Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

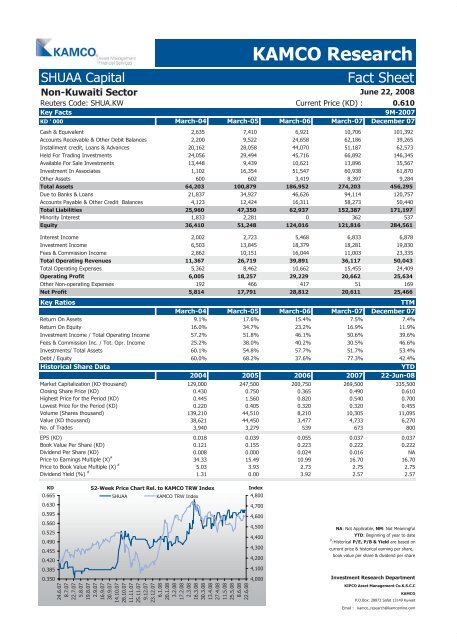

SHUAA Capital <strong>Fact</strong> <strong>Sheet</strong><br />

Non-<strong>Kuwait</strong>i Sector<br />

Reuters Code: SHUA.KW Current Price (KD) : 0.610<br />

Key <strong>Fact</strong>s 9M-2007<br />

KD ' 000 March-04 March-05 March-06 March-07 December 07<br />

Cash & Equivalent 2,635 7,410 6,921 10,706 101,392<br />

Accounts Receivable & Other Debit Balances 2,200 9,522 24,658 62,186 39,265<br />

Installment credit, Loans & Advances 20,162 28,058 44,070 51,187 62,573<br />

Held For Trading Investments 24,056 29,494 45,716 66,892 146,345<br />

Available For Sale Investments 13,448 9,439 10,621 13,896 35,567<br />

Investment In Associates 1,102 16,354 51,547 60,938 61,870<br />

Other Assets 600 602 3,419 8,397 9,284<br />

Total Assets 64,203 100,879 186,952 274,203 456,295<br />

Due to Banks & Loans 21,837 34,927 46,626 94,114 120,757<br />

Accounts Payable & Other Credit Balances 4,123 12,424 16,311 58,273 50,440<br />

Total Liabilities 25,960 47,350 62,937 152,387 171,197<br />

Minority Interest 1,833 2,281 0 362 537<br />

Equity 36,410 51,248 124,016 121,816 284,561<br />

Interest Income 2,002 2,723 5,468 6,833 6,878<br />

Investment Income 6,503 13,845 18,379 18,281 19,830<br />

Fees & Commission Income 2,862 10,151 16,044 11,003 23,335<br />

Total Operating Revenues 11,367 26,719 39,891 36,117 50,043<br />

Total Operating Expenses 5,362 8,462 10,662 15,455 24,409<br />

Operating Profit 6,005 18,257 29,229 20,662 25,634<br />

Other Non-operating Expenses 192 466 417 51 169<br />

Net Profit 5,814 17,791 28,812 20,611 25,466<br />

Key Ratios TTM<br />

March-04 March-05 March-06 March-07 December 07<br />

Return On Assets 9.1% 17.6% 15.4% 7.5% 7.4%<br />

Return On Equity 16.0% 34.7% 23.2% 16.9% 11.9%<br />

Investment Income / Total Operating Income 57.2% 51.8% 46.1% 50.6% 39.6%<br />

Fees & Commission Inc. / Tot. Opr. Income 25.2% 38.0% 40.2% 30.5% 46.6%<br />

Investments/ Total Assets 60.1% 54.8% 57.7% 51.7% 53.4%<br />

Debt / Equity 60.0% 68.2% 37.6% 77.3% 42.4%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 129,000 247,500 200,750 269,500 335,500<br />

Closing Share Price (KD) 0.430 0.750 0.365 0.490 0.610<br />

Highest Price for the Period (KD) 0.445 1.560 0.820 0.540 0.700<br />

Lowest Price for the Period (KD) 0.220 0.405 0.320 0.320 0.455<br />

Volume (Shares thousand) 139,210 44,510 8,210 10,305 11,095<br />

Value (KD thousand) 38,621 44,450 3,477 4,733 6,270<br />

No. of Trades 3,940 3,279 539 673 800<br />

EPS (KD) 0.018 0.039 0.055 0.037 0.037<br />

Book Value Per Share (KD) 0.121 0.155 0.223 0.222 0.222<br />

Dividend Per Share (KD) 0.008 0.000 0.024 0.016 NA<br />

Price to Earnings Multiple (X) #<br />

34.33 15.49 10.99 16.70 16.70<br />

Price to Book Value Multiple (X) #<br />

5.03 3.93 2.73 2.75 2.75<br />

Dividend Yield (%) #<br />

1.31 0.00 3.92 2.57 2.57<br />

KD<br />

0.665<br />

0.630<br />

0.595<br />

0.560<br />

0.525<br />

0.490<br />

0.455<br />

0.420<br />

0.385<br />

0.350<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

SHUAA KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

KAMCO Research<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

June 22, 2008<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com