2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language.<br />

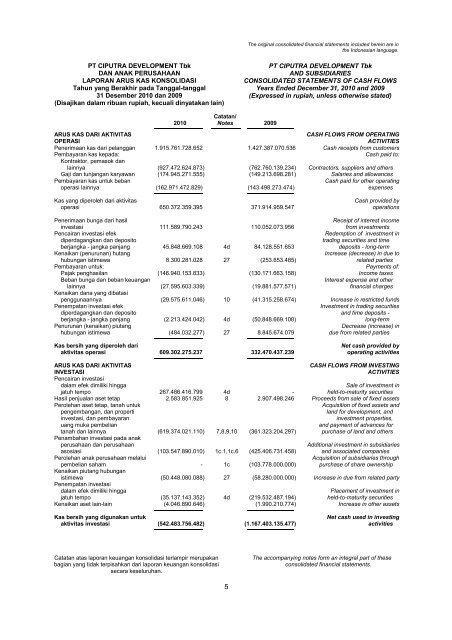

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

LAPORAN ARUS KAS KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam ribuan rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

Years Ended December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

Catatan/<br />

2010 Notes <strong>2009</strong><br />

ARUS KAS DARI AKTIVITAS<br />

CASH FLOWS FROM OPERATING<br />

OPERASI<br />

ACTIVITIES<br />

Penerimaan kas dari pelanggan 1.915.761.728.652 1.427.387.070.536 Cash receipts from customers<br />

Pembayaran kas kepada:<br />

Cash paid to:<br />

Kontraktor, pemasok dan<br />

lainnya (927.472.624.873) (762.760.139.234) Contractors, suppliers and others<br />

Gaji dan tunjangan karyawan (174.945.271.555) (149.213.698.281) Salaries and allowances<br />

Pembayaran kas untuk beban<br />

Cash paid for other operating<br />

operasi lainnya (162.971.472.829) (143.498.273.474) expenses<br />

Kas yang diperoleh dari aktivitas<br />

Cash provided by<br />

operasi 650.372.359.395 371.914.959.547 operations<br />

Penerimaan bunga dari hasil<br />

Receipt of interest income<br />

investasi 111.589.790.243 110.052.073.956 from investments<br />

Pencairan investasi efek<br />

Redemption of investment in<br />

diperdagangkan dan deposito<br />

trading securities and time<br />

berjangka - jangka panjang 45.848.669.108 4d 84.128.551.653 deposits - long-term<br />

Kenaikan (penurunan) hutang<br />

Increase (decrease) in due to<br />

hubungan istimewa 8.300.281.028 27 (253.653.485) related parties<br />

Pembayaran untuk:<br />

Payments of:<br />

Pajak penghasilan (146.940.153.833) (130.171.663.158) Income taxes<br />

Beban bunga dan beban keuangan<br />

Interest expense and other<br />

lainnya (27.595.603.339) (19.881.577.571) financial charges<br />

Kenaikan dana yang dibatasi<br />

penggunaannya (29.575.611.046) 10 (41.315.258.674) Increase in restricted funds<br />

Penempatan investasi efek<br />

Investment in trading securities<br />

diperdagangkan dan deposito and time deposits -<br />

berjangka - jangka panjang (2.213.424.042) 4d (50.848.669.108) long-term<br />

Penurunan (kenaikan) piutang<br />

Decrease (increase) in<br />

hubungan istimewa (484.032.277) 27 8.845.674.079 due from related parties<br />

Kas bersih yang diperoleh dari<br />

Net cash provided by<br />

aktivitas operasi 609.302.275.237 332.470.437.239 operating activities<br />

ARUS KAS DARI AKTIVITAS<br />

CASH FLOWS FROM INVESTING<br />

INVESTASI<br />

ACTIVITIES<br />

Pencairan investasi<br />

dalam efek dimiliki hingga<br />

Sale of investment in<br />

jatuh tempo 267.486.416.799 4d - held-to-maturity securities<br />

Hasil penjualan aset tetap 2.583.851.925 8 2.907.498.246 Proceeds from sale of fixed assets<br />

Perolehan aset tetap, tanah untuk<br />

Acquisition of fixed assets and<br />

pengembangan, dan properti<br />

land for development, and<br />

investasi, dan pembayaran<br />

investment properties,<br />

uang muka pembelian<br />

and payment of advances for<br />

tanah dan lainnya (619.374.021.110) 7,8,9,10 (361.323.204.297) purchase of land and others<br />

Penambahan investasi pada anak<br />

perusahaan dan perusahaan<br />

Additional investment in subsidiaries<br />

asosiasi (103.547.890.010) 1c.1,1c.6 (425.406.731.458) and associated companies<br />

Perolehan anak perusahaan melalui<br />

Acquisition of subsidiaries through<br />

pembelian saham - 1c (103.778.000.000) purchase of share ownership<br />

Kenaikan piutang hubungan<br />

istimewa (50.448.080.088) 27 (58.280.000.000) Increase in due from related party<br />

Penempatan investasi<br />

dalam efek dimiliki hingga<br />

Placement of investment in<br />

jatuh tempo (35.137.143.352) 4d (219.532.487.194) held-to-maturity securities<br />

Kenaikan aset lain-lain (4.046.890.646) (1.990.210.774) Increase in other assets<br />

Kas bersih yang digunakan untuk<br />

Net cash used in investing<br />

aktivitas investasi (542.483.756.482) (1.167.403.135.477) activities<br />

Catatan atas laporan keuangan konsolidasi terlampir merupakan<br />

bagian yang tidak terpisahkan dari laporan keuangan konsolidasi<br />

secara keseluruhan.<br />

The accompanying notes form an integral part of these<br />

consolidated financial statements.<br />

5