2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

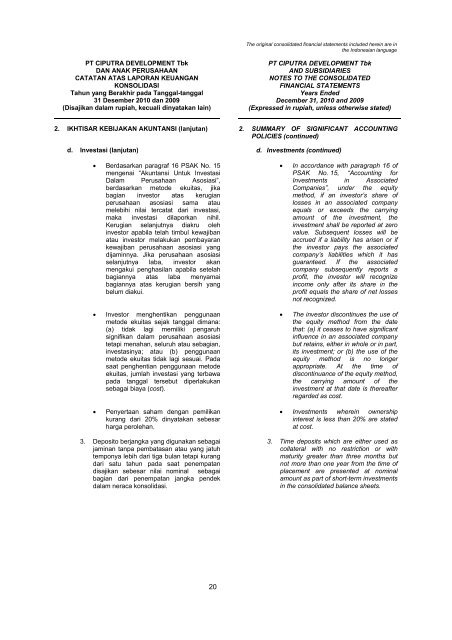

2. IKHTISAR KEBIJAKAN AKUNTANSI (lanjutan) 2. SUMMARY OF SIGNIFICANT ACCOUNTING<br />

POLICIES (continued)<br />

d. Investasi (lanjutan) d. Investments (continued)<br />

Berdasarkan paragraf 16 PSAK No. 15<br />

mengenai “Akuntansi Untuk Investasi<br />

Dalam Perusahaan Asosiasi”,<br />

berdasarkan metode ekuitas, jika<br />

bagian investor atas kerugian<br />

perusahaan asosiasi sama atau<br />

melebihi nilai tercatat dari investasi,<br />

maka investasi dilaporkan nihil.<br />

Kerugian selanjutnya diakru oleh<br />

investor apabila telah timbul kewajiban<br />

atau investor melakukan pembayaran<br />

kewajiban perusahaan asosiasi yang<br />

dijaminnya. Jika perusahaan asosiasi<br />

selanjutnya laba, investor akan<br />

mengakui penghasilan apabila setelah<br />

bagiannya atas laba menyamai<br />

bagiannya atas kerugian bersih yang<br />

belum diakui.<br />

Investor menghentikan penggunaan<br />

metode ekuitas sejak tanggal dimana:<br />

(a) tidak lagi memiliki pengaruh<br />

signifikan dalam perusahaan asosiasi<br />

tetapi menahan, seluruh atau sebagian,<br />

investasinya; atau (b) penggunaan<br />

metode ekuitas tidak lagi sesuai. Pada<br />

saat penghentian penggunaan metode<br />

ekuitas, jumlah investasi yang terbawa<br />

pada tanggal tersebut diperlakukan<br />

sebagai biaya (cost).<br />

<br />

<br />

In accordance with paragraph 16 of<br />

PSAK No. 15, “Accounting for<br />

Investments in Associated<br />

Companies”, under the equity<br />

method, if an investor’s share of<br />

losses in an associated company<br />

equals or exceeds the carrying<br />

amount of the investment, the<br />

investment shall be reported at zero<br />

value. Subsequent losses will be<br />

accrued if a liability has arisen or if<br />

the investor pays the associated<br />

company’s liabilities which it has<br />

guaranteed. If the associated<br />

company subsequently reports a<br />

profit, the investor will recognize<br />

income only after its share in the<br />

profit equals the share of net losses<br />

not recognized.<br />

The investor discontinues the use of<br />

the equity method from the date<br />

that: (a) it ceases to have significant<br />

influence in an associated company<br />

but retains, either in whole or in part,<br />

its investment; or (b) the use of the<br />

equity method is no longer<br />

appropriate. At the time of<br />

discontinuance of the equity method,<br />

the carrying amount of the<br />

investment at that date is thereafter<br />

regarded as cost.<br />

<br />

Penyertaan saham dengan pemilikan<br />

kurang dari 20% dinyatakan sebesar<br />

harga perolehan.<br />

Investments wherein ownership<br />

interest is less than 20% are stated<br />

at cost.<br />

3. Deposito berjangka yang digunakan sebagai<br />

jaminan tanpa pembatasan atau yang jatuh<br />

temponya lebih dari tiga bulan tetapi kurang<br />

dari satu tahun pada saat penempatan<br />

disajikan sebesar nilai nominal sebagai<br />

bagian dari penempatan jangka pendek<br />

dalam neraca konsolidasi.<br />

3. Time deposits which are either used as<br />

collateral with no restriction or with<br />

maturity greater than three months but<br />

not more than one year from the time of<br />

placement are presented at nominal<br />

amount as part of short-term investments<br />

in the consolidated balance sheets.<br />

20