Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

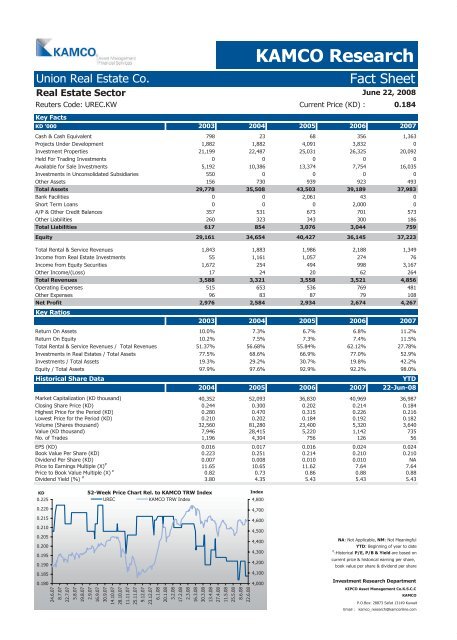

Union Real Estate Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Real Estate Sector<br />

Reuters Code: UREC.KW Current Price (KD) : 0.184<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

June 22, 2008<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Cash Equivalent 798 23 68 356 1,363<br />

Projects Under Development 1,882 1,882 4,091 3,832 0<br />

Investment Properties 21,199 22,487 25,031 26,325 20,092<br />

Held For Trading Investments 0 0 0 0 0<br />

Available for Sale Investments 5,192 10,386 13,374 7,754 16,035<br />

Investments in Unconsolidated Subsidiaries 550 0 0 0 0<br />

Other Assets 156 730 939 923 493<br />

Total Assets 29,778 35,508 43,503 39,189 37,983<br />

Bank Facilities 0 0 2,061 43 0<br />

Short Term Loans 0 0 0 2,000 0<br />

A/P & Other Credit Balances 357 531 673 701 573<br />

Other Liabilities 260 323 343 300 186<br />

Total Liabilities 617 854 3,076 3,044 759<br />

Equity 29,161 34,654 40,427 36,145 37,223<br />

Total Rental & Service Revenues 1,843 1,883 1,986 2,188 1,349<br />

Income from Real Estate Investments 55 1,161 1,057 274 76<br />

Income from Equity Securities 1,672 254 494 998 3,167<br />

Other Income/(Loss) 17 24 20 62 264<br />

Total Revenues 3,588 3,321 3,558 3,521 4,856<br />

Operating Expenses 515 653 536 769 481<br />

Other Expenses 96 83 87 79 108<br />

Net Profit<br />

Key Ratios<br />

2,976 2,584 2,934 2,674 4,267<br />

2003 2004 2005 2006 2007<br />

Return On Assets 10.0% 7.3% 6.7% 6.8% 11.2%<br />

Return On Equity 10.2% 7.5% 7.3% 7.4% 11.5%<br />

Total Rental & Service Revenues / Total Revenues 51.37% 56.68% 55.84% 62.12% 27.78%<br />

Investments in Real Estates / Total Assets 77.5% 68.6% 66.9% 77.0% 52.9%<br />

Investments / Total Assets 19.3% 29.2% 30.7% 19.8% 42.2%<br />

Equity / Total Assets 97.9% 97.6% 92.9% 92.2% 98.0%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 40,352 52,093 36,830 40,969 36,987<br />

Closing Share Price (KD) 0.244 0.300 0.202 0.214 0.184<br />

Highest Price for the Period (KD) 0.280 0.470 0.315 0.226 0.216<br />

Lowest Price for the Period (KD) 0.210 0.202 0.184 0.192 0.182<br />

Volume (Shares thousand) 32,560 81,280 23,400 5,320 3,640<br />

Value (KD thousand) 7,946 28,415 5,220 1,142 735<br />

No. of Trades 1,196 4,304 756 126 56<br />

EPS (KD) 0.016 0.017 0.016 0.024 0.024<br />

Book Value Per Share (KD) 0.223 0.251 0.214 0.210 0.210<br />

Dividend Per Share (KD) 0.007 0.008 0.010 0.010 NA<br />

Price to Earnings Multiple (X) #<br />

11.65 10.65 11.62 7.64 7.64<br />

Price to Book Value Multiple (X) #<br />

0.82 0.73 0.86 0.88 0.88<br />

Dividend Yield (%) #<br />

3.80 4.35 5.43 5.43 5.43<br />

KD<br />

0.225<br />

0.220<br />

0.215<br />

0.210<br />

0.205<br />

0.200<br />

0.195<br />

0.190<br />

0.185<br />

0.180<br />

Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

UREC KAMCO TRW Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com