CONSULTING

20160713MSC-WNISR2016V2-LR

20160713MSC-WNISR2016V2-LR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

in the evolution of AREVA’s share price, which, as of early July 2016, is 96 percent lower than it was<br />

in June 2008 (see Figure 26).<br />

The nuclear industry is Russia is largely state owned and operated. However, Rosatom State Atomic<br />

Energy Corporation of Russia is the 100 percent owner of the joint stock company JSC<br />

Atomenergoprom, which is rated by the major credit agencies. In January 2015, S&B downgraded<br />

the company to BB+ (“junk”). In April 2016, it was given a negative outlook by Moody’s, primarily<br />

in response to the sovereign credit ratings of the Russian Federation as a whole, but the rating<br />

company warned that “the lack of adequate liquidity could put pressure on the company's<br />

rating.” 232 This is particularly important given that Rosatom stated that it is currently building<br />

nine reactors in Russia and an additional 11 overseas (with said to a total of 29 reactors in the<br />

portfolio). They further stated that the overseas order portfolio is worth US$101.4 billion. 233<br />

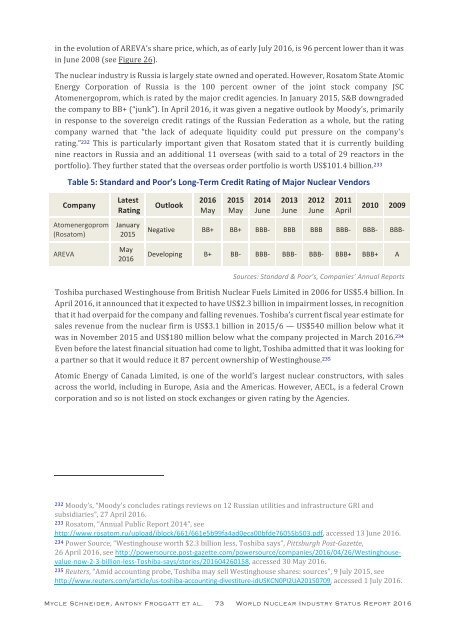

Table 5: Standard and Poor’s Long-Term Credit Rating of Major Nuclear Vendors<br />

Company<br />

Atomenergoprom<br />

(Rosatom)<br />

AREVA<br />

Latest<br />

Rating<br />

January<br />

2015<br />

May<br />

2016<br />

Outlook<br />

2016<br />

May<br />

2015<br />

May<br />

2014<br />

June<br />

2013<br />

June<br />

2012<br />

June<br />

2011<br />

April<br />

2010 2009<br />

Negative BB+ BB+ BBB- BBB BBB BBB- BBB- BBB-<br />

Developing B+ BB- BBB- BBB- BBB- BBB+ BBB+ A<br />

Sources: Standard & Poor’s, Companies’ Annual Reports<br />

Toshiba purchased Westinghouse from British Nuclear Fuels Limited in 2006 for US$5.4 billion. In<br />

April 2016, it announced that it expected to have US$2.3 billion in impairment losses, in recognition<br />

that it had overpaid for the company and falling revenues. Toshiba’s current fiscal year estimate for<br />

sales revenue from the nuclear firm is US$3.1 billion in 2015/6 — US$540 million below what it<br />

was in November 2015 and US$180 million below what the company projected in March 2016. 234<br />

Even before the latest financial situation had come to light, Toshiba admitted that it was looking for<br />

a partner so that it would reduce it 87 percent ownership of Westinghouse. 235<br />

Atomic Energy of Canada Limited, is one of the world’s largest nuclear constructors, with sales<br />

across the world, including in Europe, Asia and the Americas. However, AECL, is a federal Crown<br />

corporation and so is not listed on stock exchanges or given rating by the Agencies.<br />

232 Moody’s, “Moody's concludes ratings reviews on 12 Russian utilities and infrastructure GRI and<br />

subsidiaries”, 27 April 2016.<br />

233 Rosatom, “Annual Public Report 2014”, see<br />

http://www.rosatom.ru/upload/iblock/661/661e5b99fa4ad0eca00bfde76055b503.pdf, accessed 13 June 2016.<br />

234 Power Source, “Westinghouse worth $2.3 billion less, Toshiba says”, Pittsburgh Post-Gazette,<br />

26 April 2016, see http://powersource.post-gazette.com/powersource/companies/2016/04/26/Westinghousevalue-now-2-3-billion-less-Toshiba-says/stories/201604260158,<br />

accessed 30 May 2016.<br />

235 Reuters, “Amid accounting probe, Toshiba may sell Westinghouse shares: sources”, 9 July 2015, see<br />

http://www.reuters.com/article/us-toshiba-accounting-divestiture-idUSKCN0PI2UA20150709, accessed 1 July 2016.<br />

Mycle Schneider, Antony Froggatt et al. 73 World Nuclear Industry Status Report 2016