Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

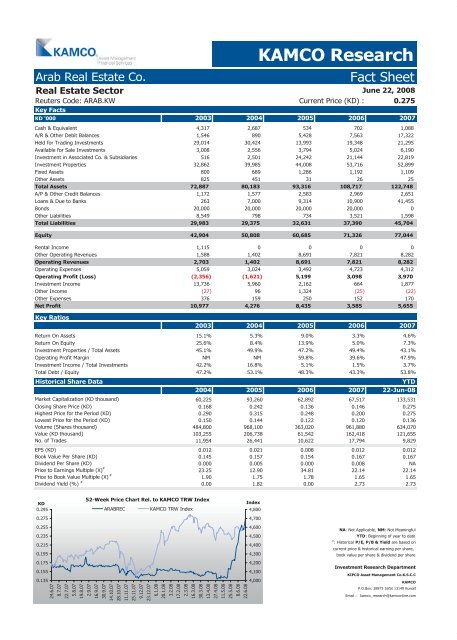

Arab Real Estate Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Real Estate Sector<br />

Reuters Code: ARAB.KW Current Price (KD) : 0.275<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 4,317 2,687 534 702 1,088<br />

A/R & Other Debit Balances 1,546 890 5,428 7,563 17,322<br />

Held for Trading Investments 29,014 30,424 13,993 19,348 21,295<br />

Available for Sale Investments 3,008 2,556 3,794 5,024 6,190<br />

Investment in Associated Co. & Subsidiaries 516 2,501 24,242 21,144 22,819<br />

Investment Properties 32,862 39,985 44,008 53,716 52,899<br />

Fixed Assets 800 689 1,286 1,192 1,109<br />

Other Assets 825 451 31 26 25<br />

Total Assets 72,887 80,183 93,316 108,717 122,748<br />

A/P & Other Credit Balances 1,172 1,577 2,583 2,969 2,651<br />

Loans & Due to Banks 263 7,000 9,314 10,900 41,455<br />

Bonds 20,000 20,000 20,000 20,000 0<br />

Other Liabilities 8,549 798 734 3,521 1,598<br />

Total Liabilities 29,983 29,375 32,631 37,390 45,704<br />

Equity 42,904 50,808 60,685 71,326 77,044<br />

Rental Income 1,115 0 0 0 0<br />

Other Operating Revenues 1,588 1,402 8,691 7,821 8,282<br />

Operating Revenues 2,703 1,402 8,691 7,821 8,282<br />

Operating Expenses 5,059 3,024 3,492 4,723 4,312<br />

Operating Profit (Loss) (2,356) (1,621) 5,199 3,098 3,970<br />

Investment Income 13,736 5,960 2,162 664 1,877<br />

Other Income (27) 96 1,324 (25) (22)<br />

Other Expenses 376 159 250 152 170<br />

Net Profit 10,977 4,276 8,435 3,585 5,655<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

2003 2004 2005 2006 2007<br />

Return On Assets 15.1% 5.3% 9.0% 3.3% 4.6%<br />

Return On Equity 25.6% 8.4% 13.9% 5.0% 7.3%<br />

Investment Properties / Total Assets 45.1% 49.9% 47.2% 49.4% 43.1%<br />

Operating Profit Margin NM NM 59.8% 39.6% 47.9%<br />

Investment Income / Total Investments 42.2% 16.8% 5.1% 1.5% 3.7%<br />

Total Debt / Equity 47.2% 53.1% 48.3% 43.3% 53.8%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 60,225 93,260 62,892 67,517 133,531<br />

Closing Share Price (KD) 0.168 0.242 0.136 0.146 0.275<br />

Highest Price for the Period (KD) 0.290 0.315 0.248 0.200 0.275<br />

Lowest Price for the Period (KD) 0.150 0.144 0.122 0.120 0.136<br />

Volume (Shares thousand) 484,800 968,100 363,020 961,880 634,070<br />

Value (KD thousand) 103,255 206,738 61,542 162,418 121,655<br />

No. of Trades 11,954 26,441 10,622 17,794 9,829<br />

EPS (KD) 0.012 0.021 0.008 0.012 0.012<br />

Book Value Per Share (KD) 0.145 0.157 0.154 0.167 0.167<br />

Dividend Per Share (KD) 0.000 0.005 0.000 0.008 NA<br />

Price to Earnings Multiple (X) #<br />

23.25 12.90 34.81 22.14 22.14<br />

Price to Book Value Multiple (X) #<br />

1.90 1.75 1.78 1.65 1.65<br />

Dividend Yield (%) #<br />

0.00 1.82 0.00 2.73 2.73<br />

KD<br />

0.295<br />

0.275<br />

0.255<br />

0.235<br />

0.215<br />

0.195<br />

0.175<br />

0.155<br />

0.135<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

ARABREC KAMCO TRW Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

: Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com