2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

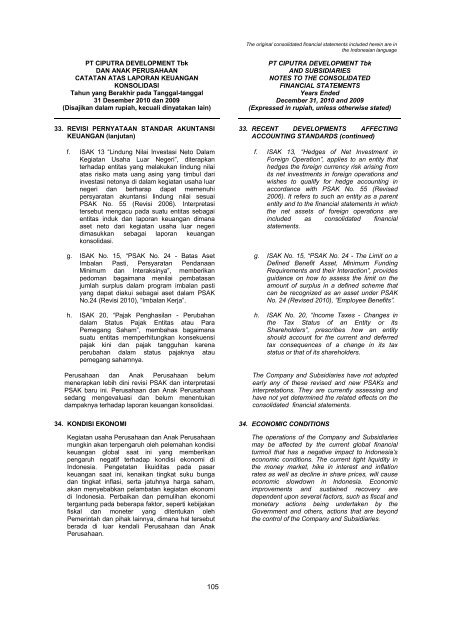

33. REVISI PERNYATAAN STANDAR AKUNTANSI<br />

KEUANGAN (lanjutan)<br />

f. ISAK 13 “Lindung Nilai Investasi Neto Dalam<br />

Kegiatan Usaha Luar Negeri”, diterapkan<br />

terhadap entitas yang melakukan lindung nilai<br />

atas risiko mata uang asing yang timbul dari<br />

investasi netonya di dalam kegiatan usaha luar<br />

negeri dan berharap dapat memenuhi<br />

persyaratan akuntansi lindung nilai sesuai<br />

PSAK No. 55 (Revisi 2006). Interpretasi<br />

tersebut mengacu pada suatu entitas sebagai<br />

entitas induk dan laporan keuangan dimana<br />

aset neto dari kegiatan usaha luar negeri<br />

dimasukkan sebagai laporan keuangan<br />

konsolidasi.<br />

g. ISAK No. 15, “PSAK No. 24 - Batas Aset<br />

Imbalan Pasti, Persyaratan Pendanaan<br />

Minimum dan Interaksinya”, memberikan<br />

pedoman bagaimana menilai pembatasan<br />

jumlah surplus dalam program imbalan pasti<br />

yang dapat diakui sebagai aset dalam PSAK<br />

No.24 (Revisi 2010), “Imbalan Kerja”.<br />

h. ISAK 20, “Pajak Penghasilan - Perubahan<br />

dalam Status Pajak Entitas atau Para<br />

Pemegang Saham”, membahas bagaimana<br />

suatu entitas memperhitungkan konsekuensi<br />

pajak kini dan pajak tangguhan karena<br />

perubahan dalam status pajaknya atau<br />

pemegang sahamnya.<br />

Perusahaan dan Anak Perusahaan belum<br />

menerapkan lebih dini revisi PSAK dan interpretasi<br />

PSAK baru ini. Perusahaan dan Anak Perusahaan<br />

sedang mengevaluasi dan belum menentukan<br />

dampaknya terhadap laporan keuangan konsolidasi.<br />

33. RECENT DEVELOPMENTS AFFECTING<br />

ACCOUNTING STANDARDS (continued)<br />

f. ISAK 13, “Hedges of Net Investment in<br />

Foreign Operation”, applies to an entity that<br />

hedges the foreign currency risk arising from<br />

its net investments in foreign operations and<br />

wishes to qualify for hedge accounting in<br />

accordance with PSAK No. 55 (Revised<br />

2006). It refers to such an entity as a parent<br />

entity and to the financial statements in which<br />

the net assets of foreign operations are<br />

included as consolidated financial<br />

statements.<br />

g. ISAK No. 15, “PSAK No. 24 - The Limit on a<br />

Defined Benefit Asset, Minimum Funding<br />

Requirements and their Interaction”, provides<br />

guidance on how to assess the limit on the<br />

amount of surplus in a defined scheme that<br />

can be recognized as an asset under PSAK<br />

No. 24 (Revised 2010), ”Employee Benefits”.<br />

h. ISAK No. 20, “Income Taxes - Changes in<br />

the Tax Status of an Entity or its<br />

Shareholders”, prescribes how an entity<br />

should account for the current and deferred<br />

tax consequences of a change in its tax<br />

status or that of its shareholders.<br />

The Company and Subsidiaries have not adopted<br />

early any of these revised and new PSAKs and<br />

interpretations. They are currently assessing and<br />

have not yet determined the related effects on the<br />

consolidated financial statements.<br />

34. KONDISI EKONOMI 34. ECONOMIC CONDITIONS<br />

Kegiatan usaha Perusahaan dan Anak Perusahaan<br />

mungkin akan terpengaruh oleh pelemahan kondisi<br />

keuangan global saat ini yang memberikan<br />

pengaruh negatif terhadap kondisi ekonomi di<br />

Indonesia. Pengetatan likuiditas pada pasar<br />

keuangan saat ini, kenaikan tingkat suku bunga<br />

dan tingkat inflasi, serta jatuhnya harga saham,<br />

akan menyebabkan pelambatan kegiatan ekonomi<br />

di Indonesia. Perbaikan dan pemulihan ekonomi<br />

tergantung pada beberapa faktor, seperti kebijakan<br />

fiskal dan moneter yang ditentukan oleh<br />

Pemerintah dan pihak lainnya, dimana hal tersebut<br />

berada di luar kendali Perusahaan dan Anak<br />

Perusahaan.<br />

The operations of the Company and Subsidiaries<br />

may be affected by the current global financial<br />

turmoil that has a negative impact to Indonesia’s<br />

economic conditions. The current tight liquidity in<br />

the money market, hike in interest and inflation<br />

rates as well as decline in share prices, will cause<br />

economic slowdown in Indonesia. Economic<br />

improvements and sustained recovery are<br />

dependent upon several factors, such as fiscal and<br />

monetary actions being undertaken by the<br />

Government and others, actions that are beyond<br />

the control of the Company and Subsidiaries.<br />

105