2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

14. PERPAJAKAN (lanjutan) 14. TAXATION (continued)<br />

Pada tanggal penyelesaian laporan keuangan<br />

konsolidasi, Perusahaan belum<br />

menyampaikan SPT pajak penghasilan badan<br />

tahun 2010 kepada Kantor Pajak. Manajemen<br />

Perusahaan menyatakan bahwa SPT pajak<br />

penghasilan badan tahun 2010 akan<br />

dilaporkan sesuai dengan perhitungan pajak<br />

di atas.<br />

Perusahaan memutuskan untuk tidak<br />

mengakui aset pajak tangguhan dari saldo rugi<br />

fiskal dan dari perbedaan temporer kena pajak<br />

dan yang dapat dikurangkan karena<br />

ketidakpastian pemulihan nilainya di masa<br />

yang akan datang sebelum manfaatnya<br />

berakhir.<br />

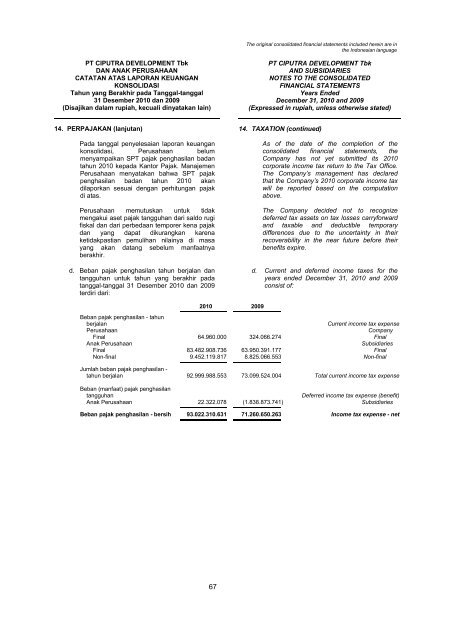

d. Beban pajak penghasilan tahun berjalan dan<br />

tangguhan untuk tahun yang berakhir pada<br />

tanggal-tanggal 31 Desember 2010 dan <strong>2009</strong><br />

terdiri dari:<br />

As of the date of the completion of the<br />

consolidated financial statements, the<br />

Company has not yet submitted its 2010<br />

corporate income tax return to the Tax Office.<br />

The Company’s management has declared<br />

that the Company’s 2010 corporate income tax<br />

will be reported based on the computation<br />

above.<br />

The Company decided not to recognize<br />

deferred tax assets on tax losses carryforward<br />

and taxable and deductible temporary<br />

differences due to the uncertainty in their<br />

recoverability in the near future before their<br />

benefits expire.<br />

d. Current and deferred income taxes for the<br />

years ended December 31, 2010 and <strong>2009</strong><br />

consist of:<br />

2010 <strong>2009</strong><br />

Beban pajak penghasilan - tahun<br />

berjalan<br />

Current income tax expense<br />

Perusahaan<br />

Company<br />

Final 64.960.000 324.066.274 Final<br />

Anak Perusahaan<br />

Subsidiaries<br />

Final 83.482.908.736 63.950.391.177 Final<br />

Non-final 9.452.119.817 8.825.066.553 Non-final<br />

Jumlah beban pajak penghasilan -<br />

tahun berjalan 92.999.988.553 73.099.524.004 Total current income tax expense<br />

Beban (manfaat) pajak penghasilan<br />

tangguhan<br />

Deferred income tax expense (benefit)<br />

Anak Perusahaan 22.322.078 (1.838.873.741) Subsidiaries<br />

Beban pajak penghasilan - bersih 93.022.310.631 71.260.650.263 Income tax expense - net<br />

67