Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

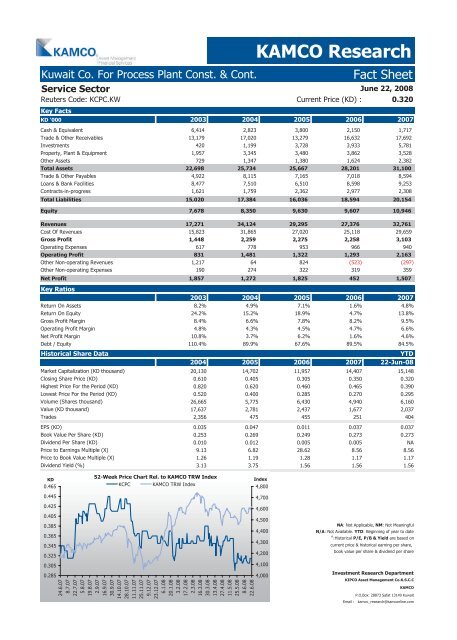

<strong>Kuwait</strong> Co. For Process Plant Const. & Cont. <strong>Fact</strong> <strong>Sheet</strong><br />

Service Sector<br />

Reuters Code: KCPC.KW Current Price (KD) : 0.320<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

June 22, 2008<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 6,414 2,823 3,800 2,150 1,717<br />

Trade & Other Receivables 13,179 17,020 13,279 16,632 17,692<br />

Investments 420 1,199 3,728 3,933 5,781<br />

Property, Plant & Equipment 1,957 3,345 3,480 3,862 3,528<br />

Other Assets 729 1,347 1,380 1,624 2,382<br />

Total Assets 22,698 25,734 25,667 28,201 31,100<br />

Trade & Other Payables 4,922 8,115 7,165 7,018 8,594<br />

Loans & Bank Facilities 8,477 7,510 6,510 8,598 9,253<br />

Contracts-in-progress 1,621 1,759 2,362 2,977 2,308<br />

Total Liabilities 15,020 17,384 16,036 18,594 20,154<br />

Equity 7,678 8,350 9,630 9,607 10,946<br />

Revenues 17,271 34,124 29,295 27,376 32,761<br />

Cost Of Revenues 15,823 31,865 27,020 25,118 29,659<br />

Gross Profit 1,448 2,259 2,275 2,258 3,103<br />

Operating Expenses 617 778 953 966 940<br />

Operating Profit 831 1,481 1,322 1,293 2,163<br />

Other Non-operating Revenues 1,217 64 824 (523) (297)<br />

Other Non-operating Expenses 190 274 322 319 359<br />

Net Profit<br />

Key Ratios<br />

1,857 1,272 1,825 452 1,507<br />

2003 2004 2005 2006 2007<br />

Return On Assets 8.2% 4.9% 7.1% 1.6% 4.8%<br />

Return On Equity 24.2% 15.2% 18.9% 4.7% 13.8%<br />

Gross Profit Margin 8.4% 6.6% 7.8% 8.2% 9.5%<br />

Operating Profit Margin 4.8% 4.3% 4.5% 4.7% 6.6%<br />

Net Profit Margin 10.8% 3.7% 6.2% 1.6% 4.6%<br />

Debt / Equity 110.4% 89.9% 67.6% 89.5% 84.5%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 20,130 14,702 11,957 14,407 15,148<br />

Closing Share Price (KD) 0.610 0.405 0.305 0.350 0.320<br />

Highest Price For the Period (KD) 0.820 0.620 0.460 0.465 0.390<br />

Lowest Price For the Period (KD) 0.520 0.400 0.285 0.270 0.295<br />

Volume (Shares thousand) 26,665 5,775 6,430 4,940 6,160<br />

Value (KD thousand) 17,637 2,781 2,437 1,677 2,037<br />

Trades 2,356 475 455 251 404<br />

EPS (KD) 0.035 0.047 0.011 0.037 0.037<br />

Book Value Per Share (KD) 0.253 0.269 0.249 0.273 0.273<br />

Dividend Per Share (KD) 0.010 0.012 0.005 0.005 NA<br />

Price to Earnings Multiple (X) 9.13 6.82 28.62 8.56 8.56<br />

Price to Book Value Multiple (X) 1.26 1.19 1.28 1.17 1.17<br />

Dividend Yield (%) 3.13 3.75 1.56 1.56 1.56<br />

KD<br />

0.465<br />

0.445<br />

0.425<br />

0.405<br />

0.385<br />

0.365<br />

0.345<br />

0.325<br />

0.305<br />

0.285<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

KCPC KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com