2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

9. PROPERTI INVESTASI (lanjutan) 9. INVESTMENT PROPERTIES (continued)<br />

Properti investasi terutama merupakan investasi<br />

pada tanah dan bangunan pusat niaga yang dimiliki<br />

oleh CSN dan CSM, keduanya merupakan anak<br />

perusahaan CP, yang terletak di Jakarta dan<br />

Semarang. Properti investasi tersebut disewakan<br />

kepada pihak ketiga. Pendapatan sewa tersebut<br />

disajikan sebagai bagian dari pendapatan pada<br />

laporan laba rugi konsolidasi.<br />

Biaya penyusutan untuk tahun 2010 dan <strong>2009</strong><br />

masing-masing adalah sebesar Rp14.382.947.387<br />

dan Rp12.572.080.177 yang dicatat sebagai beban<br />

langsung pada laporan laba rugi konsolidasi.<br />

Properti investasi, kecuali tanah, diasuransikan<br />

berdasarkan suatu paket polis gabungan dengan<br />

aset tetap (Catatan 8). Manajemen Anak<br />

Perusahaan berpendapat bahwa nilai<br />

pertanggungan tersebut cukup untuk menutup<br />

kemungkinan kerugian atas risiko tersebut.<br />

Nilai wajar properti investasi pada tanggal<br />

31 Desember 2010 dan <strong>2009</strong> masing-masing<br />

sebesar Rp1,29 triliun dan Rp1,38 triliun, yang<br />

telah ditentukan berdasarkan penilaian yang<br />

dilakukan oleh penilai independen KJPP<br />

Rengganis, Hamid & Partners.<br />

Pendapatan sewa dari properti investasi yang<br />

diakui dalam laporan laba rugi konsolidasi pada<br />

tahun 2010 dan <strong>2009</strong>, masing-masing adalah<br />

sebesar Rp222.248.169.647 dan<br />

Rp215.958.391.818 (Catatan 22).<br />

Manajemen Anak Perusahaan berkeyakinan<br />

bahwa tidak ada penurunan nilai pada properti<br />

investasi per 31 Desember 2010 dan <strong>2009</strong>.<br />

Investment properties mainly represent investment<br />

in land and shopping center building owned by<br />

CSN and CSM, both subsidiaries of CP, located in<br />

Jakarta and Semarang. These investment<br />

properties are rented out to third parties. The rental<br />

income is presented as part of revenues in the<br />

consolidated statements of income.<br />

Depreciation expenses in 2010 and <strong>2009</strong><br />

amounting to Rp14,382,947,387 and<br />

Rp12,572,080,177, respectively, are recorded as<br />

direct costs in the consolidated statements of<br />

income.<br />

Investment properties, except land, are covered by<br />

insurance under blanket policies that also cover<br />

fixed assets (Note 8). The Subsidiaries’<br />

management are of the opinion that the above<br />

coverages are adequate to cover possible losses<br />

arising from such risks.<br />

The fair value of the investment properties as of<br />

December 31, 2010 and <strong>2009</strong> amounted to Rp1.29<br />

trilion and Rp1.38 trilion, respectively, which was<br />

determined by independent appraisers KJPP<br />

Rengganis, Hamid & Partners.<br />

Rental income from investment properties<br />

recognized in the consolidated statements of<br />

income in 2010 and <strong>2009</strong> amounted to<br />

Rp222,248,169,647 and Rp215,958,391,818,<br />

respectively (Note 22).<br />

The management of the Subsidiaries believe that<br />

there is no impairment in the value of investment<br />

properties as of December 31, 2010 and <strong>2009</strong>.<br />

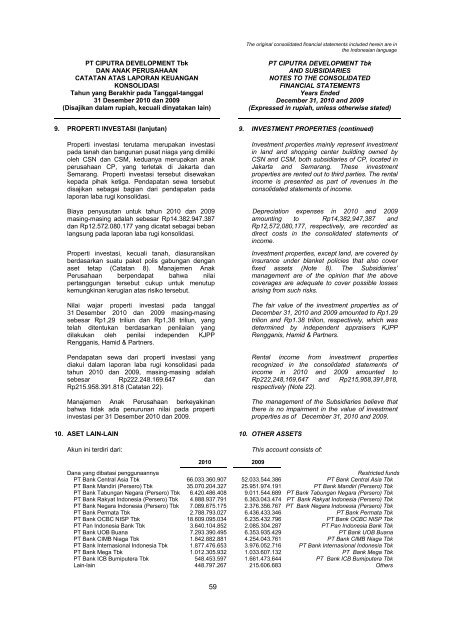

10. ASET LAIN-LAIN 10. OTHER ASSETS<br />

Akun ini terdiri dari:<br />

This account consists of:<br />

2010 <strong>2009</strong><br />

Dana yang dibatasi penggunaannya<br />

Restricted funds<br />

PT Bank Central Asia Tbk 66.033.360.907 52.033.544.386 PT Bank Central Asia Tbk<br />

PT Bank Mandiri (Persero) Tbk 35.070.204.327 25.951.974.191 PT Bank Mandiri (Persero) Tbk<br />

PT Bank Tabungan Negara (Persero) Tbk 6.420.486.408 9.011.544.689 PT Bank Tabungan Negara (Persero) Tbk<br />

PT Bank Rakyat Indonesia (Persero) Tbk 4.888.937.791 6.363.043.474 PT Bank Rakyat Indonesia (Persero) Tbk<br />

PT Bank Negara Indonesia (Persero) Tbk 7.089.675.175 2.376.356.767 PT Bank Negara Indonesia (Persero) Tbk<br />

PT Bank Permata Tbk 2.788.793.027 6.436.433.346 PT Bank Permata Tbk<br />

PT Bank OCBC NISP Tbk 18.609.095.034 6.235.432.796 PT Bank OCBC NISP Tbk<br />

PT Pan Indonesia Bank Tbk 3.640.104.852 2.085.304.287 PT Pan Indonesia Bank Tbk<br />

PT Bank UOB Buana 7.293.390.495 6.353.935.429 PT Bank UOB Buana<br />

PT Bank CIMB Niaga Tbk 1.842.882.881 4.254.043.761 PT Bank CIMB Niaga Tbk<br />

PT Bank Internasional Indonesia Tbk 1.877.476.653 3.976.052.716 PT Bank Internasional Indonesia Tbk<br />

PT Bank Mega Tbk 1.012.305.932 1.033.607.132 PT Bank Mega Tbk<br />

PT Bank ICB Bumiputera Tbk 548.453.597 1.661.473.644 PT Bank ICB Bumiputera Tbk<br />

Lain-lain 448.797.267 215.606.683 Others<br />

59