2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

31. KEBIJAKAN DAN TUJUAN MANAJEMEN<br />

RISIKO KEUANGAN (lanjutan)<br />

MANAJEMEN RISIKO (lanjutan)<br />

31. FINANCIAL RISK MANAGEMENT OBJECTIVES<br />

AND POLICIES (continued)<br />

RISK MANAGEMENT (continued)<br />

d. Risiko likuiditas (lanjutan) d. Liquidity risk (continued)<br />

Kebutuhan likuiditas Perusahaan dan Anak<br />

Perusahaan secara historis timbul dari<br />

kebutuhan untuk membiayai investasi dan<br />

pengeluaran barang modal terkait dengan<br />

program perluasan usaha. Perusahaan dan<br />

Anak Perusahaan membutuhkan modal kerja<br />

yang substansial untuk membangun proyekproyek<br />

baru dan untuk mendanai operasional.<br />

Dalam mengelola risiko likuiditas, Perusahaan<br />

dan Anak Perusahaan memantau dan<br />

menjaga tingkat kas dan setara kas yang<br />

dianggap memadai untuk membiayai<br />

operasional Perusahaan dan Anak<br />

Perusahaan dan untuk mengatasi dampak dari<br />

fluktuasi arus kas. Perusahaan dan Anak<br />

Perusahaan juga secara rutin mengevaluasi<br />

proyeksi arus kas dan arus kas aktual,<br />

termasuk jadwal jatuh tempo hutang bank<br />

panjang mereka, dan terus menelaah kondisi<br />

pasar keuangan untuk memelihara fleksibilitas<br />

pendanaan dengan cara menjaga<br />

ketersediaan komitmen fasilitas kredit.<br />

Kegiatan ini meliputi pinjaman bank.<br />

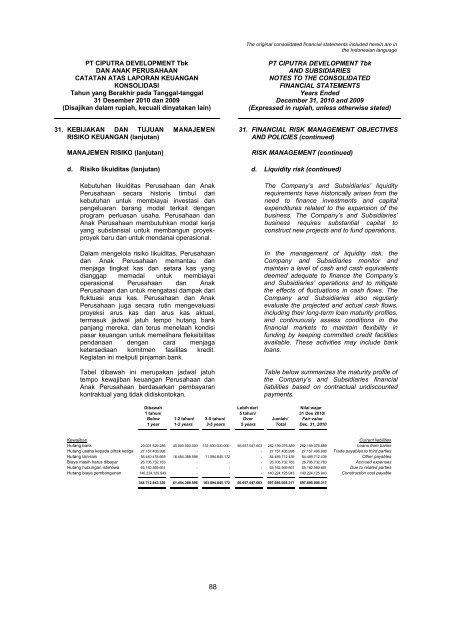

Tabel dibawah ini merupakan jadwal jatuh<br />

tempo kewajiban keuangan Perusahaan dan<br />

Anak Perusahaan berdasarkan pembayaran<br />

kontraktual yang tidak didiskontokan.<br />

The Company’s and Subsidiaries’ liquidity<br />

requirements have historically arisen from the<br />

need to finance investments and capital<br />

expenditures related to the expansion of the<br />

business. The Company’s and Subsidiaries’<br />

business requires substantial capital to<br />

construct new projects and to fund operations.<br />

In the management of liquidity risk, the<br />

Company and Subsidiaries monitor and<br />

maintain a level of cash and cash equivalents<br />

deemed adequate to finance the Company’s<br />

and Subsidiaries’ operations and to mitigate<br />

the effects of fluctuations in cash flows. The<br />

Company and Subsidiaries also regularly<br />

evaluate the projected and actual cash flows,<br />

including their long-term loan maturity profiles,<br />

and continuously assess conditions in the<br />

financial markets to maintain flexibility in<br />

funding by keeping committed credit facilities<br />

available. These activities may include bank<br />

loans.<br />

Table below summarizes the maturity profile of<br />

the Company’s and Subsidiaries financial<br />

liabilities based on contractual undiscounted<br />

payments.<br />

Dibawah Lebih dari Nilai wajar<br />

1 tahun/ 5 tahun/ 31 Des 2010/<br />

Below 1-2 tahun/ 3-5 tahun/ Over Jumlah/ Fair value<br />

1 year 1-2 years 3-5 years 5 years Total Dec. 31, 2010<br />

Kewajiban<br />

Current liabilities<br />

Hutang bank 29.001.529.286 45.000.000.000 151.500.000.000 56.657.547.603 282.159.076.889 282.159.076.889 Loans from banks<br />

Hutang usaha kepada pihak ketiga 27.157.406.998 - - - 27.157.406.998 27.157.406.998 Trade payables to third parties<br />

Hutang lain-lain 56.440.478.669 16.454.388.598 11.594.845.172 - 84.489.712.439 84.489.712.439 Other payables<br />

Biaya masih harus dibayar 26.706.732.763 - - - 26.706.732.763 26.706.732.763 Accrued expenses<br />

Hutang hubungan istimewa 65.182.569.661 - - - 65.182.569.661 65.182.569.661 Due to related parties<br />

Hutang biaya pembangunan 140.224.125.943 - - - 140.224.125.943 140.224.125.943 Construction cost payable<br />

344.712.843.320 61.454.388.598 163.094.845.172 56.657.547.603 597.695.005.317 597.695.005.317<br />

88