2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

4. INVESTASI (lanjutan)<br />

d. Efek Dimiliki Hingga Jatuh Tempo (lanjutan)<br />

Efek dimiliki hingga jatuh tempo memperoleh<br />

tingkat bunga tahunan berkisar antara 8,80%<br />

sampai dengan 10,38%.<br />

4. INVESTMENTS (continued)<br />

d. Held-to-Maturity Securities (continued)<br />

Annual interest rates of investment in held-tomaturity<br />

securities ranged from 8.80% to<br />

10.38%.<br />

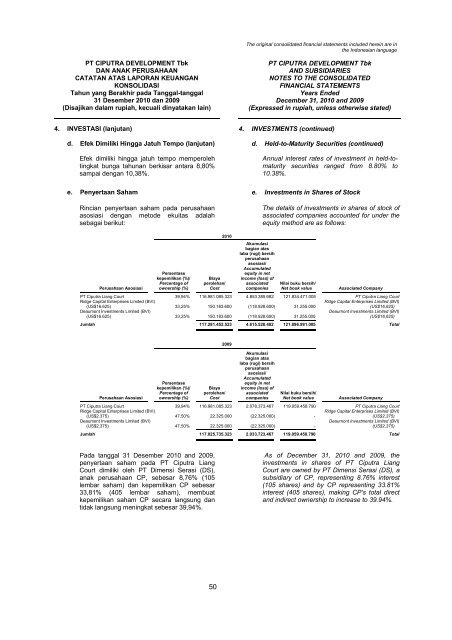

e. Penyertaan Saham e. Investments in Shares of Stock<br />

Rincian penyertaan saham pada perusahaan<br />

asosiasi dengan metode ekuitas adalah<br />

sebagai berikut:<br />

The details of investments in shares of stock of<br />

associated companies accounted for under the<br />

equity method are as follows:<br />

2010<br />

Akumulasi<br />

bagian atas<br />

laba (rugi) bersih<br />

perusahaan<br />

asosiasi/<br />

Accumulated<br />

Persentase<br />

equity in net<br />

kepemilikan (%)/ Biaya income (loss) of<br />

Percentage of perolehan/ associated Nilai buku bersih/<br />

Perusahaan Asosiasi ownership (%) Cost companies Net book value Associated Company<br />

PT <strong>Ciputra</strong> Liang Court 39,94% 116.981.085.323 4.853.385.682 121.834.471.005 PT <strong>Ciputra</strong> Liang Court<br />

Ridge Capital Enterprises Limited (BVI)<br />

Ridge Capital Enterprises Limited (BVI)<br />

(US$16.625) 33,25% 150.183.600 (118.928.600) 31.255.000 (US$16,625)<br />

Deaumont Investments Limited (BVI)<br />

Deaumont Investments Limited (BVI)<br />

(US$16.625) 33,25% 150.183.600 (118.928.600) 31.255.000 (US$16,625)<br />

Jumlah 117.281.452.523 4.615.528.482 121.896.981.005 Total<br />

<strong>2009</strong><br />

Akumulasi<br />

bagian atas<br />

laba (rugi) bersih<br />

perusahaan<br />

asosiasi/<br />

Accumulated<br />

Persentase<br />

equity in net<br />

kepemilikan (%)/ Biaya income (loss) of<br />

Percentage of perolehan/ associated Nilai buku bersih/<br />

Perusahaan Asosiasi ownership (%) Cost companies Net book value Associated Company<br />

PT <strong>Ciputra</strong> Liang Court 39,94% 116.981.085.323 2.078.373.467 119.059.458.790 PT <strong>Ciputra</strong> Liang Court<br />

Ridge Capital Enterprises Limited (BVI)<br />

Ridge Capital Enterprises Limited (BVI)<br />

(US$2.375) 47,50% 22.325.000 (22.325.000) - (US$2,375)<br />

Deaumont Investments Limited (BVI)<br />

Deaumont Investments Limited (BVI)<br />

(US$2.375) 47,50% 22.325.000 (22.325.000) - (US$2,375)<br />

Jumlah 117.025.735.323 2.033.723.467 119.059.458.790 Total<br />

Pada tanggal 31 Desember 2010 and <strong>2009</strong>,<br />

penyertaan saham pada PT <strong>Ciputra</strong> Liang<br />

Court dimiliki oleh PT Dimensi Serasi (DS),<br />

anak perusahaan CP, sebesar 8,76% (105<br />

lembar saham) dan kepemilikan CP sebesar<br />

33,81% (405 lembar saham), membuat<br />

kepemilikan saham CP secara langsung dan<br />

tidak langsung meningkat sebesar 39,94%.<br />

As of December 31, 2010 and <strong>2009</strong>, the<br />

investments in shares of PT <strong>Ciputra</strong> Liang<br />

Court are owned by PT Dimensi Serasi (DS), a<br />

subsidiary of CP, representing 8.76% interest<br />

(105 shares) and by CP representing 33.81%<br />

interest (405 shares), making CP’s total direct<br />

and indirect ownership to increase to 39.94%.<br />

50