Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

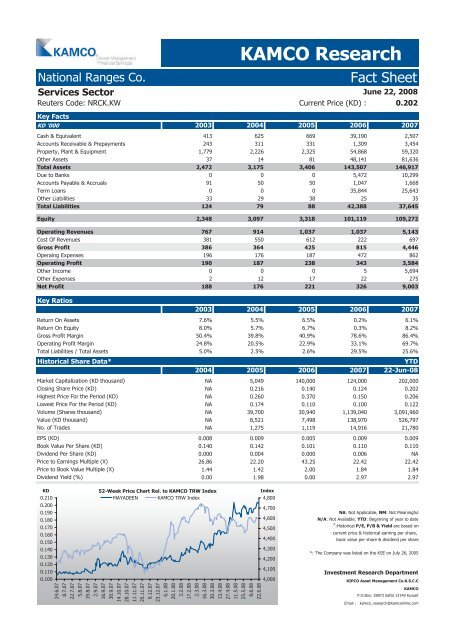

National Ranges Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Services Sector<br />

Reuters Code: NRCK.KW Current Price (KD) : 0.202<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 413 625 669 39,190 2,507<br />

Accounts Receivable & Prepayments 243 311 331 1,309 3,454<br />

Property, Plant & Equipment 1,779 2,226 2,325 54,868 59,320<br />

Other Assets 37 14 81 48,141 81,636<br />

Total Assets 2,472 3,175 3,406 143,507 146,917<br />

Due to Banks 0 0 0 5,472 10,299<br />

Accounts Payable & Accruals 91 50 50 1,047 1,668<br />

Term Loans 0 0 0 35,844 25,643<br />

Other Liabilities 33 29 38 25 35<br />

Total Liabilities 124 79 88 42,388 37,645<br />

Equity 2,348 3,097 3,318 101,119 109,272<br />

Operating Revenues 767 914 1,037 1,037 5,143<br />

Cost Of Revenues 381 550 612 222 697<br />

Gross Profit 386 364 425 815 4,446<br />

Operaing Expenses 196 176 187 472 862<br />

Operating Profit 190 187 238 343 3,584<br />

Other Income 0 0 0 5 5,694<br />

Other Expenses 2 12 17 22 275<br />

Net Profit 188 176 221 326 9,003<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

2003 2004 2005 2006 2007<br />

Return On Assets 7.6% 5.5% 6.5% 0.2% 6.1%<br />

Return On Equity 8.0% 5.7% 6.7% 0.3% 8.2%<br />

Gross Profit Margin 50.4% 39.8% 40.9% 78.6% 86.4%<br />

Operating Profit Margin 24.8% 20.5% 22.9% 33.1% 69.7%<br />

Total Liabilities / Total Assets 5.0% 2.5% 2.6% 29.5% 25.6%<br />

Historical Share Data* YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) NA 5,049 140,000 124,000 202,000<br />

Closing Share Price (KD) NA 0.216 0.140 0.124 0.202<br />

Highest Price For the Period (KD) NA 0.260 0.370 0.150 0.206<br />

Lowest Price For the Period (KD) NA 0.174 0.110 0.100 0.122<br />

Volume (Shares thousand) NA 39,700 30,940 1,139,040 3,091,960<br />

Value (KD thousand) NA 8,521 7,498 138,970 526,797<br />

No. of Trades NA 1,275 1,119 14,916 21,780<br />

EPS (KD) 0.008 0.009 0.005 0.009 0.009<br />

Book Value Per Share (KD) 0.140 0.142 0.101 0.110 0.110<br />

Dividend Per Share (KD) 0.000 0.004 0.000 0.006 NA<br />

Price to Earnings Multiple (X) 26.86 22.20 43.25 22.42 22.42<br />

Price to Book Value Multiple (X) 1.44 1.42 2.00 1.84 1.84<br />

Dividend Yield (%) 0.00 1.98 0.00 2.97 2.97<br />

KD<br />

0.210<br />

0.200<br />

0.190<br />

0.180<br />

0.170<br />

0.160<br />

0.150<br />

0.140<br />

0.130<br />

0.120<br />

0.110<br />

0.100<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

MAYADEEN KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

*: The Company was listed on the KSE on July 26, 2005<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com