2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

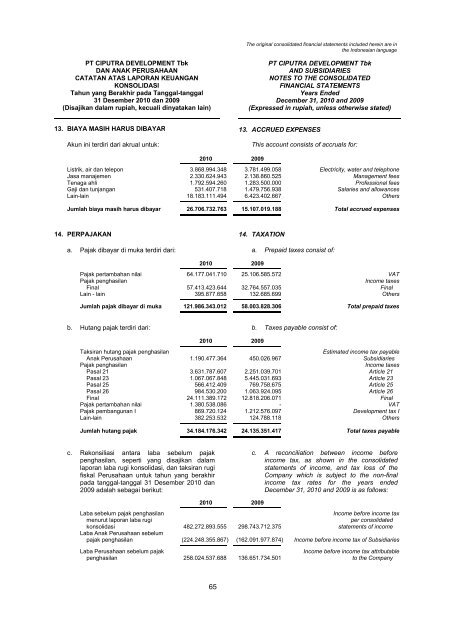

13. BIAYA MASIH HARUS DIBAYAR 13. ACCRUED EXPENSES<br />

Akun ini terdiri dari akrual untuk:<br />

This account consists of accruals for:<br />

2010 <strong>2009</strong><br />

Listrik, air dan telepon 3.868.994.348 3.781.499.058 Electricity, water and telephone<br />

Jasa manajemen 2.330.624.943 2.138.860.525 Management fees<br />

Tenaga ahli 1.792.594.260 1.283.500.000 Professional fees<br />

Gaji dan tunjangan 531.407.718 1.479.756.938 Salaries and allowances<br />

Lain-lain 18.183.111.494 6.423.402.667 Others<br />

Jumlah biaya masih harus dibayar 26.706.732.763 15.107.019.188 Total accrued expenses<br />

14. PERPAJAKAN 14. TAXATION<br />

a. Pajak dibayar di muka terdiri dari: a. Prepaid taxes consist of:<br />

2010 <strong>2009</strong><br />

Pajak pertambahan nilai 64.177.041.710 25.106.585.572 VAT<br />

Pajak penghasilan<br />

Income taxes<br />

Final 57.413.423.644 32.764.557.035 Final<br />

Lain - lain 395.877.658 132.685.699 Others<br />

Jumlah pajak dibayar di muka 121.986.343.012 58.003.828.306 Total prepaid taxes<br />

b. Hutang pajak terdiri dari: b. Taxes payable consist of:<br />

2010 <strong>2009</strong><br />

Taksiran hutang pajak penghasilan<br />

Estimated income tax payable<br />

Anak Perusahaan 1.190.477.364 450.026.967 Subsidiaries<br />

Pajak penghasilan<br />

Income taxes<br />

Pasal 21 3.631.787.607 2.251.039.701 Article 21<br />

Pasal 23 1.067.067.848 5.445.031.693 Article 23<br />

Pasal 25 566.412.409 769.758.675 Article 25<br />

Pasal 26 984.530.200 1.063.924.095 Article 26<br />

Final 24.111.389.172 12.818.206.071 Final<br />

Pajak pertambahan nilai 1.380.538.086 - VAT<br />

Pajak pembangunan I 869.720.124 1.212.576.097 <strong>Development</strong> tax I<br />

Lain-lain 382.253.532 124.788.118 Others<br />

Jumlah hutang pajak 34.184.176.342 24.135.351.417 Total taxes payable<br />

c. Rekonsiliasi antara laba sebelum pajak<br />

penghasilan, seperti yang disajikan dalam<br />

laporan laba rugi konsolidasi, dan taksiran rugi<br />

fiskal Perusahaan untuk tahun yang berakhir<br />

pada tanggal-tanggal 31 Desember 2010 dan<br />

<strong>2009</strong> adalah sebagai berikut:<br />

c. A reconciliation between income before<br />

income tax, as shown in the consolidated<br />

statements of income, and tax loss of the<br />

Company which is subject to the non-final<br />

income tax rates for the years ended<br />

December 31, 2010 and <strong>2009</strong> is as follows:<br />

2010 <strong>2009</strong><br />

Laba sebelum pajak penghasilan<br />

Income before income tax<br />

menurut laporan laba rugi<br />

per consolidated<br />

konsolidasi 482.272.893.555 298.743.712.375 statements of income<br />

Laba Anak Perusahaan sebelum<br />

pajak penghasilan (224.248.355.867) (162.091.977.874) Income before income tax of Subsidiaries<br />

Laba Perusahaan sebelum pajak<br />

Income before income tax attributable<br />

penghasilan 258.024.537.688 136.651.734.501 to the Company<br />

65