CONSULTING

20160713MSC-WNISR2016V2-LR

20160713MSC-WNISR2016V2-LR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ownership of the six generating companies as well as its monopoly operation of the transmission<br />

and distribution systems. Furthermore, with falling fossil fuel costs and the absence of an automatic<br />

pass-through to customers, its earning almost doubled in 2015. Consequently, Moody’s have noted<br />

that the strong operating results support a stable outlook rating. 219<br />

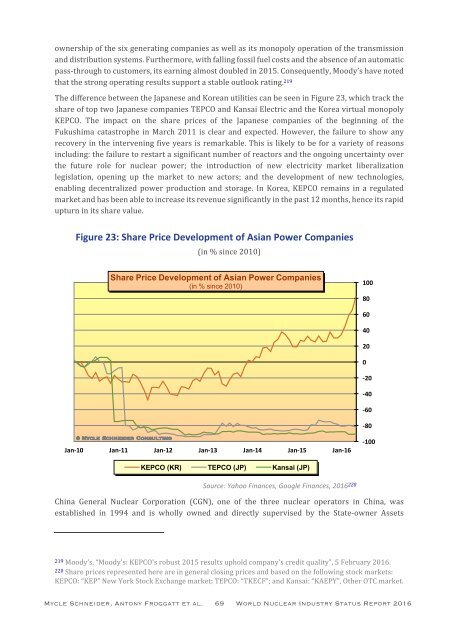

The difference between the Japanese and Korean utilities can be seen in Figure 23, which track the<br />

share of top two Japanese companies TEPCO and Kansai Electric and the Korea virtual monopoly<br />

KEPCO. The impact on the share prices of the Japanese companies of the beginning of the<br />

Fukushima catastrophe in March 2011 is clear and expected. However, the failure to show any<br />

recovery in the intervening five years is remarkable. This is likely to be for a variety of reasons<br />

including: the failure to restart a significant number of reactors and the ongoing uncertainty over<br />

the future role for nuclear power; the introduction of new electricity market liberalization<br />

legislation, opening up the market to new actors; and the development of new technologies,<br />

enabling decentralized power production and storage. In Korea, KEPCO remains in a regulated<br />

market and has been able to increase its revenue significantly in the past 12 months, hence its rapid<br />

upturn in its share value.<br />

Figure 23: Share Price Development of Asian Power Companies<br />

(in % since 2010)<br />

Share Price Development of Asian Power Companies<br />

(in % since 2010)<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

-60<br />

-80<br />

Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16<br />

-100<br />

KEPCO (KR) TEPCO (JP) Kansai (JP)<br />

Source: Yahoo Finances, Google Finances, 2016 220<br />

China General Nuclear Corporation (CGN), one of the three nuclear operators in China, was<br />

established in 1994 and is wholly owned and directly supervised by the State-owner Assets<br />

219 Moody’s, “Moody's: KEPCO's robust 2015 results uphold company's credit quality”, 5 February 2016.<br />

220 Share prices represented here are in general closing prices and based on the following stock markets:<br />

KEPCO: “KEP” New York Stock Exchange market; TEPCO: “TKECF”; and Kansai: “KAEPY”, Other OTC market.<br />

Mycle Schneider, Antony Froggatt et al. 69 World Nuclear Industry Status Report 2016