2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

1. UMUM (lanjutan) 1. GENERAL (continued)<br />

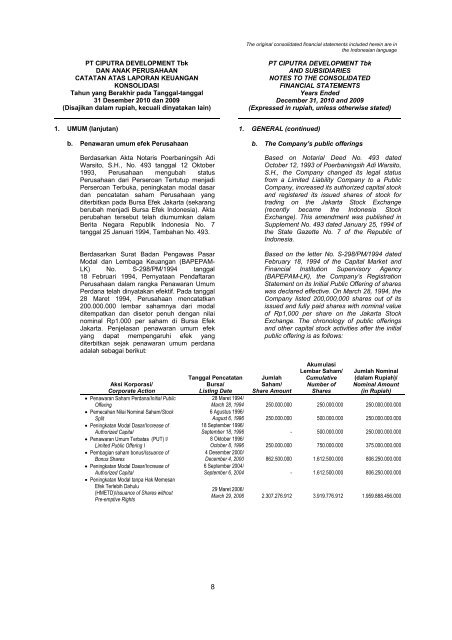

b. Penawaran umum efek Perusahaan b. The Company’s public offerings<br />

Berdasarkan Akta Notaris Poerbaningsih Adi<br />

Warsito, S.H., No. 493 tanggal 12 Oktober<br />

1993, Perusahaan mengubah status<br />

Perusahaan dari Perseroan Tertutup menjadi<br />

Perseroan Terbuka, peningkatan modal dasar<br />

dan pencatatan saham Perusahaan yang<br />

diterbitkan pada Bursa Efek Jakarta (sekarang<br />

berubah menjadi Bursa Efek Indonesia). Akta<br />

perubahan tersebut telah diumumkan dalam<br />

Berita Negara Republik Indonesia No. 7<br />

tanggal 25 Januari 1994, Tambahan No. 493.<br />

Berdasarkan Surat Badan Pengawas Pasar<br />

Modal dan Lembaga Keuangan (BAPEPAM-<br />

LK) No. S-298/PM/1994 tanggal<br />

18 Februari 1994, Pernyataan Pendaftaran<br />

Perusahaan dalam rangka Penawaran Umum<br />

Perdana telah dinyatakan efektif. Pada tanggal<br />

28 Maret 1994, Perusahaan mencatatkan<br />

200.000.000 lembar sahamnya dari modal<br />

ditempatkan dan disetor penuh dengan nilai<br />

nominal Rp1.000 per saham di Bursa Efek<br />

Jakarta. Penjelasan penawaran umum efek<br />

yang dapat mempengaruhi efek yang<br />

diterbitkan sejak penawaran umum perdana<br />

adalah sebagai berikut:<br />

Based on Notarial Deed No. 493 dated<br />

October 12, 1993 of Poerbaningsih Adi Warsito,<br />

S.H., the Company changed its legal status<br />

from a Limited Liability Company to a Public<br />

Company, increased its authorized capital stock<br />

and registered its issued shares of stock for<br />

trading on the Jakarta Stock Exchange<br />

(recently became the Indonesia Stock<br />

Exchange). This amendment was published in<br />

Supplement No. 493 dated January 25, 1994 of<br />

the State Gazette No. 7 of the Republic of<br />

Indonesia.<br />

Based on the letter No. S-298/PM/1994 dated<br />

February 18, 1994 of the Capital Market and<br />

Financial Institution Supervisory Agency<br />

(BAPEPAM-LK), the Company’s Registration<br />

Statement on its Initial Public Offering of shares<br />

was declared effective. On March 28, 1994, the<br />

Company listed 200,000,000 shares out of its<br />

issued and fully paid shares with nominal value<br />

of Rp1,000 per share on the Jakarta Stock<br />

Exchange. The chronology of public offerings<br />

and other capital stock activities after the initial<br />

public offering is as follows:<br />

Akumulasi<br />

Lembar Saham/<br />

Cumulative<br />

Number of<br />

Shares<br />

Jumlah Nominal<br />

(dalam Rupiah)/<br />

Nominal Amount<br />

(in Rupiah)<br />

Aksi Korporasi/<br />

Corporate Action<br />

Tanggal Pencatatan<br />

Bursa/<br />

Listing Date<br />

Jumlah<br />

Saham/<br />

Share Amount<br />

Penawaran Saham Perdana/Initial Public<br />

28 Maret 1994/<br />

Offering<br />

March 28, 1994 250.000.000 250.000.000 250.000.000.000<br />

Pemecahan Nilai Nominal Saham/Stock<br />

6 Agustus 1996/<br />

Split August 6, 1996 250.000.000 500.000.000 250.000.000.000<br />

Peningkatan Modal Dasar/Increase of<br />

18 September 1996/<br />

Authorized Capital<br />

September 18, 1996 - 500.000.000 250.000.000.000<br />

Penawaran Umum Terbatas (PUT) I/<br />

8 Oktober 1996/<br />

Limited Public Offering I<br />

October 8, 1996 250.000.000 750.000.000 375.000.000.000<br />

Pembagian saham bonus/Issuance of<br />

4 Desember 2000/<br />

Bonus Shares<br />

December 4, 2000 862.500.000 1.612.500.000 806.250.000.000<br />

Peningkatan Modal Dasar/Increase of<br />

6 September 2004/<br />

Authorized Capital September 6, 2004 - 1.612.500.000 806.250.000.000<br />

Peningkatan Modal tanpa Hak Memesan<br />

Efek Terlebih Dahulu<br />

(HMETD)/Issuance of Shares without<br />

Pre-emptive Rights<br />

29 Maret 2006/<br />

March 29, 2006 2.307.276.912 3.919.776.912 1.959.888.456.000<br />

8