1822 - Edocs

1822 - Edocs

1822 - Edocs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

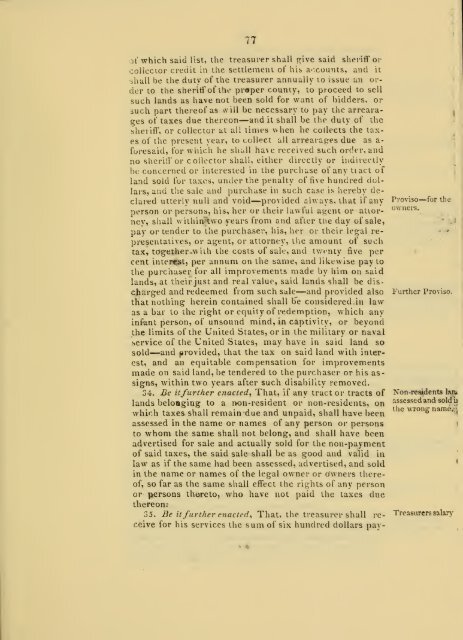

77<br />

of which said list, the treasurer shall ?ive said sheriff or<br />

collector credit in the settlement of his accounts, and it<br />

shall be the duty of the treasurer annually to issue an order<br />

to the sheriff of the proper county, to proceed to sell<br />

such lands as have not been sold for want of bidders, or<br />

such part thereof as will be necessary to pay the arrearages<br />

of taxes due thereon—and it shall be the duty of the<br />

sheiiff, or collector at all limes when he collects the tax-<br />

es of the present year, to collect all arrearages due as aforesaid,<br />

for which he shall have received such order, and<br />

no sheriff or collector shall, either directly or indirectly<br />

be concerned or interested in the purchase of any tiact of<br />

land sold for taxes, under the penalty of five hundred dollars,<br />

and the sale and purchase in such case is hereby declared<br />

utterly null and void— provided always, that if any<br />

person or persons, his, her or their lawful agent or attor-<br />

Proviso—for the<br />

owners.<br />

ney, shall withintwo years from and after the day of sale,<br />

pay or tender to the purchaser, his, her or their legal representatives,<br />

or agent, or attorney, the amount of such<br />

tax, together with the costs of sale, and twenty five per<br />

cent interest, per annum on the same, and likewise pay to<br />

the purchaser for all improvements made by him on said<br />

lands, at their just and real value, said lands shall be discharged<br />

and redeemed from such sale—and provided also Further Proviso<br />

that nothing herein contained shall b'e considered in law<br />

as a bar to the right or equity of redemption, which any<br />

infant person, of unsound mind, in captivity, or beyond<br />

the limits of the United States, or in the military or naval<br />

service of the United States, may have in said land so<br />

sold—and provided, that the tax on said land with interest,<br />

and an equitable compensation for improvements<br />

made on said land, be tendered to the purchaser or his as-<br />

signs, within two years after such disability removed.<br />

34. Be itfurther enacted, That, if any tract or tracts of<br />

lands belonging to a non-resident or non-residents, on<br />

which taxes shall remain due and unpaid, shall have been<br />

assessed in the name or names of any person or persons<br />

to whom the same shall not belong, and shall have been<br />

advertised for sale and actually sold for the non-payment<br />

of said taxes, the said sale shall be as good and valid in<br />

law as if the same had been assessed, advertised, and sold<br />

in the name or names of the legal owner or owners thereof,<br />

so far as the same shall effect the rights of any person<br />

or persons thereto, who have not paid the taxes due<br />

thereon;<br />

35. Be it further enacted, That, the treasurer shall receive<br />

for his services the sum of six hundred dollars pay-<br />

Non-residents Ian*<br />

assessedand soldu<br />

the wrong name.';<br />

Treasurers salarv