2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

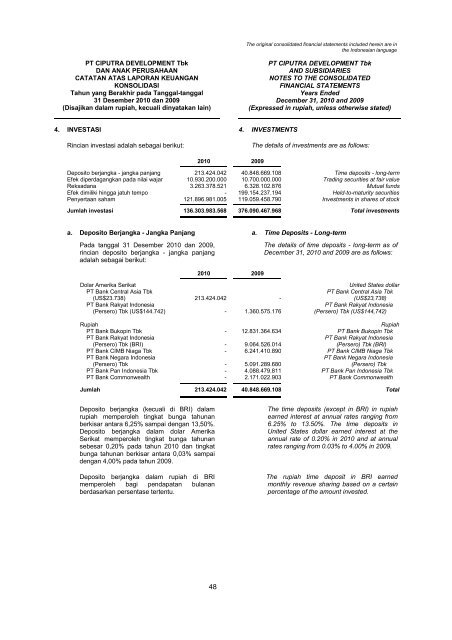

4. INVESTASI 4. INVESTMENTS<br />

Rincian investasi adalah sebagai berikut:<br />

The details of investments are as follows:<br />

2010 <strong>2009</strong><br />

Deposito berjangka - jangka panjang 213.424.042 40.848.669.108 Time deposits - long-term<br />

Efek diperdagangkan pada nilai wajar 10.930.200.000 10.700.000.000 Trading securities at fair value<br />

Reksadana 3.263.378.521 6.328.102.876 Mutual funds<br />

Efek dimiliki hingga jatuh tempo - 199.154.237.194 Held-to-maturity securities<br />

Penyertaan saham 121.896.981.005 119.059.458.790 Investments in shares of stock<br />

Jumlah investasi 136.303.983.568 376.090.467.968 Total investments<br />

a. Deposito Berjangka - Jangka Panjang<br />

Pada tanggal 31 Desember 2010 dan <strong>2009</strong>,<br />

rincian deposito berjangka - jangka panjang<br />

adalah sebagai berikut:<br />

a. Time Deposits - Long-term<br />

The details of time deposits - long-term as of<br />

December 31, 2010 and <strong>2009</strong> are as follows:<br />

2010 <strong>2009</strong><br />

Dolar Amerika Serikat<br />

United States dollar<br />

PT Bank Central Asia Tbk<br />

PT Bank Central Asia Tbk<br />

(US$23.738) 213.424.042 - (US$23,738)<br />

PT Bank Rakyat Indonesia<br />

PT Bank Rakyat Indonesia<br />

(Persero) Tbk (US$144.742) - 1.360.575.176 (Persero) Tbk (US$144,742)<br />

Rupiah<br />

Rupiah<br />

PT Bank Bukopin Tbk - 12.831.364.634 PT Bank Bukopin Tbk<br />

PT Bank Rakyat Indonesia<br />

PT Bank Rakyat Indonesia<br />

(Persero) Tbk (BRI) - 9.064.526.014 (Persero) Tbk (BRI)<br />

PT Bank CIMB Niaga Tbk - 6.241.410.890 PT Bank CIMB Niaga Tbk<br />

PT Bank Negara Indonesia<br />

PT Bank Negara Indonesia<br />

(Persero) Tbk - 5.091.289.680 (Persero) Tbk<br />

PT Bank Pan Indonesia Tbk - 4.088.479.811 PT Bank Pan Indonesia Tbk<br />

PT Bank Commonwealth - 2.171.022.903 PT Bank Commonwealth<br />

Jumlah 213.424.042 40.848.669.108 Total<br />

Deposito berjangka (kecuali di BRI) dalam<br />

rupiah memperoleh tingkat bunga tahunan<br />

berkisar antara 6,25% sampai dengan 13,50%.<br />

Deposito berjangka dalam dolar Amerika<br />

Serikat memperoleh tingkat bunga tahunan<br />

sebesar 0,20% pada tahun 2010 dan tingkat<br />

bunga tahunan berkisar antara 0,03% sampai<br />

dengan 4,00% pada tahun <strong>2009</strong>.<br />

Deposito berjangka dalam rupiah di BRI<br />

memperoleh bagi pendapatan bulanan<br />

berdasarkan persentase tertentu.<br />

The time deposits (except in BRI) in rupiah<br />

earned interest at annual rates ranging from<br />

6.25% to 13.50%. The time deposits in<br />

United States dollar earned interest at the<br />

annual rate of 0.20% in 2010 and at annual<br />

rates ranging from 0.03% to 4.00% in <strong>2009</strong>.<br />

The rupiah time deposit in BRI earned<br />

monthly revenue sharing based on a certain<br />

percentage of the amount invested.<br />

48