Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

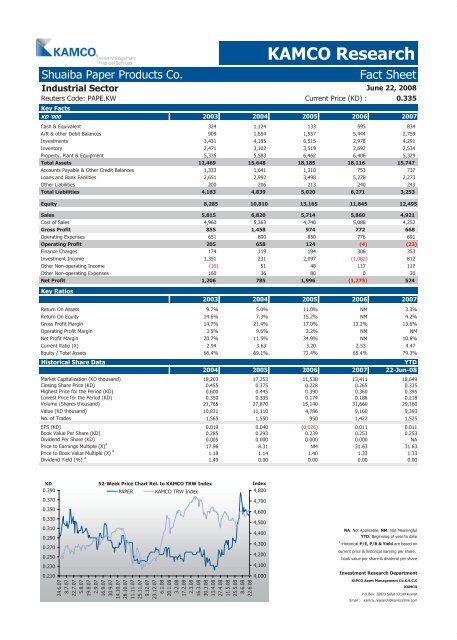

Shuaiba Paper Products Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Industrial Sector<br />

Reuters Code: PAPE.KW Current Price (KD) : 0.335<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 324 1,124 133 595 834<br />

A/R & other Debit Balances 909 1,654 1,557 5,444 2,759<br />

Investments 3,431 4,185 6,515 2,978 4,291<br />

Inventory 2,471 3,102 3,519 2,692 2,534<br />

Property, Plant & Equipment 5,335 5,583 6,462 6,406 5,329<br />

Total Assets 12,469 15,648 18,185 18,116 15,747<br />

Accounts Payable & Other Credit Balances 1,333 1,641 1,310 753 737<br />

Loans and Bank Facilities 2,651 2,992 3,498 5,278 2,273<br />

Other Liabilities 200 206 213 240 243<br />

Total Liabilities 4,183 4,839 5,020 6,271 3,253<br />

Equity 8,285 10,810 13,165 11,845 12,495<br />

Sales 5,815 6,820 5,714 5,860 4,921<br />

Cost of Sales 4,960 5,363 4,740 5,088 4,252<br />

Gross Profit 855 1,458 974 772 668<br />

Operating Expenses 651 800 850 776 691<br />

Operating Profit 205 658 124 (4) (23)<br />

Finance Charges 174 119 194 306 353<br />

Investment Income 1,351 231 2,097 (1,082) 812<br />

Other Non-operating Income (16) 51 48 117 117<br />

Other Non-operating Expenses 160 36 80 0 30<br />

Net Profit 1,206 785 1,996 (1,275) 524<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

2003 2004 2005 2006 2007<br />

Return On Assets 9.7% 5.0% 11.0% NM 3.3%<br />

Return On Equity 14.6% 7.3% 15.2% NM 4.2%<br />

Gross Profit Margin 14.7% 21.4% 17.0% 13.2% 13.6%<br />

Operating Profit Margin 3.5% 9.6% 2.2% NM NM<br />

Net Profit Margin 20.7% 11.5% 34.9% NM 10.6%<br />

Current Ratio (X) 2.94<br />

3.63<br />

3.20<br />

2.53<br />

4.47<br />

Equity / Total Assets 66.4% 69.1% 72.4% 65.4% 79.3%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 18,203 17,253 11,538 13,411 18,649<br />

Closing Share Price (KD) 0.455 0.375 0.228 0.265 0.335<br />

Highest Price for the Period (KD) 0.600 0.445 0.390 0.360 0.395<br />

Lowest Price for the Period (KD) 0.350 0.335 0.174 0.186 0.218<br />

Volume (Shares thousand) 21,765 27,870 15,140 31,660 29,160<br />

Value (KD thousand) 10,831 11,110 4,786 9,160 9,393<br />

No. of Trades 1,565 1,550 950 1,422 1,525<br />

EPS (KD) 0.019 0.040 (0.026) 0.011 0.011<br />

Book Value Per Share (KD) 0.285 0.293 0.239 0.253 0.253<br />

Dividend Per Share (KD) 0.005 0.000 0.000 0.000 NA<br />

Price to Earnings Multiple (X) #<br />

17.96 8.31 NM 31.63 31.63<br />

Price to Book Value Multiple (X) #<br />

1.18 1.14 1.40 1.33 1.33<br />

Dividend Yield (%) #<br />

1.49 0.00 0.00 0.00 0.00<br />

KD<br />

0.390<br />

0.370<br />

0.350<br />

0.330<br />

0.310<br />

0.290<br />

0.270<br />

0.250<br />

0.230<br />

0.210<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

PAPER KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com