Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

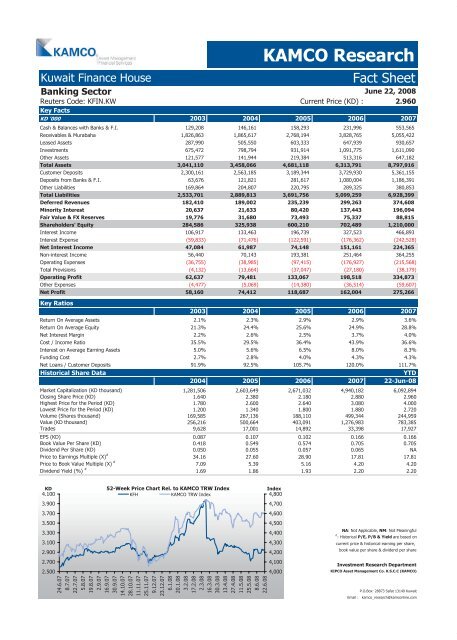

<strong>Kuwait</strong> Finance House <strong>Fact</strong> <strong>Sheet</strong><br />

Banking Sector<br />

KAMCO Research<br />

Reuters Code: KFIN.KW<br />

Key <strong>Fact</strong>s<br />

Current Price (KD) :<br />

June 22, 2008<br />

2.960<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Balances with Banks & F.I. 129,208 146,161 158,293 231,996 553,565<br />

Receivables & Murabaha 1,826,863 1,865,617 2,768,194 3,828,765 5,055,422<br />

Leased Assets 287,990 505,550 603,333 647,939 930,657<br />

Investments 675,472 798,794 931,914 1,091,775 1,611,090<br />

Other Assets 121,577 141,944 219,384 513,316 647,182<br />

Total Assets 3,041,110 3,458,066 4,681,118 6,313,791 8,797,916<br />

Customer Deposits 2,300,161 2,563,185 3,189,344 3,729,930 5,361,155<br />

Deposits from Banks & F.I. 63,676 121,821 281,617 1,080,004 1,186,391<br />

Other Liabilities 169,864 204,807 220,795 289,325 380,853<br />

Total Liabilities 2,533,701 2,889,813 3,691,756 5,099,259 6,928,399<br />

Deferred Revenues 182,410 189,002 235,239 299,263 374,608<br />

Minority Interest 20,637 21,633 80,420 137,443 196,094<br />

Fair Value & FX Reserves 19,776 31,680 73,493 75,337 88,815<br />

Shareholders' Equity 284,586 325,938 600,210 702,489 1,210,000<br />

Interest Income 106,917 133,463 196,739 327,523 466,893<br />

Interest Expense (59,833) (71,476) (122,591) (176,362) (242,528)<br />

Net Interest Income 47,084 61,987 74,148 151,161 224,365<br />

Non-interest Income 56,440 70,143 193,381 251,464 364,255<br />

Operating Expenses (36,755) (38,985) (97,415) (176,927) (215,568)<br />

Total Provisions (4,132) (13,664) (37,047) (27,180) (38,179)<br />

Operating Profit 62,637 79,481 133,067 198,518 334,873<br />

Other Expenses (4,477) (5,069) (14,380) (36,514) (59,607)<br />

Net Profit 58,160 74,412 118,687 162,004 275,266<br />

Key Ratios<br />

2003 2004 2005 2006 2007<br />

Return On Average Assets 2.1% 2.3% 2.9% 2.9% 3.6%<br />

Return On Average Equity 21.3% 24.4% 25.6% 24.9% 28.8%<br />

Net Interest Margin 2.2% 2.6% 2.5% 3.7% 4.0%<br />

Cost / Income Ratio 35.5% 29.5% 36.4% 43.9% 36.6%<br />

Interest on Average Earning Assets 5.0% 5.6% 6.5% 8.0% 8.3%<br />

Funding Cost 2.7% 2.8% 4.0% 4.3% 4.3%<br />

Net Loans / Customer Deposits 91.9% 92.5% 105.7% 120.0% 111.7%<br />

Historical Share Data<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 1,281,506 2,603,649 2,671,032 4,940,182 6,092,894<br />

Closing Share Price (KD) 1.640 2.380 2.180 2.880 2.960<br />

Highest Price for the Period (KD) 1.780 2.600 2.640 3.080 4.000<br />

Lowest Price for the Period (KD) 1.200 1.340 1.800 1.880 2.720<br />

Volume (Shares thousand) 169,585 267,136 188,110 499,344 244,959<br />

Value (KD thousand) 256,216 500,664 403,091 1,276,983 783,385<br />

Trades 9,628 17,001 14,892 33,398 17,927<br />

EPS (KD) 0.087 0.107 0.102 0.166 0.166<br />

Book Value Per Share (KD) 0.418 0.549 0.574 0.705 0.705<br />

Dividend Per Share (KD) 0.050 0.055 0.057 0.065 NA<br />

Price to Earnings Multiple (X) #<br />

34.16 27.60 28.90 17.81 17.81<br />

Price to Book Value Multiple (X) #<br />

7.09 5.39 5.16 4.20 4.20<br />

Dividend Yield (%) #<br />

YTD<br />

1.69 1.86 1.93 2.20 2.20<br />

KD<br />

4.100<br />

3.900<br />

3.700<br />

3.500<br />

3.300<br />

3.100<br />

2.900<br />

2.700<br />

2.500<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

KFH KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

#<br />

: Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co. K.S.C.C (KAMCO)<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com