2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

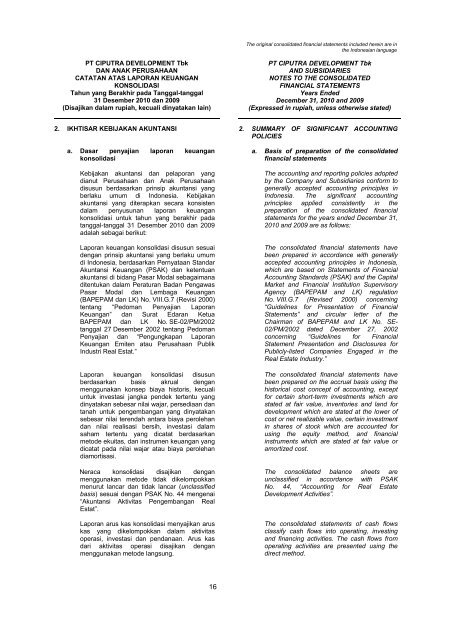

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

2. IKHTISAR KEBIJAKAN AKUNTANSI 2. SUMMARY OF SIGNIFICANT ACCOUNTING<br />

POLICIES<br />

a. Dasar penyajian laporan keuangan<br />

konsolidasi<br />

Kebijakan akuntansi dan pelaporan yang<br />

dianut Perusahaan dan Anak Perusahaan<br />

disusun berdasarkan prinsip akuntansi yang<br />

berlaku umum di Indonesia. Kebijakan<br />

akuntansi yang diterapkan secara konsisten<br />

dalam penyusunan laporan keuangan<br />

konsolidasi untuk tahun yang berakhir pada<br />

tanggal-tanggal 31 Desember 2010 dan <strong>2009</strong><br />

adalah sebagai berikut:<br />

Laporan keuangan konsolidasi disusun sesuai<br />

dengan prinsip akuntansi yang berlaku umum<br />

di Indonesia, berdasarkan Pernyataan Standar<br />

Akuntansi Keuangan (PSAK) dan ketentuan<br />

akuntansi di bidang Pasar Modal sebagaimana<br />

ditentukan dalam Peraturan Badan Pengawas<br />

Pasar Modal dan Lembaga Keuangan<br />

(BAPEPAM dan LK) No. VIII.G.7 (Revisi 2000)<br />

tentang “Pedoman Penyajian Laporan<br />

Keuangan” dan Surat Edaran Ketua<br />

BAPEPAM dan LK No. SE-02/PM/2002<br />

tanggal 27 Desember 2002 tentang Pedoman<br />

Penyajian dan “Pengungkapan Laporan<br />

Keuangan Emiten atau Perusahaan Publik<br />

Industri Real Estat.”<br />

Laporan keuangan konsolidasi disusun<br />

berdasarkan basis akrual dengan<br />

menggunakan konsep biaya historis, kecuali<br />

untuk investasi jangka pendek tertentu yang<br />

dinyatakan sebesar nilai wajar, persediaan dan<br />

tanah untuk pengembangan yang dinyatakan<br />

sebesar nilai terendah antara biaya perolehan<br />

dan nilai realisasi bersih, investasi dalam<br />

saham tertentu yang dicatat berdasarkan<br />

metode ekuitas, dan instrumen keuangan yang<br />

dicatat pada nilai wajar atau biaya perolehan<br />

diamortisasi.<br />

Neraca konsolidasi disajikan dengan<br />

menggunakan metode tidak dikelompokkan<br />

menurut lancar dan tidak lancar (unclassified<br />

basis) sesuai dengan PSAK No. 44 mengenai<br />

“Akuntansi Aktivitas Pengembangan Real<br />

Estat”.<br />

Laporan arus kas konsolidasi menyajikan arus<br />

kas yang dikelompokkan dalam aktivitas<br />

operasi, investasi dan pendanaan. Arus kas<br />

dari aktivitas operasi disajikan dengan<br />

menggunakan metode langsung.<br />

a. Basis of preparation of the consolidated<br />

financial statements<br />

The accounting and reporting policies adopted<br />

by the Company and Subsidiaries conform to<br />

generally accepted accounting principles in<br />

Indonesia. The significant accounting<br />

principles applied consistently in the<br />

preparation of the consolidated financial<br />

statements for the years ended December 31,<br />

2010 and <strong>2009</strong> are as follows:<br />

The consolidated financial statements have<br />

been prepared in accordance with generally<br />

accepted accounting principles in Indonesia,<br />

which are based on Statements of Financial<br />

Accounting Standards (PSAK) and the Capital<br />

Market and Financial Institution Supervisory<br />

Agency (BAPEPAM and LK) regulation<br />

No. VIII.G.7 (Revised 2000) concerning<br />

“Guidelines for Presentation of Financial<br />

Statements” and circular letter of the<br />

Chairman of BAPEPAM and LK No. SE-<br />

02/PM/2002 dated December 27, 2002<br />

concerning “Guidelines for Financial<br />

Statement Presentation and Disclosures for<br />

Publicly-listed Companies Engaged in the<br />

Real Estate Industry.”<br />

The consolidated financial statements have<br />

been prepared on the accrual basis using the<br />

historical cost concept of accounting, except<br />

for certain short-term investments which are<br />

stated at fair value, inventories and land for<br />

development which are stated at the lower of<br />

cost or net realizable value, certain investment<br />

in shares of stock which are accounted for<br />

using the equity method, and financial<br />

instruments which are stated at fair value or<br />

amortized cost.<br />

The consolidated balance sheets are<br />

unclassified in accordance with PSAK<br />

No. 44, “Accounting for Real Estate<br />

<strong>Development</strong> Activities”.<br />

The consolidated statements of cash flows<br />

classify cash flows into operating, investing<br />

and financing activities. The cash flows from<br />

operating activities are presented using the<br />

direct method.<br />

16