3c hapter - Index of

3c hapter - Index of

3c hapter - Index of

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

146 Locavesting<br />

•<br />

•<br />

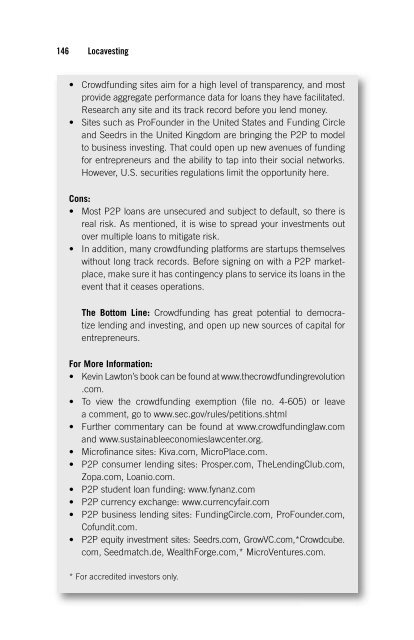

Crowdfunding sites aim for a high level <strong>of</strong> transparency, and most<br />

provide aggregate performance data for loans they have facilitated.<br />

Research any site and its track record before you lend money.<br />

Sites such as ProFounder in the United States and Funding Circle<br />

and Seedrs in the United Kingdom are bringing the P2P to model<br />

to business investing. That could open up new avenues <strong>of</strong> funding<br />

for entrepreneurs and the ability to tap into their social networks.<br />

However, U.S. securities regulations limit the opportunity here.<br />

Cons:<br />

• Most P2P loans are unsecured and subject to default, so there is<br />

real risk. As mentioned, it is wise to spread your investments out<br />

over multiple loans to mitigate risk.<br />

• In addition, many crowdfunding platforms are startups themselves<br />

without long track records. Before signing on with a P2P marketplace,<br />

make sure it has contingency plans to service its loans in the<br />

event that it ceases operations.<br />

The Bottom Line: Crowdfunding has great potential to democratize<br />

lending and investing, and open up new sources <strong>of</strong> capital for<br />

entrepreneurs.<br />

For More Information:<br />

• Kevin Lawton’s book can be found at www.thecrowdfundingrevolution<br />

.com.<br />

• To view the crowdfunding exemption (fi le no. 4-605) or leave<br />

a comment, go to www.sec.gov/rules/petitions.shtml<br />

• Further commentary can be found at www.crowdfundinglaw.com<br />

and www.sustainableeconomieslawcenter.org.<br />

• Micr<strong>of</strong>i nance sites: Kiva.com, MicroPlace.com.<br />

• P2P consumer lending sites: Prosper.com, TheLendingClub.com,<br />

Zopa.com, Loanio.com.<br />

• P2P student loan funding: www.fynanz.com<br />

• P2P currency exchange: www.currencyfair.com<br />

• P2P business lending sites: FundingCircle.com, ProFounder.com,<br />

C<strong>of</strong>undit.com.<br />

•<br />

P2P equity investment sites: Seedrs.com, GrowVC.com,*Crowdcube.<br />

com, Seedmatch.de, WealthForge.com,* MicroVentures.com.<br />

* For accredited investors only.