Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

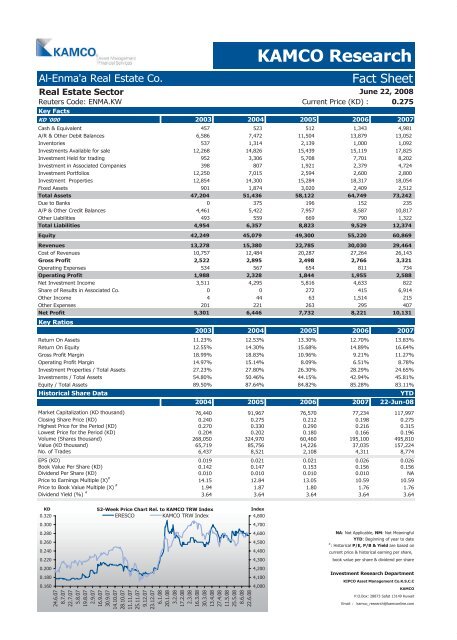

Al-Enma'a Real Estate Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Real Estate Sector<br />

KAMCO Research<br />

June 22, 2008<br />

Reuters Code: ENMA.KW<br />

Key <strong>Fact</strong>s<br />

Current Price (KD) : 0.275<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 457 523 512 1,343 4,981<br />

A/R & Other Debit Balances 6,586 7,472 11,504 13,879 13,052<br />

Inventories 537 1,314 2,139 1,000 1,092<br />

Investments Available for sale 12,268 14,826 15,439 15,119 17,825<br />

Investment Held for trading 952 3,306 5,708 7,701 8,202<br />

Investment in Associated Companies 398 807 1,921 2,379 4,724<br />

Investment Portfolios 12,250 7,015 2,594 2,600 2,800<br />

Investment Properties 12,854 14,300 15,284 18,317 18,054<br />

Fixed Assets 901 1,874 3,020 2,409 2,512<br />

Total Assets 47,204 51,436 58,122 64,749 73,242<br />

Due to Banks 0 375 196 152 235<br />

A/P & Other Credit Balances 4,461 5,422 7,957 8,587 10,817<br />

Other Liabilities 493 559 669 790 1,322<br />

Total Liabilities 4,954 6,357 8,823 9,529 12,374<br />

Equity 42,249 45,079 49,300 55,220 60,869<br />

Revenues 13,278 15,380 22,785 30,030 29,464<br />

Cost of Revenues 10,757 12,484 20,287 27,264 26,143<br />

Gross Profit 2,522 2,895 2,498 2,766 3,321<br />

Operating Expenses 534 567 654 811 734<br />

Operating Profit 1,988 2,328 1,844 1,955 2,588<br />

Net Investment Income 3,511 4,295 5,816 4,633 822<br />

Share of Results in Associated Co. 0 0 272 415 6,914<br />

Other Income 4 44 63 1,514 215<br />

Other Expenses 201 221 263 295 407<br />

Net Profit<br />

Key Ratios<br />

5,301 6,446 7,732 8,221 10,131<br />

2003 2004 2005 2006 2007<br />

Return On Assets 11.23% 12.53% 13.30% 12.70% 13.83%<br />

Return On Equity 12.55% 14.30% 15.68% 14.89% 16.64%<br />

Gross Profit Margin 18.99% 18.83% 10.96% 9.21% 11.27%<br />

Operating Profit Margin 14.97% 15.14% 8.09% 6.51% 8.78%<br />

Investment Properties / Total Assets 27.23% 27.80% 26.30% 28.29% 24.65%<br />

Investments / Total Assets 54.80% 50.46% 44.15% 42.94% 45.81%<br />

Equity / Total Assets 89.50% 87.64% 84.82% 85.28% 83.11%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 76,440 91,967 76,570 77,234 117,997<br />

Closing Share Price (KD) 0.240 0.275 0.212 0.198 0.275<br />

Highest Price for the Period (KD) 0.270 0.330 0.290 0.216 0.315<br />

Lowest Price for the Period (KD) 0.204 0.202 0.180 0.166 0.196<br />

Volume (Shares thousand) 268,050 324,970 60,460 195,100 495,810<br />

Value (KD thousand) 65,719 85,756 14,226 37,035 157,224<br />

No. of Trades 6,437 8,521 2,108 4,311 8,774<br />

EPS (KD) 0.019 0.021 0.021 0.026 0.026<br />

Book Value Per Share (KD) 0.142 0.147 0.153 0.156 0.156<br />

Dividend Per Share (KD) 0.010 0.010 0.010 0.010 NA<br />

Price to Earnings Multiple (X) #<br />

14.15 12.84 13.05 10.59 10.59<br />

Price to Book Value Multiple (X) #<br />

1.94 1.87 1.80 1.76 1.76<br />

Dividend Yield (%) #<br />

3.64 3.64 3.64 3.64 3.64<br />

KD<br />

0.320<br />

0.300<br />

0.280<br />

0.260<br />

0.240<br />

0.220<br />

0.200<br />

0.180<br />

0.160<br />

Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

ERESCO KAMCO TRW Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

: Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com