Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

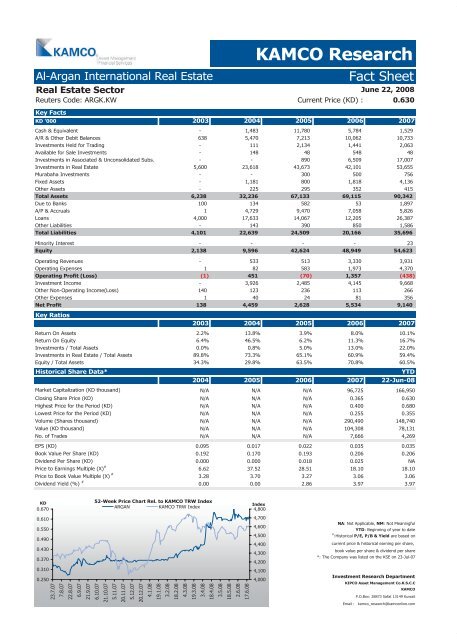

Al-Argan International Real Estate <strong>Fact</strong> <strong>Sheet</strong><br />

Real Estate Sector<br />

Reuters Code: ARGK.KW Current Price (KD) : 0.630<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

June 22, 2008<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent -<br />

1,483 11,780 5,784 1,529<br />

A/R & Other Debit Balances 638 5,470 7,213 10,062 10,733<br />

Investments Held for Trading -<br />

111 2,134 1,441 2,063<br />

Available for Sale Investments -<br />

148 48 548 48<br />

Investments in Associated & Unconsolidated Subs. -<br />

-<br />

890 6,509 17,007<br />

Investments in Real Estate 5,600 23,618 43,673 42,101 53,655<br />

Murabaha Investments -<br />

-<br />

300 500 756<br />

Fixed Assets -<br />

1,181<br />

800<br />

1,818<br />

4,136<br />

Other Assets -<br />

225<br />

295<br />

352<br />

415<br />

Total Assets 6,238 32,236 67,133 69,115 90,342<br />

Due to Banks 100 134 582 53 1,897<br />

A/P & Accruals 1 4,729 9,470 7,058 5,826<br />

Loans 4,000 17,633 14,067 12,205 26,387<br />

Other Liabilities -<br />

143<br />

390<br />

850<br />

1,586<br />

Total Liabilities 4,101 22,639 24,509 20,166 35,696<br />

Minority Interest -<br />

-<br />

-<br />

-<br />

23<br />

Equity 2,138 9,596 42,624 48,949 54,623<br />

Operating Revenues -<br />

533 513 3,330 3,931<br />

Operating Expenses 1 82 583 1,973 4,370<br />

Operating Profit (Loss) (1) 451 (70) 1,357 (438)<br />

Investment Income -<br />

3,926 2,485 4,145 9,668<br />

Other Non-Operating Income(Loss) 140 123 236 113 266<br />

Other Expenses 1 40 24 81 356<br />

Net Profit<br />

Key Ratios<br />

138 4,459 2,628 5,534 9,140<br />

2003 2004 2005 2006 2007<br />

Return On Assets 2.2% 13.8% 3.9% 8.0% 10.1%<br />

Return On Equity 6.4% 46.5% 6.2% 11.3% 16.7%<br />

Investments / Total Assets 0.0% 0.8% 5.0% 13.0% 22.0%<br />

Investments in Real Estate / Total Assets 89.8% 73.3% 65.1% 60.9% 59.4%<br />

Equity / Total Assets 34.3% 29.8% 63.5% 70.8% 60.5%<br />

Historical Share Data* YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A N/A N/A 96,725 166,950<br />

Closing Share Price (KD) N/A N/A N/A 0.365 0.630<br />

Highest Price for the Period (KD) N/A N/A N/A 0.400 0.680<br />

Lowest Price for the Period (KD) N/A N/A N/A 0.255 0.355<br />

Volume (Shares thousand) N/A N/A N/A 290,490 148,740<br />

Value (KD thousand) N/A N/A N/A 104,308 78,131<br />

No. of Trades N/A N/A N/A 7,666 4,269<br />

EPS (KD) 0.095 0.017 0.022 0.035 0.035<br />

Book Value Per Share (KD) 0.192 0.170 0.193 0.206 0.206<br />

Dividend Per Share (KD) 0.000 0.000 0.018 0.025 NA<br />

Price to Earnings Multiple (X) #<br />

6.62 37.52 28.51 18.10 18.10<br />

Price to Book Value Multiple (X) #<br />

3.28 3.70 3.27 3.06 3.06<br />

Dividend Yield (%) #<br />

0.00 0.00 2.86 3.97 3.97<br />

KD<br />

0.670<br />

0.610<br />

0.550<br />

0.490<br />

0.430<br />

0.370<br />

0.310<br />

0.250<br />

23.7.07<br />

7.8.07<br />

22.8.07<br />

6.9.07<br />

21.9.07<br />

6.10.07<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

ARGAN KAMCO TRW Index<br />

21.10.07<br />

5.11.07<br />

20.11.07<br />

5.12.07<br />

20.12.07<br />

4.1.08<br />

19.1.08<br />

3.2.08<br />

18.2.08<br />

4.3.08<br />

19.3.08<br />

3.4.08<br />

18.4.08<br />

3.5.08<br />

18.5.08<br />

2.6.08<br />

17.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

*: The Company was listed on the KSE on 23-Jul-07<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com