2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

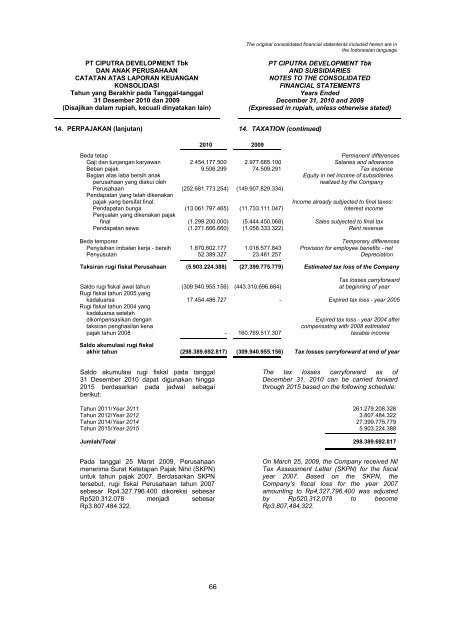

14. PERPAJAKAN (lanjutan) 14. TAXATION (continued)<br />

2010 <strong>2009</strong><br />

Beda tetap<br />

Permanent differences<br />

Gaji dan tunjangan karyawan 2.454.177.500 2.977.665.100 Salaries and allowance<br />

Beban pajak 9.506.299 74.509.291 Tax expense<br />

Bagian atas laba bersih anak<br />

Equity in net income of subsidiaries<br />

perusahaan yang diakui oleh<br />

realized by the Company<br />

Perusahaan (252.681.773.254) (149.907.829.334)<br />

Pendapatan yang telah dikenakan<br />

pajak yang bersifat final:<br />

Income already subjected to final taxes:<br />

Pendapatan bunga (13.061.797.465) (11.733.111.047) Interest income<br />

Penjualan yang dikenakan pajak<br />

final (1.299.200.000) (5.444.450.068) Sales subjected to final tax<br />

Pendapatan sewa (1.271.666.660) (1.058.333.322) Rent revenue<br />

Beda temporer<br />

Temporary differences<br />

Penyisihan imbalan kerja - bersih 1.870.602.177 1.016.577.843 Provision for employee benefits - net<br />

Penyusutan 52.389.327 23.461.257 Depreciation<br />

Taksiran rugi fiskal Perusahaan (5.903.224.388) (27.399.775.779) Estimated tax loss of the Company<br />

Tax losses carryforward<br />

Saldo rugi fiskal awal tahun (309.940.955.156) (443.310.696.684) at beginning of year<br />

Rugi fiskal tahun 2005 yang<br />

kadaluarsa 17.454.486.727 - Expired tax loss - year 2005<br />

Rugi fiskal tahun 2004 yang<br />

kadaluarsa setelah<br />

dikompensasikan dengan<br />

Expired tax loss - year 2004 after<br />

taksiran penghasilan kena<br />

compensating with 2008 estimated<br />

pajak tahun 2008 - 160.769.517.307 taxable income<br />

Saldo akumulasi rugi fiskal<br />

akhir tahun (298.389.692.817) (309.940.955.156) Tax losses carryforward at end of year<br />

Saldo akumulasi rugi fiskal pada tanggal<br />

31 Desember 2010 dapat digunakan hingga<br />

2015 berdasarkan pada jadwal sebagai<br />

berikut:<br />

The tax losses carryforward as of<br />

December 31, 2010 can be carried forward<br />

through 2015 based on the following schedule:<br />

Tahun 2011/Year 2011 261.279.208.328<br />

Tahun 2012/Year 2012 3.807.484.322<br />

Tahun 2014/Year 2014 27.399.775.779<br />

Tahun 2015/Year 2015 5.903.224.388<br />

Jumlah/Total 298.389.692.817<br />

Pada tanggal 25 Maret <strong>2009</strong>, Perusahaan<br />

menerima Surat Ketetapan Pajak Nihil (SKPN)<br />

untuk tahun pajak 2007. Berdasarkan SKPN<br />

tersebut, rugi fiskal Perusahaan tahun 2007<br />

sebesar Rp4.327.796.400 dikoreksi sebesar<br />

Rp520.312.078 menjadi sebesar<br />

Rp3.807.484.322.<br />

On March 25, <strong>2009</strong>, the Company received Nil<br />

Tax Assessment Letter (SKPN) for the fiscal<br />

year 2007. Based on the SKPN, the<br />

Company’s fiscal loss for the year 2007<br />

amounting to Rp4,327,796,400 was adjusted<br />

by Rp520,312,078 to become<br />

Rp3,807,484,322.<br />

66