Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

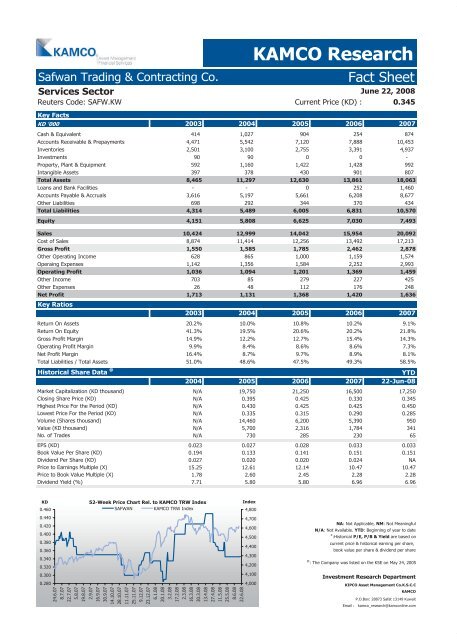

Safwan Trading & Contracting Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Services Sector<br />

Reuters Code: SAFW.KW Current Price (KD) : 0.345<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

June 22, 2008<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 414<br />

1,027<br />

904 254 874<br />

Accounts Receivable & Prepayments 4,471<br />

5,542<br />

7,120 7,888 10,453<br />

Inventories 2,501<br />

3,100<br />

2,755 3,391 4,937<br />

Investments 90<br />

90<br />

0 0 -<br />

Property, Plant & Equipment 592<br />

1,160<br />

1,422 1,428 992<br />

Intangible Assets 397<br />

378<br />

430 901 807<br />

Total Assets 8,465 11,297 12,630 13,861 18,063<br />

Loans and Bank Facilities -<br />

-<br />

0 252 1,460<br />

Accounts Payable & Accruals 3,616<br />

5,197<br />

5,661 6,208 8,677<br />

Other Liabilities 698<br />

292<br />

344 370 434<br />

Total Liabilities 4,314 5,489 6,005 6,831 10,570<br />

Equity 4,151 5,808 6,625 7,030 7,493<br />

Sales 10,424 12,999 14,042 15,954 20,092<br />

Cost of Sales 8,874<br />

11,414<br />

12,256 13,492 17,213<br />

Gross Profit 1,550 1,585 1,785 2,462 2,878<br />

Other Operating Income 628<br />

865<br />

1,000 1,159 1,574<br />

Operaing Expenses 1,142<br />

1,356<br />

1,584 2,252 2,993<br />

Operating Profit 1,036 1,094 1,201 1,369 1,459<br />

Other Income 703<br />

85<br />

279 227 425<br />

Other Expenses 26<br />

48<br />

112 176 248<br />

Net Profit<br />

Key Ratios<br />

1,713 1,131 1,368 1,420 1,636<br />

2003 2004 2005 2006 2007<br />

Return On Assets 20.2% 10.0% 10.8% 10.2% 9.1%<br />

Return On Equity 41.3% 19.5% 20.6% 20.2% 21.8%<br />

Gross Profit Margin 14.9% 12.2% 12.7% 15.4% 14.3%<br />

Operating Profit Margin 9.9% 8.4% 8.6% 8.6% 7.3%<br />

Net Profit Margin 16.4% 8.7% 9.7% 8.9% 8.1%<br />

Total Liabilities / Total Assets 51.0% 48.6% 47.5% 49.3% 58.5%<br />

Historical Share Data @<br />

YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A 19,750 21,250 16,500 17,250<br />

Closing Share Price (KD) N/A 0.395 0.425 0.330 0.345<br />

Highest Price For the Period (KD) N/A 0.430 0.425 0.425 0.450<br />

Lowest Price For the Period (KD) N/A 0.335 0.315 0.290 0.285<br />

Volume (Shares thousand) N/A 14,460 6,200 5,390 950<br />

Value (KD thousand) N/A 5,700 2,316 1,784 341<br />

No. of Trades N/A 730 285 230 65<br />

EPS (KD) 0.023 0.027 0.028 0.033 0.033<br />

Book Value Per Share (KD) 0.194 0.133 0.141 0.151 0.151<br />

Dividend Per Share (KD) 0.027 0.020 0.020 0.024 NA<br />

Price to Earnings Multiple (X) 15.25 12.61 12.14 10.47 10.47<br />

Price to Book Value Multiple (X) 1.78 2.60 2.45 2.28 2.28<br />

Dividend Yield (%) 7.71 5.80 5.80 6.96 6.96<br />

KD<br />

0.460<br />

0.440<br />

0.420<br />

0.400<br />

0.380<br />

0.360<br />

0.340<br />

0.320<br />

0.300<br />

0.280<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

SAFWAN KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

@ : The Company was listed on the KSE on May 24, 2005<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com