7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

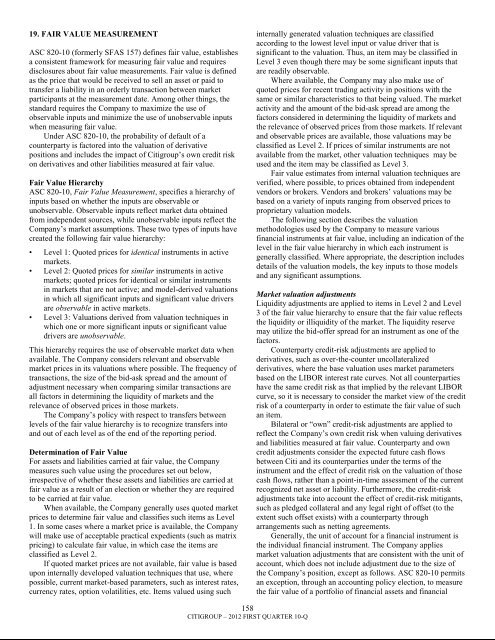

19. FAIR VALUE MEASUREMENTASC 820-10 (formerly SFAS 157) defines fair value, establishesa consistent framework for measuring fair value and requiresdisclosures about fair value measurements. Fair value is definedas the price that would be received to sell an asset or paid totransfer a liability in an orderly transaction between marketparticipants at the measurement date. Among other things, thestandard requires the Company to maximize the use ofobservable inputs and minimize the use of unobservable inputswhen measuring fair value.Under ASC 820-10, the probability of default of acounterparty is factored into the valuation of derivativepositions and includes the impact of <strong>Citigroup</strong>‘s own credit riskon derivatives and other liabilities measured at fair value.Fair Value HierarchyASC 820-10, Fair Value Measurement, specifies a hierarchy ofinputs based on whether the inputs are observable orunobservable. Observable inputs reflect market data obtainedfrom independent sources, while unobservable inputs reflect theCompany‘s market assumptions. These two types of inputs havecreated the following fair value hierarchy:• Level 1: Quoted prices for identical instruments in activemarkets.• Level 2: Quoted prices for similar instruments in activemarkets; quoted prices for identical or similar instrumentsin markets that are not active; and model-derived valuationsin which all significant inputs and significant value driversare observable in active markets.• Level 3: Valuations derived from valuation techniques inwhich one or more significant inputs or significant valuedrivers are unobservable.This hierarchy requires the use of observable market data whenavailable. The Company considers relevant and observablemarket prices in its valuations where possible. The frequency oftransactions, the size of the bid-ask spread and the amount ofadjustment necessary when comparing similar transactions areall factors in determining the liquidity of markets and therelevance of observed prices in those markets.The Company‘s policy with respect to transfers betweenlevels of the fair value hierarchy is to recognize transfers intoand out of each level as of the end of the reporting period.Determination of Fair ValueFor assets and liabilities carried at fair value, the Companymeasures such value using the procedures set out below,irrespective of whether these assets and liabilities are carried atfair value as a result of an election or whether they are requiredto be carried at fair value.When available, the Company generally uses quoted marketprices to determine fair value and classifies such items as Level1. In some cases where a market price is available, the Companywill make use of acceptable practical expedients (such as matrixpricing) to calculate fair value, in which case the items areclassified as Level 2.If quoted market prices are not available, fair value is basedupon internally developed valuation techniques that use, wherepossible, current market-based parameters, such as interest rates,currency rates, option volatilities, etc. Items valued using suchinternally generated valuation techniques are classifiedaccording to the lowest level input or value driver that issignificant to the valuation. Thus, an item may be classified inLevel 3 even though there may be some significant inputs thatare readily observable.Where available, the Company may also make use ofquoted prices for recent trading activity in positions with thesame or similar characteristics to that being valued. The marketactivity and the amount of the bid-ask spread are among thefactors considered in determining the liquidity of markets andthe relevance of observed prices from those markets. If relevantand observable prices are available, those valuations may beclassified as Level 2. If prices of similar instruments are notavailable from the market, other valuation techniques may beused and the item may be classified as Level 3.Fair value estimates from internal valuation techniques areverified, where possible, to prices obtained from independentvendors or brokers. Vendors and brokers‘ valuations may bebased on a variety of inputs ranging from observed prices toproprietary valuation models.The following section describes the valuationmethodologies used by the Company to measure variousfinancial instruments at fair value, including an indication of thelevel in the fair value hierarchy in which each instrument isgenerally classified. Where appropriate, the description includesdetails of the valuation models, the key inputs to those modelsand any significant assumptions.Market valuation adjustmentsLiquidity adjustments are applied to items in Level 2 and Level3 of the fair value hierarchy to ensure that the fair value reflectsthe liquidity or illiquidity of the market. The liquidity reservemay utilize the bid-offer spread for an instrument as one of thefactors.Counterparty credit-risk adjustments are applied toderivatives, such as over-the-counter uncollateralizedderivatives, where the base valuation uses market parametersbased on the LIBOR interest rate curves. Not all counterpartieshave the same credit risk as that implied by the relevant LIBORcurve, so it is necessary to consider the market view of the creditrisk of a counterparty in order to estimate the fair value of suchan item.Bilateral or ―own‖ credit-risk adjustments are applied toreflect the Company‘s own credit risk when valuing derivativesand liabilities measured at fair value. Counterparty and owncredit adjustments consider the expected future cash flowsbetween Citi and its counterparties under the terms of theinstrument and the effect of credit risk on the valuation of thosecash flows, rather than a point-in-time assessment of the currentrecognized net asset or liability. Furthermore, the credit-riskadjustments take into account the effect of credit-risk mitigants,such as pledged collateral and any legal right of offset (to theextent such offset exists) with a counterparty througharrangements such as netting agreements.Generally, the unit of account for a financial instrument isthe individual financial instrument. The Company appliesmarket valuation adjustments that are consistent with the unit ofaccount, which does not include adjustment due to the size ofthe Company‘s position, except as follows. ASC 820-10 permitsan exception, through an accounting policy election, to measurethe fair value of a portfolio of financial assets and financial158CITIGROUP – 2012 FIRST QUARTER 10-Q