Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

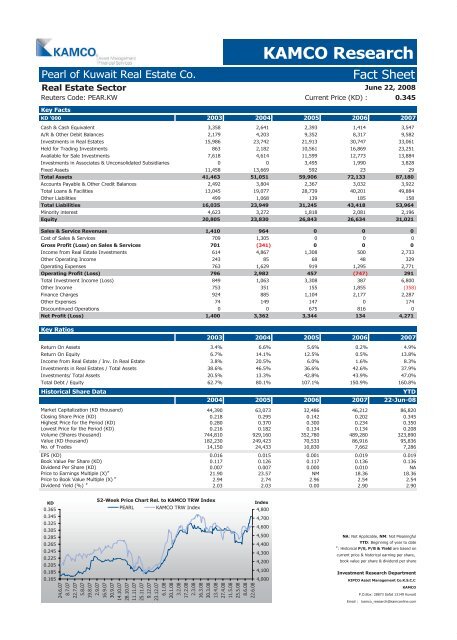

Pearl of <strong>Kuwait</strong> Real Estate Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Real Estate Sector<br />

Reuters Code: PEAR.KW Current Price (KD) : 0.345<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Cash Equivalent 3,358 2,641 2,393 1,414 3,547<br />

A/R & Other Debit Balances 2,179 4,203 9,352 8,317 9,582<br />

Investments in Real Estates 15,986 23,742 21,913 30,747 33,061<br />

Held for Trading Investments 863 2,182 10,561 16,869 23,251<br />

Available for Sale Investments 7,618 4,614 11,599 12,773 13,884<br />

Investments in Associates & Unconsolidated Subsidiaries 0 0 3,495 1,990 3,828<br />

Fixed Assets 11,458 13,669 592 23 29<br />

Total Assets 41,463 51,051 59,906 72,133 87,180<br />

Accounts Payable & Other Credit Balances 2,492 3,804 2,367 3,032 3,922<br />

Total Loans & Facilities 13,045 19,077 28,739 40,201 49,884<br />

Other Liabilities 499 1,068 139 185 158<br />

Total Liabilities 16,035 23,949 31,245 43,418 53,964<br />

Minority interest 4,623 3,272 1,818 2,081 2,196<br />

Equity 20,805 23,830 26,843 26,634 31,021<br />

Sales & Service Revenues 1,410 964 0 0 0<br />

Cost of Sales & Services 709 1,305 0 0 0<br />

Gross Profit (Loss) on Sales & Services 701 (341) 0 0 0<br />

Income from Real Estate Investments 614 4,867 1,308 500 2,733<br />

Other Operating Income 243 85 68 48 329<br />

Operating Expenses 763 1,629 919 1,295 2,771<br />

Operating Profit (Loss) 796 2,982 457 (747) 291<br />

Total Investment Income (Loss) 849 1,063 3,308 387 6,800<br />

Other Income 753 351 155 1,855 (358)<br />

Finance Charges 924 885 1,104 2,177 2,287<br />

Other Expenses 74 149 147 0 174<br />

Discountinued Operations 0 0 675 816 0<br />

Net Profit (Loss) 1,400 3,362 3,344 134 4,271<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

2003 2004 2005 2006 2007<br />

Return On Assets 3.4% 6.6% 5.6% 0.2% 4.9%<br />

Return On Equity 6.7% 14.1% 12.5% 0.5% 13.8%<br />

Income from Real Estate / Inv. In Real Estate 3.8% 20.5% 6.0% 1.6% 8.3%<br />

Investments in Real Estates / Total Assets 38.6% 46.5% 36.6% 42.6% 37.9%<br />

Investments/ Total Assets 20.5% 13.3% 42.8% 43.9% 47.0%<br />

Total Debt / Equity 62.7% 80.1% 107.1% 150.9% 160.8%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 44,390 63,073 32,486 46,212 86,820<br />

Closing Share Price (KD) 0.218 0.295 0.142 0.202 0.345<br />

Highest Price for the Period (KD) 0.280 0.370 0.300 0.234 0.350<br />

Lowest Price for the Period (KD) 0.216 0.182 0.134 0.134 0.208<br />

Volume (Shares thousand) 744,810 929,160 352,780 489,280 323,890<br />

Value (KD thousand) 182,230 249,423 70,533 86,916 95,836<br />

No. of Trades 14,150 24,433 10,830 7,662 7,286<br />

EPS (KD) 0.016 0.015 0.001 0.019 0.019<br />

Book Value Per Share (KD) 0.117 0.126 0.117 0.136 0.136<br />

Dividend Per Share (KD) 0.007 0.007 0.000 0.010 NA<br />

Price to Earnings Multiple (X) #<br />

21.90 23.57 NM 18.36 18.36<br />

Price to Book Value Multiple (X) #<br />

2.94 2.74 2.96 2.54 2.54<br />

Dividend Yield (%) #<br />

2.03 2.03 0.00 2.90 2.90<br />

KD<br />

0.365<br />

0.345<br />

0.325<br />

0.305<br />

0.285<br />

0.265<br />

0.245<br />

0.225<br />

0.205<br />

0.185<br />

0.165<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

PEARL KAMCO TRW Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

: Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com