2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

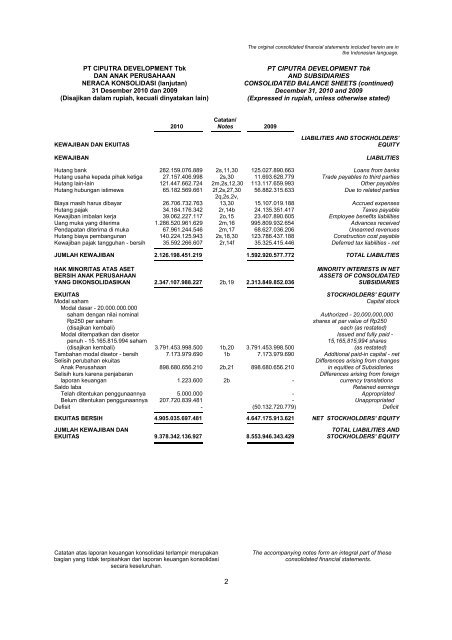

The original consolidated financial statements included herein are in<br />

the Indonesian language.<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

NERACA KONSOLIDASI (lanjutan)<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

CONSOLIDATED BALANCE SHEETS (continued)<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

Catatan/<br />

2010 Notes <strong>2009</strong><br />

KEWAJIBAN DAN EKUITAS<br />

KEWAJIBAN<br />

LIABILITIES AND STOCKHOLDERS’<br />

EQUITY<br />

LIABILITIES<br />

Hutang bank 282.159.076.889 2s,11,30 125.027.890.663 Loans from banks<br />

Hutang usaha kepada pihak ketiga 27.157.406.998 2s,30 11.693.628.779 Trade payables to third parties<br />

Hutang lain-lain 121.447.662.724 2m,2s,12,30 113.117.659.993 Other payables<br />

Hutang hubungan istimewa 65.182.569.661 2f,2s,27,30 56.882.315.633 Due to related parties<br />

2q,2s,2v,<br />

Biaya masih harus dibayar 26.706.732.763 13,30 15.107.019.188 Accrued expenses<br />

Hutang pajak 34.184.176.342 2r,14b 24.135.351.417 Taxes payable<br />

Kewajiban imbalan kerja 39.062.227.117 2o,15 23.407.890.605 Employee benefits liabilities<br />

Uang muka yang diterima 1.286.520.961.629 2m,16 995.809.932.654 Advances received<br />

Pendapatan diterima di muka 67.961.244.546 2m,17 68.627.036.206 Unearned revenues<br />

Hutang biaya pembangunan 140.224.125.943 2s,18,30 123.786.437.188 Construction cost payable<br />

Kewajiban pajak tangguhan - bersih 35.592.266.607 2r,14f 35.325.415.446 Deferred tax liabilities - net<br />

JUMLAH KEWAJIBAN 2.126.198.451.219 1.592.920.577.772 TOTAL LIABILITIES<br />

HAK MINORITAS ATAS ASET<br />

MINORITY INTERESTS IN NET<br />

BERSIH ANAK PERUSAHAAN<br />

ASSETS OF CONSOLIDATED<br />

YANG DIKONSOLIDASIKAN 2.347.107.988.227 2b,19 2.313.849.852.036 SUBSIDIARIES<br />

EKUITAS<br />

STOCKHOLDERS’ EQUITY<br />

Modal saham<br />

Capital stock<br />

Modal dasar - 20.000.000.000<br />

saham dengan nilai nominal Authorized - 20,000,000,000<br />

Rp250 per saham<br />

shares at par value of Rp250<br />

(disajikan kembali)<br />

each (as restated)<br />

Modal ditempatkan dan disetor Issued and fully paid -<br />

penuh - 15.165.815.994 saham<br />

15,165,815,994 shares<br />

(disajikan kembali) 3.791.453.998.500 1b,20 3.791.453.998.500 (as restated)<br />

Tambahan modal disetor - bersih 7.173.979.690 1b 7.173.979.690 Additional paid-in capital - net<br />

Selisih perubahan ekuitas<br />

Differences arising from changes<br />

Anak Perusahaan 898.680.656.210 2b,21 898.680.656.210 in equities of Subsidiaries<br />

Selisih kurs karena penjabaran<br />

Differences arising from foreign<br />

laporan keuangan 1.223.600 2b - currency translations<br />

Saldo laba<br />

Retained earnings<br />

Telah ditentukan penggunaannya 5.000.000 - Appropriated<br />

Belum ditentukan penggunaannya 207.720.839.481 - Unappropriated<br />

Defisit - (50.132.720.779) Deficit<br />

EKUITAS BERSIH 4.905.035.697.481 4.647.175.913.621 NET STOCKHOLDERS’ EQUITY<br />

JUMLAH KEWAJIBAN DAN<br />

TOTAL LIABILITIES AND<br />

EKUITAS 9.378.342.136.927 8.553.946.343.429 STOCKHOLDERS’ EQUITY<br />

Catatan atas laporan keuangan konsolidasi terlampir merupakan<br />

bagian yang tidak terpisahkan dari laporan keuangan konsolidasi<br />

secara keseluruhan.<br />

The accompanying notes form an integral part of these<br />

consolidated financial statements.<br />

2