2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

LAPORAN TAHUNAN<br />

2010<br />

ANNUAL REPORT<br />

Sebagai salah satu pionir pengembang properti di<br />

Indonesia dengan berbagai kelebihan yang kami miliki,<br />

seperti; memiliki land bank yang luas, paling terdiversifikasi<br />

baik segmen pasar maupun geografis, memiliki reputasi<br />

yang baik dan pengalaman, maka strategi bisnis<br />

perusahaan ke depan adalah:<br />

• Mempertahankan stabilitas pemilikan luas land bank:<br />

dengan cara bangun – jual – beli lahan baru, dan<br />

mengembangkan bisnis properti ke setiap propinsi di<br />

seluruh Indonesia, baik melalui pembelian lahan baru<br />

maupun joint venture dengan mitra lokal pemilik tanah.<br />

• Fokus pada usaha properti: mengembangkan kawasan<br />

hunian mandiri dan superblok serta produk properti<br />

lainnya, mengusahakan kombinasi optimal antara<br />

trading base dan rental base.<br />

• Program Peningkatan Mutu: pembangunan yang ramah<br />

lingkungan, menghasilkan produk unggul dan inovasi<br />

berkelanjutan, meningkatkan kepuasan konsumen dan<br />

efisiensi.<br />

• Program Sumber Daya Manusia Unggul: membangun<br />

budaya kerja berkualitas dan unggul, pelatihan dan<br />

pengembangan SDM, meningkatkan kesejahteraan<br />

karyawan, mempertahankan lingkungan kerja yang sehat.<br />

As one of the pioneers in Indonesia’s property industry<br />

with advantages such as: a large land bank, customers<br />

diversified amongst various income levels and<br />

geographical location, having a respected reputation<br />

and an experienced management team, the company’s<br />

business strategies for the near future are:<br />

• Maintain the amount of land bank owned after business<br />

operations that involve developing, selling and buying<br />

land. Also, expanding business to all provinces of<br />

Indonesia whether through purchase of land or joint<br />

venture with land owners.<br />

• Focus on property business: develop more housing<br />

and superblocks as well as other property products<br />

and continually strive to find the optimum combination<br />

between trading and rental base developments.<br />

• Quality Improvement: use more environmentally friendly<br />

building techniques and producing superior, innovative<br />

products that would increase customers’ satisfaction.<br />

• Developing superior human Resources: building highquality<br />

working culture, improving employees’ welfare<br />

and maintaining a healthy working environment.<br />

(dalam miliar Rp) (in billion Rp)<br />

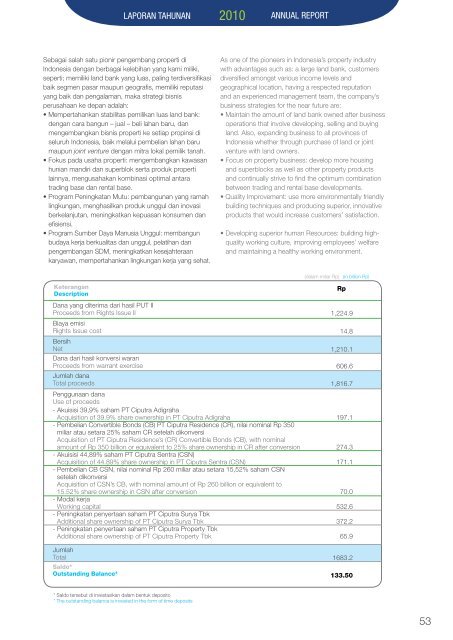

Keterangan<br />

Description<br />

Dana yang diterima dari hasil PUT II<br />

Proceeds from Rights Issue II<br />

Biaya emisi<br />

Rights Issue cost<br />

Bersih<br />

Net<br />

Dana dari hasil konversi waran<br />

Proceeds from warrant exercise<br />

Jumlah dana<br />

Total proceeds<br />

Penggunaan dana<br />

Use of proceeds<br />

- Akuisisi 39,9% saham PT <strong>Ciputra</strong> Adigraha<br />

Acquisition of 39.9% share ownership in PT <strong>Ciputra</strong> Adigraha<br />

- Pembelian Convertible Bonds (CB) PT <strong>Ciputra</strong> Residence (CR), nilai nominal Rp 350<br />

miliar atau setara 25% saham CR setelah dikonversi<br />

Acquisition of PT <strong>Ciputra</strong> Residence’s (CR) Convertible Bonds (CB), with nominal<br />

amount of Rp 350 billion or equivalent to 25% share ownership in CR after conversion<br />

- Akuisisi 44,89% saham PT <strong>Ciputra</strong> Sentra (CSN)<br />

Acquisition of 44.89% share ownership in PT <strong>Ciputra</strong> Sentra (CSN)<br />

- Pembelian CB CSN, nilai nominal Rp 260 miliar atau setara 15,52% saham CSN<br />

setelah dikonversi<br />

Acquisition of CSN’s CB, with nominal amount of Rp 260 billion or equivalent to<br />

15.52% share ownership in CSN after conversion<br />

- Modal kerja<br />

Working capital<br />

- Peningkatan penyertaan saham PT <strong>Ciputra</strong> Surya Tbk<br />

Additional share ownership of PT <strong>Ciputra</strong> Surya Tbk<br />

- Peningkatan penyertaan saham PT <strong>Ciputra</strong> Property Tbk<br />

Additional share ownership of PT <strong>Ciputra</strong> Property Tbk<br />

Jumlah<br />

Total<br />

Saldo*<br />

Outstanding Balance*<br />

Rp<br />

1,224.9<br />

14.8<br />

1,210.1<br />

606.6<br />

1,816.7<br />

197.1<br />

274.3<br />

171.1<br />

70.0<br />

532.6<br />

372.2<br />

65.9<br />

1683.2<br />

133.50<br />

* Saldo tersebut di investasikan dalam bentuk deposito<br />

* The outstanding balance is invested in the form of time deposits<br />

53