2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

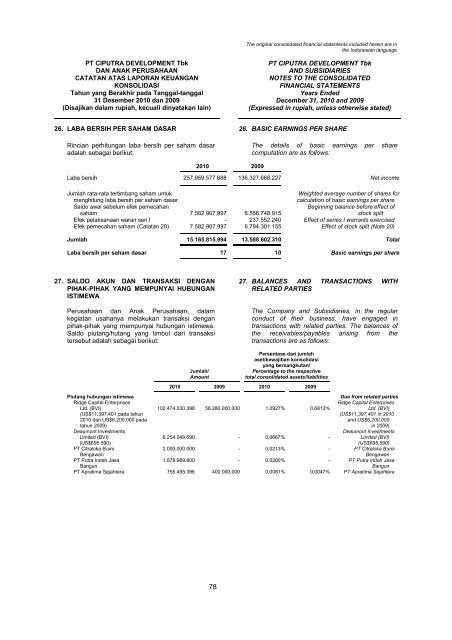

26. LABA BERSIH PER SAHAM DASAR 26. BASIC EARNINGS PER SHARE<br />

Rincian perhitungan laba bersih per saham dasar<br />

adalah sebagai berikut:<br />

The details of basic earnings per share<br />

computation are as follows:<br />

2010 <strong>2009</strong><br />

Laba bersih 257.959.577.688 136.327.668.227 Net income<br />

Jumlah rata-rata tertimbang saham untuk<br />

Weighted average number of shares for<br />

menghitung laba bersih per saham dasar<br />

calculation of basic earnings per share<br />

Saldo awal sebelum efek pemecahan<br />

Beginning balance before effect of<br />

saham 7.582.907.997 6.556.748.915 stock split<br />

Efek pelaksanaan waran seri I - 237.552.240 Effect of series I warrants exercised<br />

Efek pemecahan saham (Catatan 20) 7.582.907.997 6.794.301.155 Effect of stock split (Note 20)<br />

Jumlah 15.165.815.994 13.588.602.310 Total<br />

Laba bersih per saham dasar 17 10 Basic earnings per share<br />

27. SALDO AKUN DAN TRANSAKSI DENGAN<br />

PIHAK-PIHAK YANG MEMPUNYAI HUBUNGAN<br />

ISTIMEWA<br />

Perusahaan dan Anak Perusahaan, dalam<br />

kegiatan usahanya melakukan transaksi dengan<br />

pihak-pihak yang mempunyai hubungan istimewa.<br />

Saldo piutang/hutang yang timbul dari transaksi<br />

tersebut adalah sebagai berikut:<br />

27. BALANCES AND TRANSACTIONS WITH<br />

RELATED PARTIES<br />

The Company and Subsidiaries, in the regular<br />

conduct of their business, have engaged in<br />

transactions with related parties. The balances of<br />

the receivables/payables arising from the<br />

transactions are as follows:<br />

Jumlah/<br />

Amount<br />

Persentase dari jumlah<br />

aset/kewajiban konsolidasi<br />

yang bersangkutan/<br />

Percentage to the respective<br />

total consolidated assets/liabilities<br />

2010 <strong>2009</strong> 2010 <strong>2009</strong><br />

Piutang hubungan istimewa<br />

Due from related parties<br />

Ridge Capital Enterprises<br />

Ridge Capital Enterprises<br />

Ltd. (BVI) 102.474.030.398 58.280.000.000 1,0927% 0,6813% Ltd. (BVI)<br />

(US$11.397.401 pada tahun (US$11,397,401 in 2010<br />

2010 dan US$6.200.000 pada and US$6,200,000<br />

tahun <strong>2009</strong>) in <strong>2009</strong>)<br />

Deaumont Investments<br />

Deaumont Investments<br />

Limited (BVI) 6.254.049.690 - 0,0667% - Limited (BVI)<br />

(US$695.590)<br />

(US$695,590)<br />

PT Citraloka Bumi 2.000.000.000 - 0,0213% - PT Citraloka Bumi<br />

Bengawan<br />

Bengawan<br />

PT Putra Indah Jasa 1.878.989.800 - 0,0200% - PT Putra Indah Jasa<br />

Bangun<br />

Bangun<br />

PT Apratima Sejahtera 755.495.396 400.000.000 0,0081% 0,0047% PT Apratima Sejahtera<br />

78