Allowance for loan losses at end of period $29,020 $36,568Allowance for credit losses on unfunded lending commitments at beginning of period (2) $ 1,136 $ 1,066Provision for unfunded lending commitments (38) 25Allowance for credit losses on unfunded lending commitments at end of period (2) $ 1,097 $ 1,105Total allowance for loans, leases, and unfunded lending commitments $30,117 $37,673(1) The first quarter of 2012 primarily includes reductions of approximately $145 million related to the sale or transfer to held-for-sale of various U.S. loan portfolios.The first quarter of 2011 primarily includes reductions of approximately $560 million related to the sale or transfer to held-for-sale of various U.S. loan portfoliosand a reduction of $240 million related to the sale of the Egg card business.(2) Represents additional credit loss reserves for unfunded lending commitments and letters of credit recorded in Other Liabilities on the Consolidated Balance Sheet.Allowance for Credit Losses and Investment in LoansThree Months EndedMarch 31, 2012In millions of dollars Corporate Consumer TotalAllowance for loan losses at beginning of year $ 2,879 $ 27,236 $ 30,115Charge-offs (85) (4,686) (4,771)Recoveries 168 648 816Replenishment. of net charge-offs (83) 4,038 3,955Net reserve releases 154 (348) (194)Net specific reserve builds (releases) (4) (929) (933)Other 28 4 32Ending balance $ 3,057 $ 25,963 $ 29,020March 31, 2012 December 31, 2011In millions of dollars Corporate Consumer Total Corporate Consumer TotalAllowance for loan lossesDetermined in accordance with ASC 450-20 $ 2,580 $ 18,001 $ 20,581 $ 2,408 $ 18,334 $ 20,742Determined in accordance with ASC 310-10-35 419 7,940 8,359 420 8,885 9,305Determined in accordance with ASC 310-30 58 22 80 51 17 68Total allowance for loan losses $ 3,057 $ 25,963 $ 29,020 $ 2,879 $ 27,236 $ 30,115Loans, net of unearned incomeLoans collectively evaluated for impairment inaccordance with ASC 450-20 $225,029 $384,933 $609,962 $215,778 $390,831 $606,609Loans evaluated for impairment in accordance with ASC310-10-35 3,293 29,492 32,785 3,994 30,863 34,857Loans acquired with deteriorated credit quality inaccordance with ASC 310-30 167 364 531 191 320 511Loans held at fair value 3,430 1,314 4,744 3,939 1,326 5,265Total loans, net of unearned income $231,919 $416,103 $648,022 $223,902 $423,340 $647,242127CITIGROUP – 2012 FIRST QUARTER 10-Q