Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

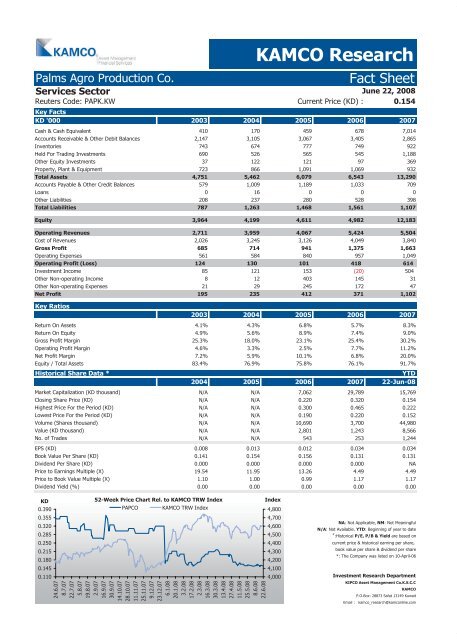

Palms Agro Production Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Services Sector<br />

June 22, 2008<br />

Reuters Code: PAPK.KW Current Price (KD) : 0.154<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Cash Equivalent 410 170 459 678 7,014<br />

Accounts Receivable & Other Debit Balances 2,147 3,105 3,067 3,405 2,865<br />

Inventories 743 674 777 749 922<br />

Held For Trading Investments 690 526 565 545 1,188<br />

Other Equity Investments 37 122 121 97 369<br />

Property, Plant & Equipment 723 866 1,091 1,069 932<br />

Total Assets 4,751 5,462 6,079 6,543 13,290<br />

Accounts Payable & Other Credit Balances 579 1,009 1,189 1,033 709<br />

Loans 0 16 0 0 0<br />

Other Liabilities 208 237 280 528 398<br />

Total Liabilities 787 1,263 1,468 1,561 1,107<br />

Equity 3,964 4,199 4,611 4,982 12,183<br />

Operating Revenues 2,711 3,959 4,067 5,424 5,504<br />

Cost of Revenues 2,026 3,245 3,126 4,049 3,840<br />

Gross Profit 685 714 941 1,375 1,663<br />

Operating Expenses 561 584 840 957 1,049<br />

Operating Profit (Loss) 124 130 101 418 614<br />

Investment Income 85 121 153 (20) 504<br />

Other Non-operating Income 8 12 403 145 31<br />

Other Non-operating Expenses 21 29 245 172 47<br />

Net Profit 195 235 412 371 1,102<br />

Key Ratios<br />

KAMCO Research<br />

2003 2004 2005 2006 2007<br />

Return On Assets 4.1% 4.3% 6.8% 5.7% 8.3%<br />

Return On Equity 4.9% 5.6% 8.9% 7.4% 9.0%<br />

Gross Profit Margin 25.3% 18.0% 23.1% 25.4% 30.2%<br />

Operating Profit Margin 4.6% 3.3% 2.5% 7.7% 11.2%<br />

Net Profit Margin 7.2% 5.9% 10.1% 6.8% 20.0%<br />

Equity / Total Assets 83.4% 76.9% 75.8% 76.1% 91.7%<br />

Historical Share Data * YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A N/A 7,062 29,789 15,769<br />

Closing Share Price (KD) N/A N/A 0.220 0.320 0.154<br />

Highest Price For the Period (KD) N/A N/A 0.300 0.465 0.222<br />

Lowest Price For the Period (KD) N/A N/A 0.190 0.220 0.152<br />

Volume (Shares thousand) N/A N/A 10,690 3,700 44,980<br />

Value (KD thousand) N/A N/A 2,801 1,243 8,566<br />

No. of Trades N/A N/A 543 253 1,244<br />

EPS (KD) 0.008 0.013 0.012 0.034 0.034<br />

Book Value Per Share (KD) 0.141 0.154 0.156 0.131 0.131<br />

Dividend Per Share (KD) 0.000 0.000 0.000 0.000 NA<br />

Price to Earnings Multiple (X) 19.54 11.95 13.26 4.49 4.49<br />

Price to Book Value Multiple (X) 1.10 1.00 0.99 1.17 1.17<br />

Dividend Yield (%) 0.00 0.00 0.00 0.00 0.00<br />

KD<br />

0.390<br />

0.355<br />

0.320<br />

0.285<br />

0.250<br />

0.215<br />

0.180<br />

0.145<br />

0.110<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

PAPCO KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

*: The Company was listed on 10-April-06<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com