Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

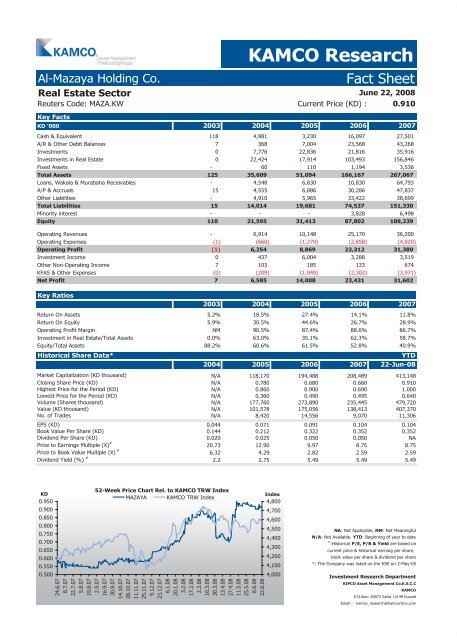

Al-Mazaya Holding Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Real Estate Sector<br />

Reuters Code: MAZA.KW Current Price (KD) : 0.910<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 118 4,981 3,230 16,097 27,501<br />

A/R & Other Debit Balances 7 368 7,004 23,568 43,268<br />

Investments 0 7,776 22,836 21,816 35,916<br />

Investments in Real Estate 0 22,424 17,914 103,493 156,846<br />

Fixed Assets -<br />

60<br />

110<br />

1,194<br />

3,536<br />

Total Assets 125 35,609 51,094 166,167 267,067<br />

Loans, Wakala & Murabaha Receivables -<br />

4,548<br />

6,830<br />

10,830<br />

64,793<br />

A/P & Accruals 15<br />

4,555<br />

6,886<br />

30,286<br />

47,837<br />

Other Liabilities -<br />

4,910<br />

5,965<br />

33,422<br />

38,699<br />

Total Liabilities 15<br />

14,014<br />

19,681<br />

74,537 151,330<br />

Minority interest -<br />

-<br />

-<br />

3,828<br />

6,498<br />

Equity 110 21,595 31,413 87,802 109,239<br />

Operating Revenues -<br />

6,914<br />

10,148<br />

25,170<br />

36,200<br />

Operating Expenses (1) (660) (1,279) (2,858) (4,820)<br />

Operating Profit (1) 6,254 8,869 22,312 31,380<br />

Investment Income 0 437 6,004 3,288 3,519<br />

Other Non-Operating Income 7 103 185 133 674<br />

KFAS & Other Expenses (0) (209) (1,049) (2,302) (3,971)<br />

Net Profit 7 6,585 14,008 23,431 31,602<br />

Key Ratios<br />

2003 2004 2005 2006 2007<br />

Return On Assets 5.2% 18.5% 27.4% 14.1% 11.8%<br />

Return On Equity 5.9% 30.5% 44.6% 26.7% 28.9%<br />

Operating Profit Margin NM 90.5% 87.4% 88.6% 86.7%<br />

Investment in Real Estate/Total Assets 0.0% 63.0% 35.1% 62.3% 58.7%<br />

Equity/Total Assets 88.2% 60.6% 61.5% 52.8% 40.9%<br />

Historical Share Data* YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A 118,170 194,488 208,489 413,148<br />

Closing Share Price (KD) N/A 0.780 0.680 0.660 0.910<br />

Highest Price for the Period (KD) N/A 0.860 0.900 0.690 1.000<br />

Lowest Price for the Period (KD) N/A 0.360 0.490 0.495 0.640<br />

Volume (Shares thousand) N/A 177,760 273,890 235,445 479,720<br />

Value (KD thousand) N/A 101,578 175,056 138,413 407,370<br />

No. of Trades N/A 8,420 14,556 9,070 11,306<br />

EPS (KD) 0.044 0.071 0.091 0.104 0.104<br />

Book Value Per Share (KD) 0.144 0.212 0.322 0.352 0.352<br />

Dividend Per Share (KD) 0.020 0.025 0.050 0.050 NA<br />

Price to Earnings Multiple (X) #<br />

20.73 12.90 9.97 8.75 8.75<br />

Price to Book Value Multiple (X) #<br />

6.32 4.29 2.82 2.59 2.59<br />

Dividend Yield (%) #<br />

2.2 2.75 5.49 5.49 5.49<br />

KD<br />

0.950<br />

0.900<br />

0.850<br />

0.800<br />

0.750<br />

0.700<br />

0.650<br />

0.600<br />

0.550<br />

0.500<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

MAZAYA KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

270,268,000<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

KAMCO Research<br />

270,268,000<br />

11.5.08<br />

Index<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

June 22, 2008<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

*: The Company was listed on the KSE on 2-May-05<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com