Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

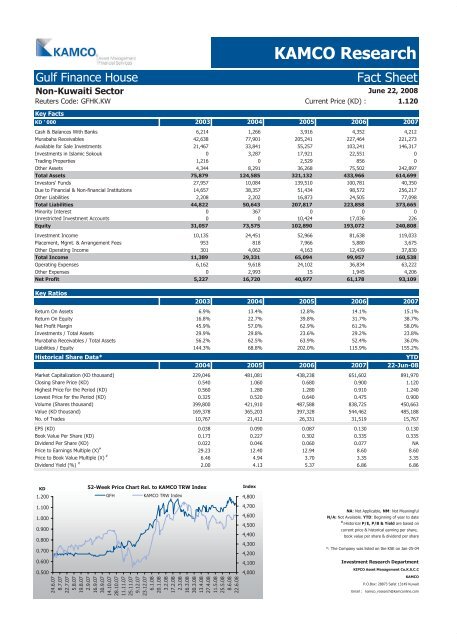

Gulf Finance House <strong>Fact</strong> <strong>Sheet</strong><br />

Non-<strong>Kuwait</strong>i Sector<br />

Reuters Code: GFHK.KW Current Price (KD) : 1.120<br />

Key <strong>Fact</strong>s<br />

KD ' 000 2003 2004 2005 2006 2007<br />

Cash & Balances With Banks 6,214 1,266 3,916 4,352 4,212<br />

Murabaha Receivables 42,638 77,901 205,241 227,464 221,273<br />

Available for Sale Investments 21,467 33,841 55,257 103,241 146,317<br />

Investments in Islamic Sokouk 0 3,287 17,921 22,551 0<br />

Trading Properties 1,216 0 2,529 856 0<br />

Other Assets 4,344 8,291 36,268 75,502 242,897<br />

Total Assets 75,879 124,585 321,132 433,966 614,699<br />

Investors' Funds 27,957 10,084 139,510 100,781 40,350<br />

Due to Financial & Non-financial Institutions 14,657 38,357 51,434 98,572 256,217<br />

Other Liabilities 2,208 2,202 16,873 24,505 77,098<br />

Total Liabilities 44,822 50,643 207,817 223,858 373,665<br />

Minority Interest 0 367 0 0 0<br />

Unrestricted Investment Accounts 0 0 10,424 17,036 226<br />

Equity 31,057 73,575 102,890 193,072 240,808<br />

Investment Income 10,135 24,451 52,966 81,638 119,033<br />

Placement, Mgmt. & Arrangement Fees 953 818 7,966 5,880 3,675<br />

Other Operating Income 301 4,062 4,163 12,439 37,830<br />

Total Income 11,389 29,331 65,094 99,957 160,538<br />

Operating Expenses 6,162 9,618 24,102 36,834 63,222<br />

Other Expenses 0 2,993 15 1,945 4,206<br />

Net Profit 5,227 16,720 40,977 61,178 93,109<br />

Key Ratios<br />

2003 2004 2005 2006 2007<br />

Return On Assets 6.9% 13.4% 12.8% 14.1% 15.1%<br />

Return On Equity 16.8% 22.7% 39.8% 31.7% 38.7%<br />

Net Profit Margin 45.9% 57.0% 62.9% 61.2% 58.0%<br />

Investments / Total Assets 29.9% 29.8% 23.6% 29.2% 23.8%<br />

Murabaha Receivables / Total Assets 56.2% 62.5% 63.9% 52.4% 36.0%<br />

Liabilities / Equity 144.3% 68.8% 202.0% 115.9% 155.2%<br />

Historical Share Data* YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 229,046 481,081 438,238 651,602 891,970<br />

Closing Share Price (KD) 0.540 1.060 0.680 0.900 1.120<br />

Highest Price for the Period (KD) 0.560 1.280 1.280 0.910 1.240<br />

Lowest Price for the Period (KD) 0.325 0.520 0.640 0.475 0.900<br />

Volume (Shares thousand) 399,800 421,910 487,588 838,725 450,663<br />

Value (KD thousand) 169,378 365,203 397,328 544,462 485,188<br />

No. of Trades 10,767 21,412 26,331 31,519 15,767<br />

EPS (KD) 0.038 0.090 0.087 0.130 0.130<br />

Book Value Per Share (KD) 0.173 0.227 0.302 0.335 0.335<br />

Dividend Per Share (KD) 0.022 0.046 0.060 0.077 NA<br />

Price to Earnings Multiple (X) #<br />

29.23 12.40 12.94 8.60 8.60<br />

Price to Book Value Multiple (X) #<br />

6.46 4.94 3.70 3.35 3.35<br />

Dividend Yield (%) #<br />

2.00 4.13 5.37 6.86 6.86<br />

KD<br />

1.200<br />

1.100<br />

1.000<br />

0.900<br />

0.800<br />

0.700<br />

0.600<br />

0.500<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

GFH KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

KAMCO Research<br />

June 22, 2008<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

*: The Company was listed on the KSE on Jan-25-04<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com