CONSULTING

20160713MSC-WNISR2016V2-LR

20160713MSC-WNISR2016V2-LR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

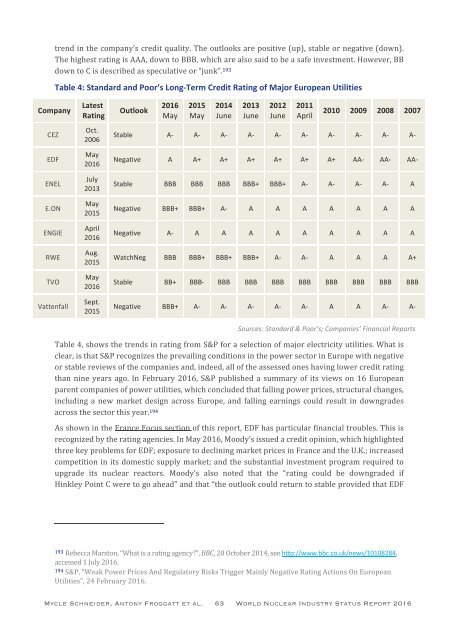

trend in the company’s credit quality. The outlooks are positive (up), stable or negative (down).<br />

The highest rating is AAA, down to BBB, which are also said to be a safe investment. However, BB<br />

down to C is described as speculative or “junk”. 193<br />

Table 4: Standard and Poor’s Long-Term Credit Rating of Major European Utilities<br />

Company<br />

CEZ<br />

EDF<br />

ENEL<br />

E.ON<br />

ENGIE<br />

RWE<br />

TVO<br />

Vattenfall<br />

Latest<br />

Rating<br />

Oct.<br />

2006<br />

May<br />

2016<br />

July<br />

2013<br />

May<br />

2015<br />

April<br />

2016<br />

Aug.<br />

2015<br />

May<br />

2016<br />

Sept.<br />

2015<br />

Outlook<br />

2016<br />

May<br />

2015<br />

May<br />

2014<br />

June<br />

2013<br />

June<br />

2012<br />

June<br />

2011<br />

April<br />

2010 2009 2008 2007<br />

Stable A- A- A- A- A- A- A- A- A- A-<br />

Negative A A+ A+ A+ A+ A+ A+ AA- AA- AA-<br />

Stable BBB BBB BBB BBB+ BBB+ A- A- A- A- A<br />

Negative BBB+ BBB+ A- A A A A A A A<br />

Negative A- A A A A A A A A A<br />

WatchNeg BBB BBB+ BBB+ BBB+ A- A- A A A A+<br />

Stable BB+ BBB- BBB BBB BBB BBB BBB BBB BBB BBB<br />

Negative BBB+ A- A- A- A- A- A A A- A-<br />

Sources: Standard & Poor’s; Companies’ Financial Reports<br />

Table 4, shows the trends in rating from S&P for a selection of major electricity utilities. What is<br />

clear, is that S&P recognizes the prevailing conditions in the power sector in Europe with negative<br />

or stable reviews of the companies and, indeed, all of the assessed ones having lower credit rating<br />

than nine years ago. In February 2016, S&P published a summary of its views on 16 European<br />

parent companies of power utilities, which concluded that falling power prices, structural changes,<br />

including a new market design across Europe, and falling earnings could result in downgrades<br />

across the sector this year. 194<br />

As shown in the France Focus section of this report, EDF has particular financial troubles. This is<br />

recognized by the rating agencies. In May 2016, Moody’s issued a credit opinion, which highlighted<br />

three key problems for EDF; exposure to declining market prices in France and the U.K.; increased<br />

competition in its domestic supply market; and the substantial investment program required to<br />

upgrade its nuclear reactors. Moody’s also noted that the “rating could be downgraded if<br />

Hinkley Point C were to go ahead” and that “the outlook could return to stable provided that EDF<br />

193 Rebecca Marston, “What is a rating agency?”, BBC, 20 October 2014, see http://www.bbc.co.uk/news/10108284,<br />

accessed 1 July 2016.<br />

194 S&P, “Weak Power Prices And Regulatory Risks Trigger Mainly Negative Rating Actions On European<br />

Utilities”, 24 February 2016.<br />

Mycle Schneider, Antony Froggatt et al. 63 World Nuclear Industry Status Report 2016