Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

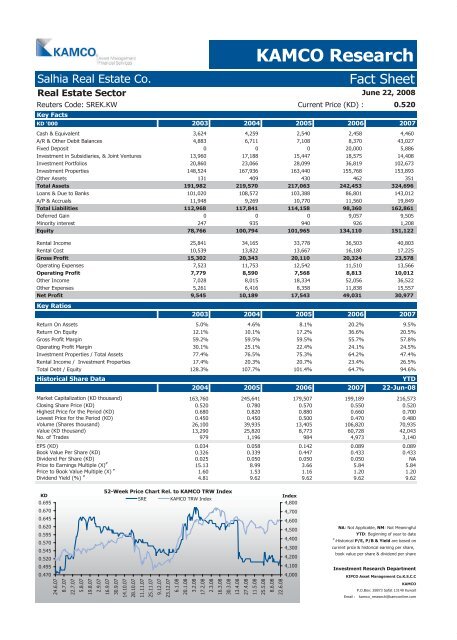

Salhia Real Estate Co.<br />

Real Estate Sector<br />

Reuters Code: SREK.KW Current Price (KD) : 0.520<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

<strong>Fact</strong> <strong>Sheet</strong><br />

June 22, 2008<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 3,624 4,259 2,540 2,458 4,460<br />

A/R & Other Debit Balances 4,883 6,711 7,108 8,370 43,027<br />

Fixed Deposit 0 0 0 20,000 5,886<br />

Investment in Subsidiaries, & Joint Ventures 13,960 17,188 15,447 18,575 14,408<br />

Investment Portfolios 20,860 23,066 28,099 36,819 102,673<br />

Investment Properties 148,524 167,936 163,440 155,768 153,893<br />

Other Assets 131 409 430 462 351<br />

Total Assets 191,982 219,570 217,063 242,453 324,696<br />

Loans & Due to Banks 101,020 108,572 103,388 86,801 143,012<br />

A/P & Accruals 11,948 9,269 10,770 11,560 19,849<br />

Total Liabilities 112,968 117,841 114,158 98,360 162,861<br />

Deferred Gain 0 0 0 9,057 9,505<br />

Minority interest 247 935 940 926 1,208<br />

Equity 78,766 100,794 101,965 134,110 151,122<br />

Rental Income 25,841 34,165 33,778 36,503 40,803<br />

Rental Cost 10,539 13,822 13,667 16,180 17,225<br />

Gross Profit 15,302 20,343 20,110 20,324 23,578<br />

Operating Expenses 7,523 11,753 12,542 11,510 13,566<br />

Operating Profit 7,779 8,590 7,568 8,813 10,012<br />

Other Income 7,028 8,015 18,334 52,056 36,522<br />

Other Expenses 5,261 6,416 8,358 11,838 15,557<br />

Net Profit<br />

Key Ratios<br />

9,545 10,189 17,543 49,031 30,977<br />

2003 2004 2005 2006 2007<br />

Return On Assets 5.0% 4.6% 8.1% 20.2% 9.5%<br />

Return On Equity 12.1% 10.1% 17.2% 36.6% 20.5%<br />

Gross Profit Margin 59.2% 59.5% 59.5% 55.7% 57.8%<br />

Operating Profit Margin 30.1% 25.1% 22.4% 24.1% 24.5%<br />

Investment Properties / Total Assets 77.4% 76.5% 75.3% 64.2% 47.4%<br />

Rental Income / Investment Properties 17.4% 20.3% 20.7% 23.4% 26.5%<br />

Total Debt / Equity 128.3% 107.7% 101.4% 64.7% 94.6%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 163,760 245,641 179,507 199,189 216,573<br />

Closing Share Price (KD) 0.520 0.780 0.570 0.550 0.520<br />

Highest Price for the Period (KD) 0.680 0.820 0.880 0.660 0.700<br />

Lowest Price for the Period (KD) 0.450 0.450 0.500 0.470 0.480<br />

Volume (Shares thousand) 26,100 39,935 13,405 106,820 70,935<br />

Value (KD thousand) 13,290 25,820 8,773 60,728 42,043<br />

No. of Trades 979 1,196 984 4,973 3,140<br />

EPS (KD) 0.034 0.058 0.142 0.089 0.089<br />

Book Value Per Share (KD) 0.326 0.339 0.447 0.433 0.433<br />

Dividend Per Share (KD) 0.025 0.050 0.050 0.050 NA<br />

Price to Earnings Multiple (X) #<br />

15.13 8.99 3.66 5.84 5.84<br />

Price to Book Value Multiple (X) #<br />

1.60 1.53 1.16 1.20 1.20<br />

Dividend Yield (%) #<br />

4.81 9.62 9.62 9.62 9.62<br />

KD<br />

0.695<br />

0.670<br />

0.645<br />

0.620<br />

0.595<br />

0.570<br />

0.545<br />

0.520<br />

0.495<br />

0.470<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

SRE KAMCO TRW Index<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

22.6.08 Index<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com