Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

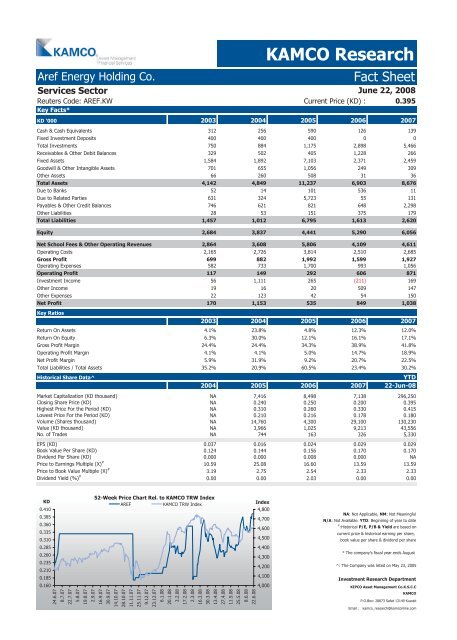

Aref Energy Holding Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Services Sector<br />

KAMCO Research<br />

June 22, 2008<br />

Reuters Code: AREF.KW<br />

Key <strong>Fact</strong>s*<br />

Current Price (KD) : 0.395<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Cash Equivalents 312 256 590 126 139<br />

Fixed Investment Deposits 400 400 400 0 0<br />

Total Investments 750 884 1,175 2,898 5,466<br />

Receivables & Other Debit Balances 329 502 405 1,228 266<br />

Fixed Assets 1,584 1,892 7,103 2,371 2,459<br />

Goodwill & Other Intangible Assets 701 655 1,056 249 309<br />

Other Assets 66 260 508 31 36<br />

Total Assets 4,142 4,849 11,237 6,903 8,676<br />

Due to Banks 52 14 101 536 11<br />

Due to Related Parties 631 324 5,723 55 131<br />

Payables & Other Credit Balances 746 621 821 648 2,298<br />

Other Liabilities 28 53 151 375 179<br />

Total Liabilities 1,457 1,012 6,795 1,613 2,620<br />

Equity 2,684 3,837 4,441 5,290 6,056<br />

Net School Fees & Other Operating Revenues 2,864 3,608 5,806 4,109 4,611<br />

Operating Costs 2,165 2,726 3,814 2,510 2,685<br />

Gross Profit 699 882 1,992 1,599 1,927<br />

Operating Expenses 582 733 1,700 993 1,056<br />

Operating Profit 117 149 292 606 871<br />

Investment Income 56 1,111 265 (211) 169<br />

Other Income 19 16 20 509 147<br />

Other Expenses 22 123 42 54 150<br />

Net Profit 170 1,153 535 849 1,038<br />

Key Ratios<br />

2003 2004 2005 2006 2007<br />

Return On Assets 4.1% 23.8% 4.8% 12.3% 12.0%<br />

Return On Equity 6.3% 30.0% 12.1% 16.1% 17.1%<br />

Gross Profit Margin 24.4% 24.4% 34.3% 38.9% 41.8%<br />

Operating Profit Margin 4.1% 4.1% 5.0% 14.7% 18.9%<br />

Net Profit Margin 5.9% 31.9% 9.2% 20.7% 22.5%<br />

Total Liabilities / Total Assets 35.2% 20.9% 60.5% 23.4% 30.2%<br />

Historical Share Data^ YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) NA 7,416 8,498 7,138 296,250<br />

Closing Share Price (KD) NA 0.240 0.250 0.200 0.395<br />

Highest Price For the Period (KD) NA 0.310 0.260 0.330 0.415<br />

Lowest Price For the Period (KD) NA 0.210 0.216 0.178 0.180<br />

Volume (Shares thousand) NA 14,760 4,300 29,100 130,230<br />

Value (KD thousand) NA 3,966 1,025 9,213 43,556<br />

No. of Trades NA 744 163 326 5,330<br />

EPS (KD) 0.037 0.016 0.024 0.029 0.029<br />

Book Value Per Share (KD) 0.124 0.144 0.156 0.170 0.170<br />

Dividend Per Share (KD) 0.000 0.000 0.008 0.000 NA<br />

Price to Earnings Multiple (X) #<br />

10.59 25.08 16.60 13.59 13.59<br />

Price to Book Value Multiple (X) #<br />

3.19 2.75 2.54 2.33 2.33<br />

Dividend Yield (%) #<br />

0.00 0.00 2.03 0.00 0.00<br />

KD<br />

0.410<br />

0.385<br />

0.360<br />

0.335<br />

0.310<br />

0.285<br />

0.260<br />

0.235<br />

0.210<br />

0.185<br />

0.160<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

AREF KAMCO TRW Index<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

* The company's fiscal year ends August<br />

^: The Company was listed on May 23, 2005<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com