2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

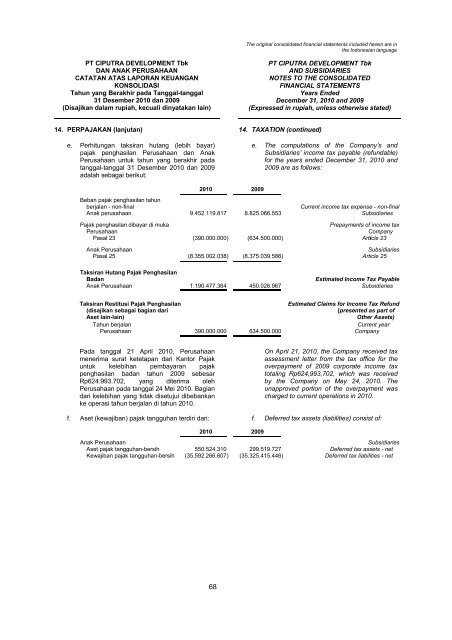

14. PERPAJAKAN (lanjutan) 14. TAXATION (continued)<br />

e. Perhitungan taksiran hutang (lebih bayar)<br />

pajak penghasilan Perusahaan dan Anak<br />

Perusahaan untuk tahun yang berakhir pada<br />

tanggal-tanggal 31 Desember 2010 dan <strong>2009</strong><br />

adalah sebagai berikut:<br />

e. The computations of the Company’s and<br />

Subsidiaries’ income tax payable (refundable)<br />

for the years ended December 31, 2010 and<br />

<strong>2009</strong> are as follows:<br />

2010 <strong>2009</strong><br />

Beban pajak penghasilan tahun<br />

berjalan - non-final<br />

Current income tax expense - non-final<br />

Anak perusahaan 9.452.119.817 8.825.066.553 Subsidiaries<br />

Pajak penghasilan dibayar di muka<br />

Prepayments of income tax<br />

Perusahaan<br />

Company<br />

Pasal 23 (390.000.000) (634.500.000) Article 23<br />

Anak Perusahaan<br />

Subsidiaries<br />

Pasal 25 (8.355.002.038) (8.375.039.586) Article 25<br />

Taksiran Hutang Pajak Penghasilan<br />

Badan<br />

Estimated Income Tax Payable<br />

Anak Perusahaan 1.190.477.364 450.026.967 Subsidiaries<br />

Taksiran Restitusi Pajak Penghasilan<br />

Estimated Claims for Income Tax Refund<br />

(disajikan sebagai bagian dari<br />

(presented as part of<br />

Aset lain-lain)<br />

Other Assets)<br />

Tahun berjalan<br />

Current year<br />

Perusahaan 390.000.000 634.500.000 Company<br />

Pada tanggal 21 April 2010, Perusahaan<br />

menerima surat ketetapan dari Kantor Pajak<br />

untuk kelebihan pembayaran pajak<br />

penghasilan badan tahun <strong>2009</strong> sebesar<br />

Rp624.993.702, yang diterima oleh<br />

Perusahaan pada tanggal 24 Mei 2010. Bagian<br />

dari kelebihan yang tidak disetujui dibebankan<br />

ke operasi tahun berjalan di tahun 2010.<br />

On April 21, 2010, the Company received tax<br />

assessment letter from the tax office for the<br />

overpayment of <strong>2009</strong> corporate income tax<br />

totaling Rp624,993,702, which was received<br />

by the Company on May 24, 2010. The<br />

unapproved portion of the overpayment was<br />

charged to current operations in 2010.<br />

f. Aset (kewajiban) pajak tangguhan terdiri dari: f. Deferred tax assets (liabilities) consist of:<br />

2010 <strong>2009</strong><br />

Anak Perusahaan<br />

Subsidiaries<br />

Aset pajak tangguhan-bersih 550.524.310 299.519.727 Deferred tax assets - net<br />

Kewajiban pajak tangguhan-bersih (35.592.266.607) (35.325.415.446) Deferred tax liabilities - net<br />

68