2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

11. HUTANG BANK (lanjutan)<br />

PT Bank ICBC Indonesia<br />

Pada tanggal 15 Januari 2010, CS memperoleh<br />

fasilitas fixed loan on demand basis dan fasilitas<br />

cerukan masing-masing sebesar<br />

Rp25.000.000.000 dan Rp5.000.000.000 dari<br />

PT Bank ICBC Indonesia (ICBC) terhitung sejak<br />

tanggal 18 Januari 2010 sampai dengan 18 Januari<br />

2011. Pinjaman dari fasilitas ini dikenakan bunga<br />

tahunan sebesar 11,5% dan dijamin secara fidusia<br />

dengan piutang usaha sebesar Rp37.500.000.000.<br />

Pada tanggal 31 Desember 2010, CS telah<br />

melunasi pinjaman ini dan tidak menggunakan<br />

fasilitas cerukan.<br />

Lain-Lain<br />

Berdasarkan perjanjian-perjanjian hutang, Anak<br />

Perusahaan harus mematuhi batasan-batasan<br />

tertentu, antara lain untuk memperoleh persutujuan<br />

tertulis dari pemberi pinjaman sebelum melakukan<br />

transaksi-transaksi tertentu seperti mengadakan<br />

penggabungan usaha, pengambilalihan, likuidasi<br />

atau perubahan status serta Anggaran Dasar,<br />

pembayaran kembali pinjaman dari pemegang<br />

saham, pembatasan dalam mengubah aktivitas<br />

utama dan pembagian dividen, serta harus<br />

mematuhi rasio-rasio keuangan tertentu<br />

Pada tanggal 31 Desember 2010 dan <strong>2009</strong>, Anak<br />

Perusahaan telah memenuhi semua rasio<br />

keuangan dan persyaratan-persyaratan<br />

sehubungan dengan pinjaman di atas.<br />

11. LOANS FROM BANKS (continued)<br />

PT Bank ICBC Indonesia<br />

On January 15, 2010, CS obtained fixed loan on<br />

demand basis and overdraft facilities amounting to<br />

Rp25,000,000,000 and Rp5,000,000,0000,<br />

respectively, from PT Bank ICBC Indonesia (ICBC)<br />

effective from January 18, 2010 up to January 18,<br />

2011. The loans from these facilities bear interest<br />

at the annual rate of 11.5% and are collateralized<br />

by fiduciary accounts receivable totaling<br />

Rp37,500,000,000. As of December 31, 2010, CS<br />

has paid the fixed loan and has not utilized the<br />

overdraft facility.<br />

Others<br />

Based on the loan agreements, the Subsidiaries<br />

are subject to various covenants, among others, to<br />

obtain written approval from the lenders before<br />

entering into certain transactions such as mergers,<br />

takeovers, liquidation or change in status, change<br />

in the Articles of Association, repayment of loans<br />

obtained from the stockholders, change in core<br />

business activities and payments of dividends, and<br />

to the requirement to comply with certain financial<br />

ratios.<br />

As of December 31, 2010 and <strong>2009</strong>, the<br />

Subsidiaries have complied with all the financial<br />

ratios and with the restrictive covenants relating to<br />

the loan facilities discussed above.<br />

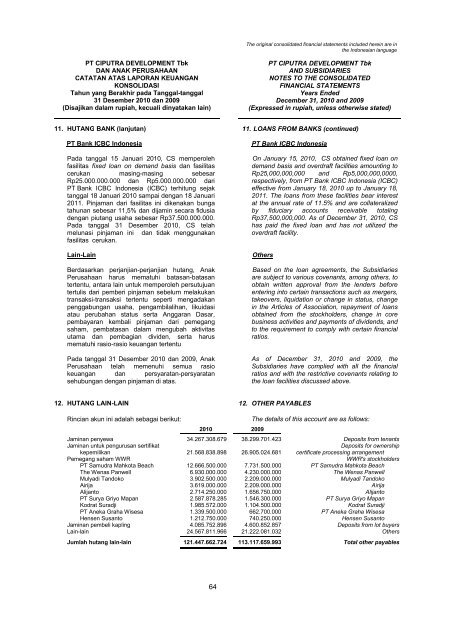

12. HUTANG LAIN-LAIN 12. OTHER PAYABLES<br />

Rincian akun ini adalah sebagai berikut:<br />

2010 <strong>2009</strong><br />

The details of this account are as follows:<br />

Jaminan penyewa 34.267.308.679 38.299.701.423 Deposits from tenants<br />

Jaminan untuk pengurusan sertifikat<br />

Deposits for ownership<br />

kepemilikan 21.568.838.898 26.905.024.681 certificate processing arrangement<br />

Pemegang saham WWR<br />

WWR's stockholders<br />

PT Samudra Mahkota Beach 12.666.500.000 7.731.500.000 PT Samudra Mahkota Beach<br />

The Wenas Panwell 6.930.000.000 4.230.000.000 The Wenas Panwell<br />

Mulyadi Tandoko 3.902.500.000 2.209.000.000 Mulyadi Tandoko<br />

Airija 3.619.000.000 2.209.000.000 Airija<br />

Alijanto 2.714.250.000 1.656.750.000 Alijanto<br />

PT Surya Griyo Mapan 2.587.878.285 1.546.300.000 PT Surya Griyo Mapan<br />

Kodrat Suradji 1.985.572.000 1.104.500.000 Kodrat Suradji<br />

PT Aneka Graha Wisesa 1.339.500.000 662.700.000 PT Aneka Graha Wisesa<br />

Hensen Susanto 1.212.750.000 740.250.000 Hensen Susanto<br />

Jaminan pembeli kapling 4.085.752.896 4.600.852.857 Deposits from lot buyers<br />

Lain-lain 24.567.811.966 21.222.081.032 Others<br />

Jumlah hutang lain-lain 121.447.662.724 113.117.659.993 Total other payables<br />

64