2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

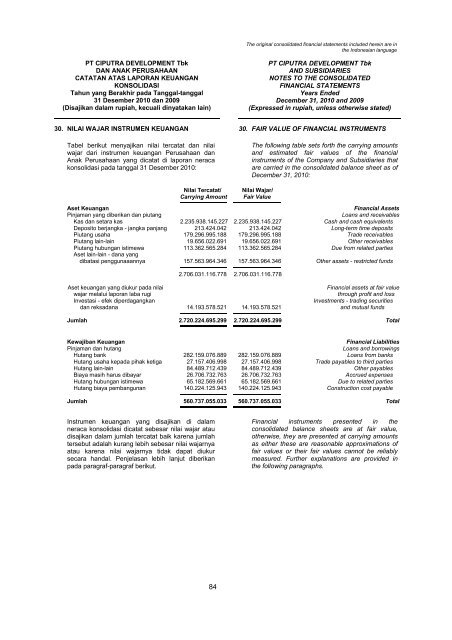

30. NILAI WAJAR INSTRUMEN KEUANGAN 30. FAIR VALUE OF FINANCIAL INSTRUMENTS<br />

Tabel berikut menyajikan nilai tercatat dan nilai<br />

wajar dari instrumen keuangan Perusahaan dan<br />

Anak Perusahaan yang dicatat di laporan neraca<br />

konsolidasi pada tanggal 31 Desember 2010:<br />

Nilai Tercatat/<br />

Carrying Amount<br />

The following table sets forth the carrying amounts<br />

and estimated fair values of the financial<br />

instruments of the Company and Subsidiaries that<br />

are carried in the consolidated balance sheet as of<br />

December 31, 2010:<br />

Nilai Wajar/<br />

Fair Value<br />

Aset Keuangan<br />

Financial Assets<br />

Pinjaman yang diberikan dan piutang<br />

Loans and receivables<br />

Kas dan setara kas 2.235.938.145.227 2.235.938.145.227 Cash and cash equivalents<br />

Deposito berjangka - jangka panjang 213.424.042 213.424.042 Long-term time deposits<br />

Piutang usaha 179.296.995.188 179.296.995.188 Trade receivables<br />

Piutang lain-lain 19.656.022.691 19.656.022.691 Other receivables<br />

Piutang hubungan istimewa 113.362.565.284 113.362.565.284 Due from related parties<br />

Aset lain-lain - dana yang<br />

dibatasi penggunaaannya 157.563.964.346 157.563.964.346 Other assets - restricted funds<br />

2.706.031.116.778 2.706.031.116.778<br />

Aset keuangan yang diukur pada nilai<br />

Financial assets at fair value<br />

wajar melalui laporan laba rugi<br />

through profit and loss<br />

Investasi - efek diperdagangkan<br />

Investments - trading securities<br />

dan reksadana 14.193.578.521 14.193.578.521 and mutual funds<br />

Jumlah 2.720.224.695.299 2.720.224.695.299 Total<br />

Kewajiban Keuangan<br />

Financial Liabilities<br />

Pinjaman dan hutang<br />

Loans and borrowings<br />

Hutang bank 282.159.076.889 282.159.076.889 Loans from banks<br />

Hutang usaha kepada pihak ketiga 27.157.406.998 27.157.406.998 Trade payables to third parties<br />

Hutang lain-lain 84.489.712.439 84.489.712.439 Other payables<br />

Biaya masih harus dibayar 26.706.732.763 26.706.732.763 Accrued expenses<br />

Hutang hubungan istimewa 65.182.569.661 65.182.569.661 Due to related parties<br />

Hutang biaya pembangunan 140.224.125.943 140.224.125.943 Construction cost payable<br />

Jumlah 560.737.055.033 560.737.055.033 Total<br />

Instrumen keuangan yang disajikan di dalam<br />

neraca konsolidasi dicatat sebesar nilai wajar atau<br />

disajikan dalam jumlah tercatat baik karena jumlah<br />

tersebut adalah kurang lebih sebesar nilai wajarnya<br />

atau karena nilai wajarnya tidak dapat diukur<br />

secara handal. Penjelasan lebih lanjut diberikan<br />

pada paragraf-paragraf berikut.<br />

Financial instruments presented in the<br />

consolidated balance sheets are at fair value,<br />

otherwise, they are presented at carrying amounts<br />

as either these are reasonable approximations of<br />

fair values or their fair values cannot be reliably<br />

measured. Further explanations are provided in<br />

the following paragraphs.<br />

84