Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

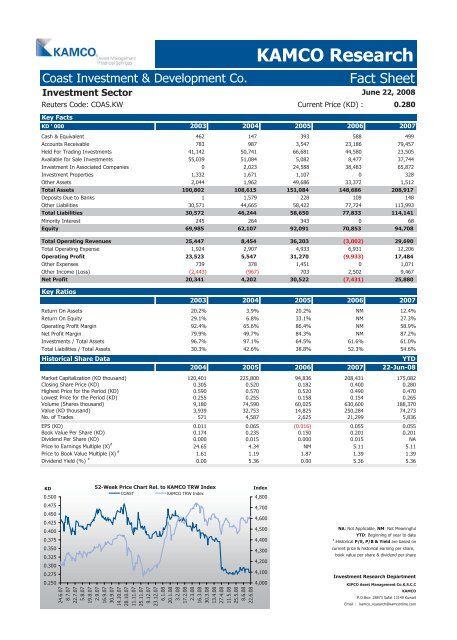

Coast Investment & Development Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Investment Sector<br />

Reuters Code: COAS.KW Current Price (KD) : 0.280<br />

Key <strong>Fact</strong>s<br />

KD ' 000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 462 147 393 588 499<br />

Accounts Receivable 783 987 3,547 23,186 79,457<br />

Held For Trading Investments 41,142 50,741 66,681 44,580 23,505<br />

Available for Sale Investments 55,039 51,084 5,082 8,477 37,744<br />

Investment In Associated Companies 0 2,023 24,588 38,483 65,872<br />

Investment Properties 1,332 1,671 1,107 0 328<br />

Other Assets 2,044 1,962 49,686 33,372 1,512<br />

Total Assets 100,802 108,615 151,084 148,686 208,917<br />

Deposits Due to Banks 1 1,579 228 109 148<br />

Other Liabilities 30,571 44,665 58,422 77,724 113,993<br />

Total Liabilities 30,572 46,244 58,650 77,833 114,141<br />

Minority Interest 245 264 343 0 68<br />

Equity 69,985 62,107 92,091 70,853 94,708<br />

Total Operating Revenues 25,447 8,454 36,203 (3,002) 29,690<br />

Total Operating Expense 1,924 2,907 4,933 6,931 12,206<br />

Operating Profit 23,523 5,547 31,270 (9,933) 17,484<br />

Other Expenses 739 378 1,451 0 1,071<br />

Other Income (Loss) (2,443) (967) 703 2,502 9,467<br />

Net Profit 20,341 4,202 30,522 (7,431) 25,880<br />

Key Ratios<br />

2003 2004 2005 2006 2007<br />

Return On Assets 20.2% 3.9% 20.2% NM 12.4%<br />

Return On Equity 29.1% 6.8% 33.1% NM 27.3%<br />

Operating Profit Margin 92.4% 65.6% 86.4% NM 58.9%<br />

Net Profit Margin 79.9% 49.7% 84.3% NM 87.2%<br />

Investments / Total Assets 96.7% 97.1% 64.5% 61.6% 61.0%<br />

Total Liabilities / Total Assets 30.3% 42.6% 38.8% 52.3% 54.6%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 120,401 225,800 94,836 208,431 175,082<br />

Closing Share Price (KD) 0.305 0.520 0.182 0.400 0.280<br />

Highest Price for the Period (KD) 0.590 0.570 0.520 0.490 0.470<br />

Lowest Price for the Period (KD) 0.255 0.255 0.158 0.154 0.265<br />

Volume (Shares thousand) 9,180 74,590 60,025 630,600 188,370<br />

Value (KD thousand) 3,939 32,753 14,825 250,284 74,273<br />

No. of Trades 571 4,587 2,625 21,299 5,836<br />

EPS (KD) 0.011 0.065 (0.016) 0.055 0.055<br />

Book Value Per Share (KD) 0.174 0.235 0.150 0.201 0.201<br />

Dividend Per Share (KD) 0.000 0.015 0.000 0.015 NA<br />

Price to Earnings Multiple (X) #<br />

24.65 4.34 NM 5.11 5.11<br />

Price to Book Value Multiple (X) #<br />

1.61 1.19 1.87 1.39 1.39<br />

Dividend Yield (%) #<br />

0.00 5.36 0.00 5.36 5.36<br />

KD<br />

0.500<br />

0.475<br />

0.450<br />

0.425<br />

0.400<br />

0.375<br />

0.350<br />

0.325<br />

0.300<br />

0.275<br />

0.250<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

COAST KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

KAMCO Research<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

June 22, 2008<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com