Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

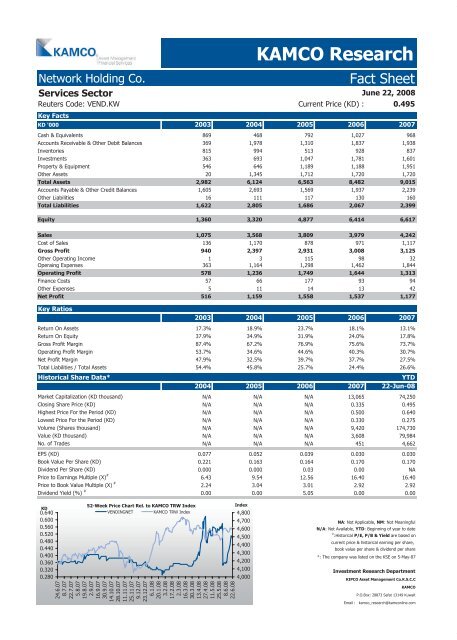

Network Holding Co.<br />

Services Sector<br />

Reuters Code: VEND.KW Current Price (KD) : 0.495<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalents 869 468 792 1,027 968<br />

Accounts Receivable & Other Debit Balances 369 1,978 1,310 1,837 1,938<br />

Inventories 815 994 513 928 837<br />

Investments 363 693 1,047 1,781 1,601<br />

Property & Equipment 546 646 1,189 1,188 1,951<br />

Other Assets 20 1,345 1,712 1,720 1,720<br />

Total Assets 2,982 6,124 6,563 8,482 9,015<br />

Accounts Payable & Other Credit Balances 1,605 2,693 1,569 1,937 2,239<br />

Other Liabilities 16 111 117 130 160<br />

Total Liabilities 1,622 2,805 1,686 2,067 2,399<br />

Equity 1,360 3,320 4,877 6,414 6,617<br />

Sales 1,075 3,568 3,809 3,979 4,242<br />

Cost of Sales 136 1,170 878 971 1,117<br />

Gross Profit 940 2,397 2,931 3,008 3,125<br />

Other Operating Income 1 3 115 98 32<br />

Operaing Expenses 363 1,164 1,298 1,462 1,844<br />

Operating Profit 578 1,236 1,749 1,644 1,313<br />

Finance Costs 57 66 177 93 94<br />

Other Expenses 5 11 14 13 42<br />

Net Profit 516 1,159 1,558 1,537 1,177<br />

Key Ratios<br />

KAMCO Research<br />

<strong>Fact</strong> <strong>Sheet</strong><br />

June 22, 2008<br />

2003 2004 2005 2006 2007<br />

Return On Assets 17.3% 18.9% 23.7% 18.1% 13.1%<br />

Return On Equity 37.9% 34.9% 31.9% 24.0% 17.8%<br />

Gross Profit Margin 87.4% 67.2% 76.9% 75.6% 73.7%<br />

Operating Profit Margin 53.7% 34.6% 44.6% 40.3% 30.7%<br />

Net Profit Margin 47.9% 32.5% 39.7% 37.7% 27.5%<br />

Total Liabilities / Total Assets 54.4% 45.8% 25.7% 24.4% 26.6%<br />

Historical Share Data* YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A N/A N/A 13,065 74,250<br />

Closing Share Price (KD) N/A N/A N/A 0.335 0.495<br />

Highest Price For the Period (KD) N/A N/A N/A 0.500 0.640<br />

Lowest Price For the Period (KD) N/A N/A N/A 0.330 0.275<br />

Volume (Shares thousand) N/A N/A N/A 9,420 174,730<br />

Value (KD thousand) N/A N/A N/A 3,608 79,984<br />

No. of Trades N/A N/A N/A 451 4,662<br />

EPS (KD) 0.077 0.052 0.039 0.030 0.030<br />

Book Value Per Share (KD) 0.221 0.163 0.164 0.170 0.170<br />

Dividend Per Share (KD) 0.000 0.000 0.03 0.00 NA<br />

Price to Earnings Multiple (X) #<br />

6.43 9.54 12.56 16.40 16.40<br />

Price to Book Value Multiple (X) #<br />

2.24 3.04 3.01 2.92 2.92<br />

Dividend Yield (%) #<br />

0.00 0.00 5.05 0.00 0.00<br />

KD<br />

0.640<br />

0.600<br />

0.560<br />

0.520<br />

0.480<br />

0.440<br />

0.400<br />

0.360<br />

0.320<br />

0.280<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

VENDINGNET KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available, YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

*: The company was listed on the KSE on 5-May-07<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com