2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

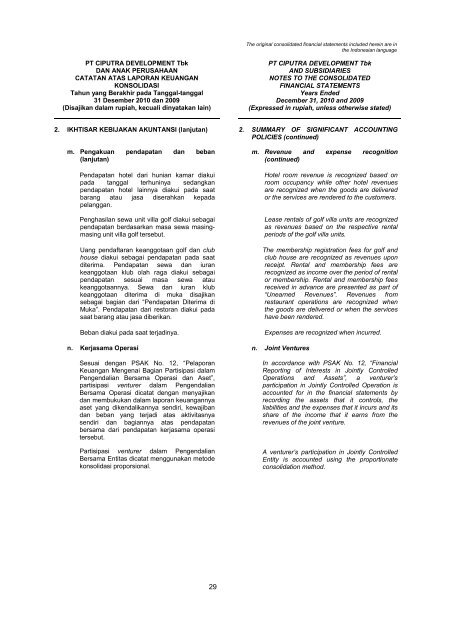

2. IKHTISAR KEBIJAKAN AKUNTANSI (lanjutan) 2. SUMMARY OF SIGNIFICANT ACCOUNTING<br />

POLICIES (continued)<br />

m. Pengakuan pendapatan dan beban<br />

(lanjutan)<br />

Pendapatan hotel dari hunian kamar diakui<br />

pada tanggal terhuninya sedangkan<br />

pendapatan hotel lainnya diakui pada saat<br />

barang atau jasa diserahkan kepada<br />

pelanggan.<br />

Penghasilan sewa unit villa golf diakui sebagai<br />

pendapatan berdasarkan masa sewa masingmasing<br />

unit villa golf tersebut.<br />

Uang pendaftaran keanggotaan golf dan club<br />

house diakui sebagai pendapatan pada saat<br />

diterima. Pendapatan sewa dan iuran<br />

keanggotaan klub olah raga diakui sebagai<br />

pendapatan sesuai masa sewa atau<br />

keanggotaannya. Sewa dan iuran klub<br />

keanggotaan diterima di muka disajikan<br />

sebagai bagian dari “Pendapatan Diterima di<br />

Muka”. Pendapatan dari restoran diakui pada<br />

saat barang atau jasa diberikan.<br />

Beban diakui pada saat terjadinya.<br />

m. Revenue and expense recognition<br />

(continued)<br />

Hotel room revenue is recognized based on<br />

room occupancy while other hotel revenues<br />

are recognized when the goods are delivered<br />

or the services are rendered to the customers.<br />

Lease rentals of golf villa units are recognized<br />

as revenues based on the respective rental<br />

periods of the golf villa units.<br />

The membership registration fees for golf and<br />

club house are recognized as revenues upon<br />

receipt. Rental and membership fees are<br />

recognized as income over the period of rental<br />

or membership. Rental and membership fees<br />

received in advance are presented as part of<br />

“Unearned Revenues”. Revenues from<br />

restaurant operations are recognized when<br />

the goods are delivered or when the services<br />

have been rendered.<br />

Expenses are recognized when incurred.<br />

n. Kerjasama Operasi n. Joint Ventures<br />

Sesuai dengan PSAK No. 12, “Pelaporan<br />

Keuangan Mengenai Bagian Partisipasi dalam<br />

Pengendalian Bersama Operasi dan Aset”,<br />

partisipasi venturer dalam Pengendalian<br />

Bersama Operasi dicatat dengan menyajikan<br />

dan membukukan dalam laporan keuangannya<br />

aset yang dikendalikannya sendiri, kewajiban<br />

dan beban yang terjadi atas aktivitasnya<br />

sendiri dan bagiannya atas pendapatan<br />

bersama dari pendapatan kerjasama operasi<br />

tersebut.<br />

Partisipasi venturer dalam Pengendalian<br />

Bersama Entitas dicatat menggunakan metode<br />

konsolidasi proporsional.<br />

In accordance with PSAK No. 12, “Financial<br />

Reporting of Interests in Jointly Controlled<br />

Operations and Assets”, a venturer’s<br />

participation in Jointly Controlled Operation is<br />

accounted for in the financial statements by<br />

recording the assets that it controls, the<br />

liabilities and the expenses that it incurs and its<br />

share of the income that it earns from the<br />

revenues of the joint venture.<br />

A venturer’s participation in Jointly Controlled<br />

Entity is accounted using the proportionate<br />

consolidation method.<br />

29