Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

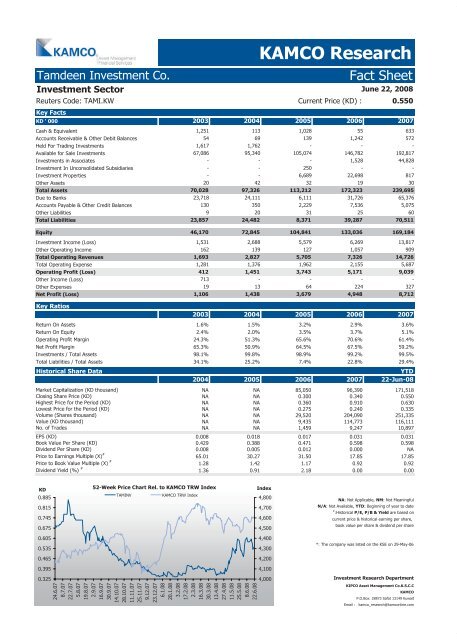

Tamdeen Investment Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Investment Sector<br />

Reuters Code: TAMI.KW Current Price (KD) : 0.550<br />

Key <strong>Fact</strong>s<br />

KD ' 000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 1,251 113 1,028 55 633<br />

Accounts Receivable & Other Debit Balances 54 69 139 1,242 572<br />

Held For Trading Investments 1,617 1,762 - - -<br />

Available for Sale Investments 67,086 95,340 105,074 146,782 192,817<br />

Investments in Associates - - - 1,528 44,828<br />

Investment In Unconsolidated Subsidiaries - - 250 - -<br />

Investment Properties - - 6,689 22,698 817<br />

Other Assets 20 42 32 19 30<br />

Total Assets 70,028 97,326 113,212 172,323 239,695<br />

Due to Banks 23,718 24,111 6,111 31,726 65,376<br />

Accounts Payable & Other Credit Balances 130 350 2,229 7,536 5,075<br />

Other Liabilities 9 20 31 25 60<br />

Total Liabilities 23,857 24,482 8,371 39,287 70,511<br />

Equity 46,170 72,845 104,841 133,036 169,184<br />

Investment Income (Loss) 1,531 2,688 5,579 6,269 13,817<br />

Other Operating Income 162 139 127 1,057 909<br />

Total Operating Revenues 1,693 2,827 5,705 7,326 14,726<br />

Total Operating Expense 1,281 1,376 1,962 2,155 5,687<br />

Operating Profit (Loss) 412 1,451 3,743 5,171 9,039<br />

Other Income (Loss) 713 - - - -<br />

Other Expenses 19 13 64 224 327<br />

Net Profit (Loss) 1,106 1,438 3,679 4,948 8,712<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

2003 2004 2005 2006 2007<br />

Return On Assets 1.6% 1.5% 3.2% 2.9% 3.6%<br />

Return On Equity 2.4% 2.0% 3.5% 3.7% 5.1%<br />

Operating Profit Margin 24.3% 51.3% 65.6% 70.6% 61.4%<br />

Net Profit Margin 65.3% 50.9% 64.5% 67.5% 59.2%<br />

Investments / Total Assets 98.1% 99.8% 98.9% 99.2% 99.5%<br />

Total Liabilities / Total Assets 34.1% 25.2% 7.4% 22.8% 29.4%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) NA NA 85,050 96,390 171,518<br />

Closing Share Price (KD) NA NA 0.300 0.340 0.550<br />

Highest Price for the Period (KD) NA NA 0.360 0.910 0.630<br />

Lowest Price for the Period (KD) NA NA 0.275 0.240 0.335<br />

Volume (Shares thousand) NA NA 29,520 204,090 251,335<br />

Value (KD thousand) NA NA 9,435 114,773 116,111<br />

No. of Trades NA NA 1,459 9,247 10,897<br />

EPS (KD) 0.008 0.018 0.017 0.031 0.031<br />

Book Value Per Share (KD) 0.429 0.388 0.471 0.598 0.598<br />

Dividend Per Share (KD) 0.008 0.005 0.012 0.000 NA<br />

Price to Earnings Multiple (X) #<br />

65.01 30.27 31.50 17.85 17.85<br />

Price to Book Value Multiple (X) #<br />

1.28 1.42 1.17 0.92 0.92<br />

Dividend Yield (%) #<br />

1.36 0.91 2.18 0.00 0.00<br />

KD<br />

0.885<br />

0.815<br />

0.745<br />

0.675<br />

0.605<br />

0.535<br />

0.465<br />

0.395<br />

0.325<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

TAMINV KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available, YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

*: The company was listed on the KSE on 29-May-06<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com