Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

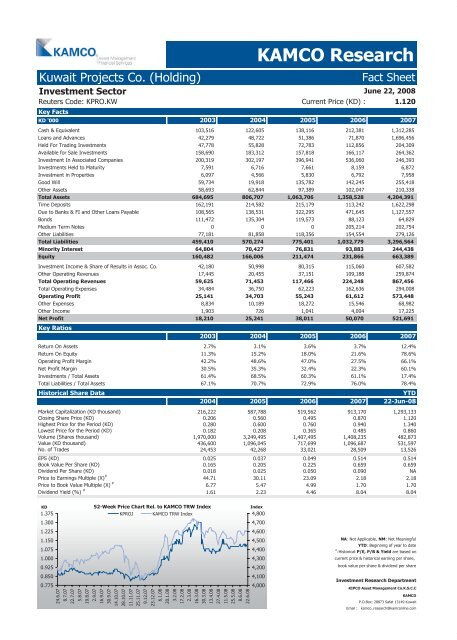

<strong>Kuwait</strong> Projects Co. (Holding) <strong>Fact</strong> <strong>Sheet</strong><br />

Investment Sector<br />

Reuters Code: KPRO.KW Current Price (KD) : 1.120<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

June 22, 2008<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 103,516 122,605 138,116 212,381 1,312,285<br />

Loans and Advances 42,279 48,722 51,386 71,870 1,696,456<br />

Held For Trading Investments 47,778 55,828 72,783 112,856 204,309<br />

Available for Sale Investments 158,690 183,312 157,818 166,117 264,362<br />

Investment In Associated Companies 200,319 302,197 396,941 536,060 246,393<br />

Investments Held to Maturity 7,591 6,716 7,661 8,159 6,872<br />

Investment in Properties 6,097 4,566 5,830 6,792 7,958<br />

Good Will 59,734 19,918 135,782 142,245 255,418<br />

Other Assets 58,693 62,844 97,389 102,047 210,338<br />

Total Assets 684,695 806,707 1,063,706 1,358,528 4,204,391<br />

Time Deposits 162,191 214,582 215,179 113,242 1,622,298<br />

Due to Banks & FI and Other Loans Payable 108,565 138,531 322,295 471,645 1,127,557<br />

Bonds 111,472 135,304 119,573 88,123 64,829<br />

Medium Term Notes 0 0 0 205,214 202,754<br />

Other Liabilities 77,181 81,858 118,356 154,554 279,126<br />

Total Liabilities 459,410 570,274 775,401 1,032,779 3,296,564<br />

Minority Interest 64,804 70,427 76,831 93,883 244,438<br />

Equity 160,482 166,006 211,474 231,866 663,389<br />

Investment Income & Share of Results in Assoc. Co. 42,180 50,998 80,315 115,060 607,582<br />

Other Operating Revenues 17,445 20,455 37,151 109,188 259,874<br />

Total Operating Revenues 59,625 71,453 117,466 224,248 867,456<br />

Total Operating Expenses 34,484 36,750 62,223 162,636 294,008<br />

Operating Profit 25,141 34,703 55,243 61,612 573,448<br />

Other Expenses 8,834 10,189 18,272 15,546 68,982<br />

Other Income 1,903 726 1,041 4,004 17,225<br />

Net Profit<br />

Key Ratios<br />

18,210 25,241 38,011 50,070 521,691<br />

2003 2004 2005 2006 2007<br />

Return On Assets 2.7% 3.1% 3.6% 3.7% 12.4%<br />

Return On Equity 11.3% 15.2% 18.0% 21.6% 78.6%<br />

Operating Profit Margin 42.2% 48.6% 47.0% 27.5% 66.1%<br />

Net Profit Margin 30.5% 35.3% 32.4% 22.3% 60.1%<br />

Investments / Total Assets 61.4% 68.5% 60.3% 61.1% 17.4%<br />

Total Liabilities / Total Assets 67.1% 70.7% 72.9% 76.0% 78.4%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 216,222 587,788 519,562 913,170 1,293,133<br />

Closing Share Price (KD) 0.206 0.560 0.495 0.870 1.120<br />

Highest Price for the Period (KD) 0.280 0.600 0.760 0.940 1.340<br />

Lowest Price for the Period (KD) 0.182 0.208 0.365 0.485 0.860<br />

Volume (Shares thousand) 1,970,000 3,249,495 1,407,495 1,408,235 482,873<br />

Value (KD thousand) 436,600 1,096,045 717,699 1,096,687 531,597<br />

No. of Trades 24,453 42,268 33,021 28,509 13,526<br />

EPS (KD) 0.025 0.037 0.049 0.514 0.514<br />

Book Value Per Share (KD) 0.165 0.205 0.225 0.659 0.659<br />

Dividend Per Share (KD) 0.018 0.025 0.050 0.090 NA<br />

Price to Earnings Multiple (X) #<br />

44.71 30.11 23.09 2.18 2.18<br />

Price to Book Value Multiple (X) #<br />

6.77 5.47 4.99 1.70 1.70<br />

Dividend Yield (%) #<br />

1.61 2.23 4.46 8.04 8.04<br />

KD<br />

1.375<br />

1.300<br />

1.225<br />

1.150<br />

1.075<br />

1.000<br />

0.925<br />

0.850<br />

0.775<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

KPROJ KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com