Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

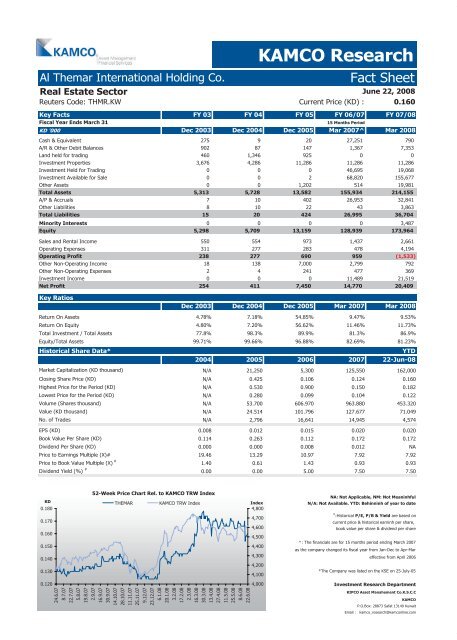

Al Themar International Holding Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Real Estate Sector<br />

Reuters Code: THMR.KW Current Price (KD) : 0.160<br />

Key <strong>Fact</strong>s FY 03 FY 04 FY 05 FY 06/07 FY 07/08<br />

Fiscal Year Ends March 31 15 Months Period<br />

KD '000 Dec 2003 Dec 2004 Dec 2005 Mar 2007^ Mar 2008<br />

Cash & Equivalent 275 9 20 27,251 790<br />

A/R & Other Debit Balances 902 87 147 1,367 7,353<br />

Land held for trading 460 1,346 925 0 0<br />

Investment Properties 3,676 4,286 11,286 11,286 11,286<br />

Investment Held for Trading 0 0 0 46,695 19,068<br />

Investment Available for Sale 0 0 2 68,820 155,677<br />

Other Assets 0 0 1,202 514 19,981<br />

Total Assets 5,313 5,728 13,582 155,934 214,155<br />

A/P & Accruals 7 10 402 26,953 32,841<br />

Other Liabilities 8 10 22 43 3,863<br />

Total Liabilities 15 20 424 26,995 36,704<br />

Minority Interests 0 0 0 0 3,487<br />

Equity 5,298 5,709 13,159 128,939 173,964<br />

Sales and Rental Income 550 554 973 1,437 2,661<br />

Operating Expenses 311 277 283 478 4,194<br />

Operating Profit 238 277 690 959 (1,533)<br />

Other Non-Operating Income 18 138 7,000 2,799 792<br />

Other Non-Operating Expenses 2 4 241 477 369<br />

Investment Income 0 0 0 11,489 21,519<br />

Net Profit 254 411 7,450 14,770 20,409<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

Dec 2003 Dec 2004 Dec 2005 Mar 2007 Mar 2008<br />

Return On Assets 4.78% 7.18% 54.85% 9.47% 9.53%<br />

Return On Equity 4.80% 7.20% 56.62% 11.46% 11.73%<br />

Total Investment / Total Assets 77.8% 98.3% 89.9% 81.3% 86.9%<br />

Equity/Total Assets 99.71% 99.66% 96.88% 82.69% 81.23%<br />

Historical Share Data* YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A 21,250 5,300 125,550 162,000<br />

Closing Share Price (KD) N/A 0.425 0.106 0.124 0.160<br />

Highest Price for the Period (KD) N/A 0.530 0.900 0.150 0.182<br />

Lowest Price for the Period (KD) N/A 0.280 0.099 0.104 0.122<br />

Volume (Shares thousand) N/A 53.700 606.970 963.880 453.320<br />

Value (KD thousand) N/A 24.514 101.796 127.677 71.049<br />

No. of Trades N/A 2,796 16,641 14,945 4,574<br />

EPS (KD) 0.008 0.012 0.015 0.020 0.020<br />

Book Value Per Share (KD) 0.114 0.263 0.112 0.172 0.172<br />

Dividend Per Share (KD) 0.000 0.000 0.008 0.012 NA<br />

Price to Earnings Multiple (X)# 19.46 13.29 10.97 7.92 7.92<br />

Price to Book Value Multiple (X) #<br />

1.40 0.61 1.43 0.93 0.93<br />

Dividend Yield (%) #<br />

0.00 0.00 5.00 7.50 7.50<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

KD THEMAR KAMCO TRW Index<br />

NA: Not Applicable, NM: Not Meaninhful<br />

N/A: Not Available. YTD: Behinninh of year to date<br />

0.180<br />

4,800<br />

0.170<br />

4,700<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earninh per share,<br />

4,600<br />

book value per share & dividend per share<br />

0.160<br />

4,500<br />

^: The financials are for 15 months period ending March 2007<br />

0.150<br />

4,400<br />

as the company changed its fiscal year from Jan-Dec to Apr-Mar<br />

0.140<br />

4,300<br />

4,200<br />

effective from April 2006<br />

\\\\\\\\\\\\\ 0.130<br />

4,100<br />

*The Company was listed on the KSE on 25-July-05<br />

0.120<br />

Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

4,000<br />

Investment Research Department<br />

KIPCO Asset Manahement Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com